Unexpected consequences

The implementation of the electronic invoice, in the way that has been done successfully in Latin America, is effective when there is a valid invoice standard at national level. The tax administration should have all the documents and the majority of documents are signed digitally or, at least, generated in an operating environment controlled to validate the issuing user. This brings benefits to the both the tax administration and taxpayers (senders and receivers).

The e-invoice users should find benefits from savings in printing, sending or receiving, long-time storage and, in particular, from process improvement. In the framework of the projects in which CIAT has collaborated with the tax administrations of Colombia and Panama, studies were performed based on statistical samples with different companies and different economic activities, foreseeing important benefits for the taxpayers.

A study of AMEXIPAC, conducted in Mexico and released in October 2016, presented “socially” in the context of our technology meeting, confirms that these economic benefits for taxpayers exist. But they come less from elements like saving paper or the courier for documents delivery and most from the improvement of processes:

- Improvement and definition of the invoices validation processes

- Less time to recover the receivables

- Decrease in staff dedicated exclusively to auditing activities

- Development of an internal service of validation of invoices

- Improvement in response times from the administrative area

- Better response time and better relationship with the tax authority

- Decrease in the staff dedicated exclusively to invoicing processes

This study confirms the economic benefits for taxpayers with large volumes of turnover (in number of documents rather than amount). But it is easy to imagine how it also brings benefits to senders and recipients of small volumes of invoices, derived largely from the use of the low cost solutions made available to these taxpayers.

Of course, we won’t deny that there are expected benefits also for the tax administration and the public revenue. These benefits, in a hypothetical perfect world where everyone pays what it should, would come almost exclusively from the improvement of the processes of control and the ability to automate tasks. But in the imperfect world in which we live, in which not everyone pay everything what they should, we speculate that electronic invoicing includes an increased control capacity, and consequently an improvement in compliance and an increase in revenue.

To verify that this economic benefit to the tax revenue is important, or even exists, is more complex. It is highly unlikely that an important movement in collection can be attributed to a single factor, when we also know that the most direct effect on consumption taxes comes from the growth or decline of the economy. However, due to the massive increase in the use of electronic invoicing and its gradual adoption, it is possible to compare the effect in terms of collection of taxpayers who invoice electronically with those who don’t, and from taxpayers with themselves on the basis of historical series.

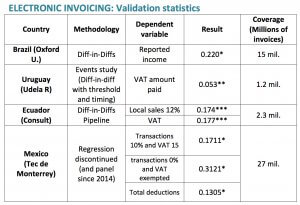

Precisely, the IDB has promoted the realization of these quasi-experimental statistical studies carried out in Mexico, Ecuador, Uruguay, and Argentina, as well as other already developed in Brazil and Chile, whose full results are detailed in the book on electronic invoicing, which we are promoting in conjunction with the IDB and the involved countries.

As a preview, the previous graph presented by Alberto Barreix, at our event on Friday in Asuncion, in April 2017, confirms that there is a statistically significant, positive influence on the VAT collection as a result of the implementation of the electronic invoice. For those interested, the respective developments of studies will be available in the aforementioned book.

But, and this is the title of this post, some other less direct benefits can be observed, arising from the implementation of the electronic invoice, whose effects go well beyond the tax environment. I would like to refer here to some of those unintended consequences, highly positive in my opinion.

- Communications infrastructure

The need to pass through the Internet to the tax administration stimulates the demand for connectivity in the country.

- Cloud services and technology solutions.

It is evident in Mexico, with its authorization model through PAC[1], and other countries that follow this model). The offer of cloud services, products and software, takes place in countries with models “without PAC“, for example, through services of preparation, storage, delivery and consultation of electronic documents; the development of interfaces to integrate ERP tools or accounting packages; or with the development of mobile applications aimed at the direct sale to consumers.

- Expansion of the use of the digital signature of documents

The use of electronic signature required no doubt a private key infrastructure and probably a specific law that valorize it, but its mere existence does not guarantee that it becomes popular. The massive use of electronic signatures in documents such as the electronic invoice open spaces to use and accept other documents signed electronically. Of course, needless to say, that the administrative acts of tax administration are among the top candidates to become electronic, to be digitally signed.

- Use of invoices as “factoring” asset

In some transactions between businesses, the moments of payment is agreed after the delivery of goods or provision of services, which may affect the cash flow of the sellers. Electronic invoicing creates the opportunity of developing a platform to negotiate, at discounted value, the credits associated with e-invoices, allowing more companies to place their “receivable invoices” in the financial market. The solution developed by the SII in Chile includes the electronic auction of those credits.

These consequences, of course, are evident only when they reach a significant level of massive use which, in turn, can be achieved only if the process is mandatory.

The benefits mentioned for the Administration and the taxpayers, as well as opportunities for various sectors lead us to conclude that the e-invoice, when and only when the conditions to implement it well are present, not only seems a good idea. It is good idea.

Greetings and good luck.

[1] Private authorized companies, authorized by the SAT on behalf of the Administration to receive and authorize electronic documents sent by taxpayers for their subsequent transmission to the SAT.

3,759 total views, 8 views today

6 comments

Thanks for sharing your article Raul!

Here is a link to AMEXIPAC´s study you refer: https://issuu.com/amexipac/docs/impactos_sectoriales_amexipac

Parabéns amigo Raul, excelente abordagem!

I also believe that by using an electronic invoice, business tasks or work are easier. This article is very helpful and informative.Thanks for sharing this. I will definitely return to this site.

Thanks for sharing this article. This is very informative. I believe that invoicing will definitely be easier with the help of electronics nowadays. It totally help to make tasks easier.

I also believe that electronic invoicing is giving a good impression to business owners because it giving them a good outcome and it is really helpful. Thanks for sharing this article.

I also think that electronic invoicing can boost the transaction between the client and business owners. I think that adapting to electronic invoicing is good to the business.