- Featured

- Working Missions

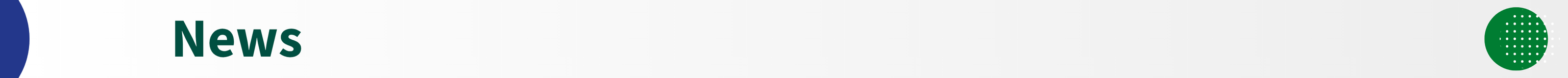

The Inter-American Center of Tax Administrations (CIAT) participated in the WU Global Transfer Pricing Conference 2026, titled “Developments in Transfer Pricing Around the World”, held from February 15 to 17,…

438 total views, 36 views today

- Featured

- Other News

Paraguay’s National Tax Revenue Directorate (DNIT) published Expression of Interest No. 01/2026, aimed at hiring a consulting firm for the following project: Republic of ParaguayContracting Entity: National Tax Revenue Directorate…

808 total views, 37 views today

- Featured

- Publications

The main tax reform measures of 19 Latin American countries announced, processed and/or approved during the 2025 fiscal year. It offers the most comprehensive, up-to-date and practical overview of the…

815 total views, 36 views today

- Featured

- The Executive Secretary in the Press

On February 11-12, 2026, the Executive Secretary of the Inter-American Center of Tax Administrations (CIAT), Mr. Márcio Verdi, participated in the international symposium “The Future of Taxes,” organized by the…

- Featured

- The Executive Secretary in the Press

On February 3 and 4, 2026, as part of the start of the annual calendar of activities, the Executive Secretary of CIAT, Mr. Márcio Verdi paid an institutional visit to…

1,541 total views, 41 views today

- Featured

- Working Missions

The Inter-American Center of Tax Administrations (CIAT) participated in the Sixth Edition of the Global Forum on Value Added Tax (VAT), organized by the Organisation for Economic Co-operation and Development…

1,508 total views, 38 views today