BLOCKCHAIN: Concepts and potential applications in the tax AREA (3/3)

4. PRACTICAL PROPOSALS FOR USE IN THE TAX ADMINISTRATION: PRESENTATION AND COMMENTS (continued)

4.2 VATCoin – the cryptocurrency for VAT payments in GCC countries[1]

Ainsworth, Alwohaibi & Cheetham[2] propose for the Gulf Cooperation Council (GCC) the joint adoption of the DICE model (accepted in the EU) to be implemented in blockchain and a specific cryptocurrency for payment ofs VAT (VATCoin), starting in 2018.

The methodological and technical details for the implementation of DICE in blockchain, as well as the cryptocurrencies in general, were treated earlier in this document. Here is a summary of the proposal that was presented2.

VATCoin and DICE blockchain – GCC-specific characteristics

The VATCoin will not be a speculative currency. It will always be fixed in relation to the local currency. The VAT will be paid, submitted and charged only in VAT Coins. Only the government will be allowed to convert VATCoin in common currency and that will happen only in a limited number of instances.

The number of nodes provided by a jurisdiction will be proportional to the GIP (Gross Internal product) of each jurisdiction with respect to the aggregate GIP of the GCC. Each company involved with transactions in VATCoin will have access to all the registries of its effective transactions.

The blockchain to be built will be extended to all 6 GCC member countries, and the approximate time of aggregation of new blocks will be 10 minutes. The mechanism of verification and digital sealing will be by a vote of 75% of the active nodes in the network.

It is assumed that the VATCoins will be centrally generated at the Computer Center of the GCC in Riyadh, Saudi Arabia, for use by all the member states. Companies will buy VATCoins for use in their commercial transactions, and they will remain in their accounts in the GCC cloud, and transferred between companies as the transactions occur. The VATCoins may be converted to local currency only via request to the Government.

The VATCoins payments will be made through “smart contracts” (see Chapter 2), inserted in the documentation of the invoices.

Tax rule

The VATCoins paid and received will be validated in real time and added to the blockchain.

After a waiting period, a smart contract will issue daily repayments, when a taxpayer account shows a negative balance of the VAT due. The daily balance of the accounts in VATCoin will be the rule.

The waiting period, after which it can be absolutely sure that a transaction was completed, will be measured by the time it takes to add 6 blocks to the blockchain after that the last VATCoin referenced in a tax statement was added to the blockchain. In some cases, a risk analysis can delay refunds.

It is observed that tax regulations will be encoded in computer programs.

Example of the scheme

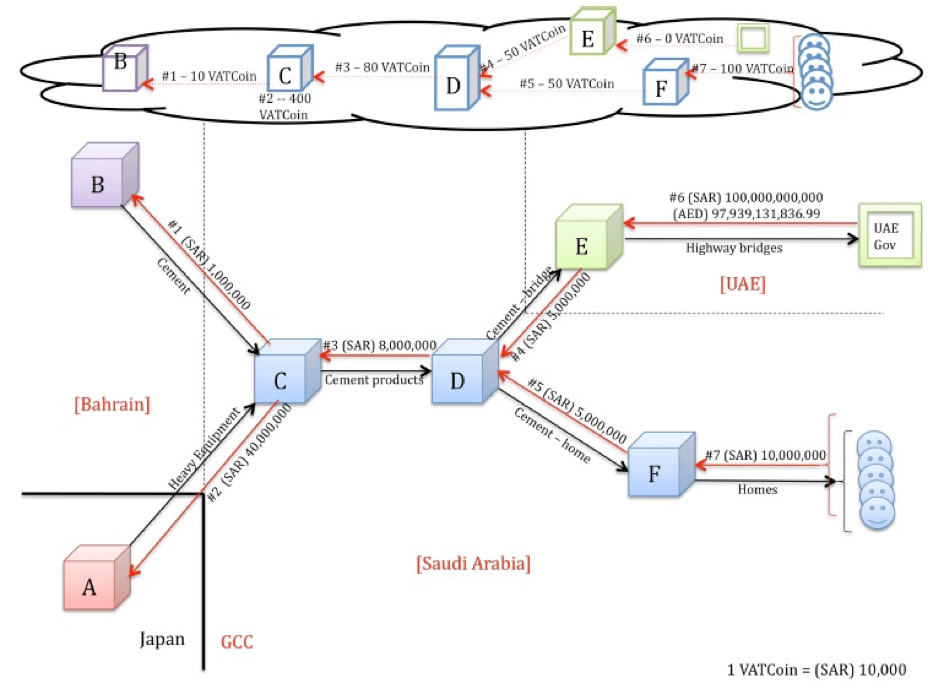

In the example presented by the authors of the proposal, it will be assumed that: there is a framework with the provision of VATCoin (cryptocurrency of VAT payments) and DICE (transactions data retrieval by digital media); all six countries of the GCC adopt a 5% rate for VAT; the concept of single window will be in force in the intra-golf trade.

