The quest for hidden treasures

A path traveled only through multilateral cooperation

In general, when thinking about hidden treasures, we imagine stories involving evil pirates and treasures chests located on islands lost in endless oceans. The story I want to tell is not about pirates, but it involves characters that have similar characteristics; no treasure chests, but elements that would allow us to find them; nor Islands lost in the endless sea, but websites lost in a wide universe.

In general, when thinking about hidden treasures, we imagine stories involving evil pirates and treasures chests located on islands lost in endless oceans. The story I want to tell is not about pirates, but it involves characters that have similar characteristics; no treasure chests, but elements that would allow us to find them; nor Islands lost in the endless sea, but websites lost in a wide universe.

Under the current view, from a tax administration perspective, the pirates would be those taxpayers who hide profits and wealth and commit “harmful international tax planning”. The treasures chests would be the information needed to find hidden wealth and the lost islands would be the so-called “tax havens”. In regard to this last aspect, we could also say that the endless ocean is comparable to the Internet.

Under this scenario, tools such as information regimes established by tax administrations for their taxpayers and third parties, the instruments for the exchange of information at international level, and the traditional verification and supervision powers are not always sufficient for the XXI century tax administration information needs.

Perhaps, one of the “hidden treasures” systematically under-used by developing countries for controlling international tax evasion is the “public information”. Some of the reasons of this may be the difficulty to identify public records abroad, language barriers, the existing asymmetry between similar registries in different countries; and in certain cases, the need of specific information for accessing those registries. It is also important to consider that not all available public information is provided via Internet for free.

Another aspect that could discourage the use of public information is the high cost of the queries in terms of “man-hours”. For example, in a working group organized by CIAT in the year 2012, we realized that not all tax auditors were aware of all the public information of their own countries; therefore, we would not expect that an auditor can easily access information abroad which are useful but generally not widely known.

With the support of GIZ from Germany, the AFIP from Argentina, the Secretaria da Receita Federal do Brazil, the AEAT of Spain and the Guardia di Finanza of Italy and eight other tax administrations that have provided information; In this regard, we have taken the first steps for a feasibility analysis for public tax information from ten Latin American countries to be available to other tax administrations in the world.

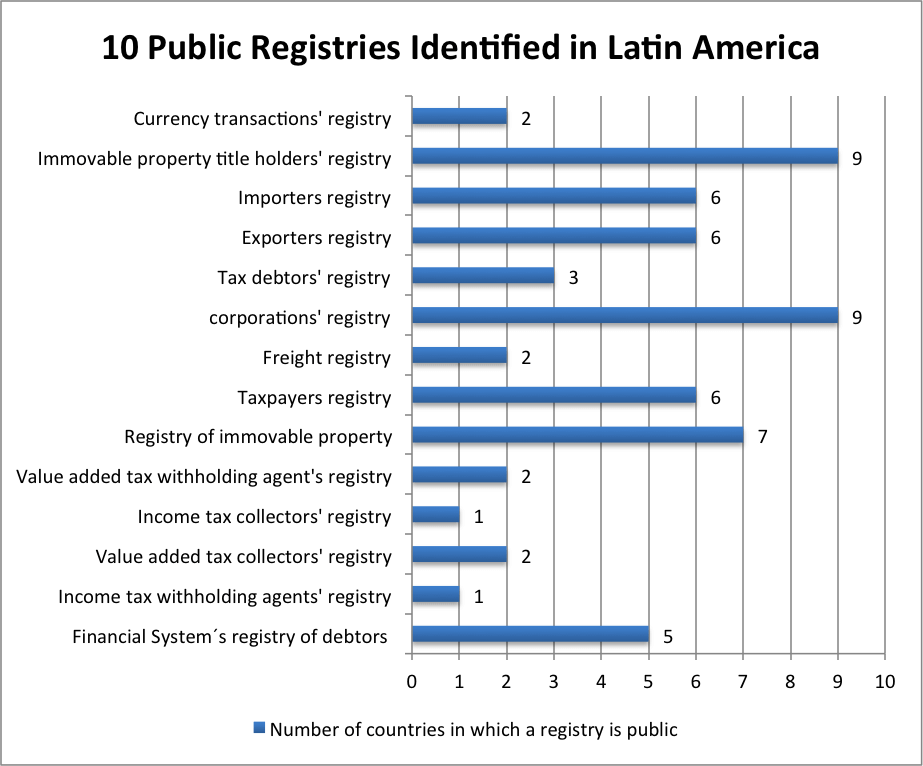

To facilitate the access to information, the first step taken was to define those public records that could be of interest for tax administrations (see table below). We have identified a total of 14 registries. The results of this feasibility analysis have exceeded our expectations, not only by the amount of identified information, but also by its quality:

To facilitate the quest for the treasure, we also believe it is essential to evaluate the registries based on certain parameters such as the procedure to access the information, its cost, its updating and reliability levels, and the support through which data is obtained. This allows the user to quickly evaluate the registry before investing his time in the query. In the future, we will consider including information on the minimum data requested to access the registries.

Currently we are working together with the GIZ from Germany and the Federal Revenue Secretariat of Brazil for developing a software tool that will allow us to provide this information to our tax administrations via Internet or facilitate the exchange when it is not available on the network.

This initiative will allow the CIAT to work with its member countries identifying and assessing public information sources, promote the dissemination of new registries by countries when there are no legal restrictions to do so, facilitate access to sources of information and reduce the time to obtain it, provide sources to tax administrations and refine formal requirements for information between tax administrations from different countries, thus avoiding formal procedures for requests of information that could be public.

The tool that we are promoting will not be kept by pirates, but by tax authorities and by the CIAT Executive Secretariat; and the commitment we all share will be the essential compromise to achieve success and reach the Islands lost in the ocean in order to easilty find new treasures.

For more information, consult the work on Availability of Public Information of Tax Interest in Latin American countries: state of situation, published in

14,861 total views, 3 views today