“C” is a company in Saudi Arabia which manufactures concrete-based materials. They have a large sand and water supply in Saudi Arabia, but need to acquire (SR) 1,000,000 in cement from company “B” in Bahrain and (SR) 40,000,000 in construction equipment from company “A”, in Japan.

All ‘C’ production is sold to “D” for (SAR) 8,000,000, a Saudi distributor of supplies for buildings. “D” sold half of its inventory for (SR) 5,000,000 to a contractor “E” in the EEAAUU, which is building road bridges for the Government (transaction exempt from VAT). “D” resells the other half of its inventory for (SR) 5,000,000 to Contractor “F” in Saudi Arabia, which is building homes in Riyadh.

The UAE pay (AED) 97,939,131,836. 99 for the building of road bridges, which is equivalent to (SAR) 100,000,000,000. The five houses built by “F” are sold for (SR) 2,000,000 each.

Figure 6, as follows, exposes all mentioned transactions. The diagram also presents the VATCoins flow in the GCC cloud associated with each of the supplies carried out in concrete products. It is assumed that 1 VATCoin = (SR) 10,000.

Figure 6: Example of the VATCoin proposal in process

Source: Ainsworth, Alwohaibi & Cheetham2

Balance

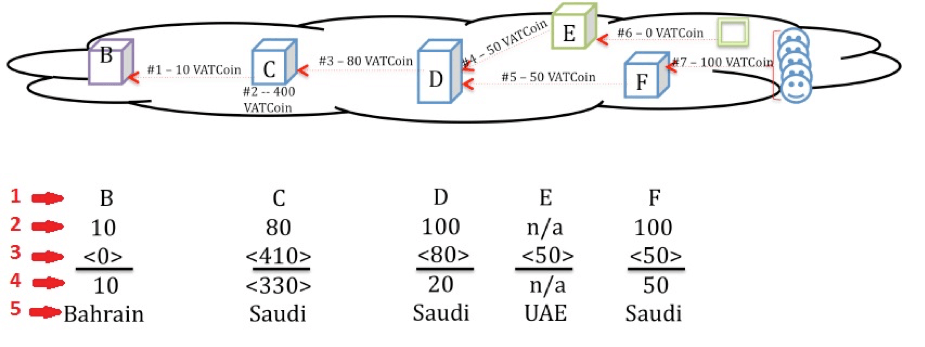

As agreed, a daily balance of accounts in VATCoin will be performed by the system. All transfers of VATCoins occur in the GCC cloud. Considering that the transactions in the example above were conducted and completed without identification of risks, Figure 7 displays the results.

Figure 7: Balance of the accounts in VATCoin

Source: Ainsworth, Alwohaibi & Cheetham2

“B”: the 10 VATCoins collected by “B” are submitted from the account of Bahrain in the cloud for the Saudi account, because it is presumed that it operates a one-stop shop in the GCC. The return of “B” is filled with the tax authorities of Bahrain, but the VATCoins go to the Saudi Treasury.

“C”: “C” has an interest in ensuring a recovery of 330 VATCoins. A smart contract will do that at the end of the day.

“D”: the 20 VATCoins collected by “D” are sent to the Saudi Treasury.

“E”: “E” transaction with the Government of the EEAAUU is tax-exempted. By the single window mechanism, “D” will fill a return in Saudi Arabia indicating that this transaction represented a consumption in the UAE. As a result, from the Saudi account in the GCC cloud 50 VATCoins will be transferred for the account of the Treasury of the UAE in the GCC cloud.

“F”: the 50 VATCoins collected by “F” are transferred to the Saudi Treasury.

The original article by Ainsworth, Alwohaibi & Cheetham, already mentioned, details all the script example.

It is shown that two interoperable blockchains will co-exist and they feedback each other: DICE, providing the detailed record of the transactions of commercial activity, and VATCoin, which will ensure that any taxpayer will retain VAT in real currency. In addition, the VAT statement will be made by the Government, which shall submit it to the taxpayer for review.

Comments

The VATCoin proposal is consistent with a VAT computerized control, with validation of transactions in real time and provision of information on-line to the control. The use of a specific cryptocurrency imposes further security and automation to the system.

The centralization of the issuance of the VATCoin and the process by which organizations will obtain and get rid of this cryptocurrency can be a weak point.

The recent crisis between the countries of the GCC may also require a revaluation in some principles for the VATCoin and slow down decision-making on the subject.

5. LIMITATIONS AND THREATS

We will not deal here with the limitations and threats related to the cryptocurrencies of current use in the world (e.g.: bitcoin), but those relating to the blockchain technology. The use of these cryptocurrencies in the payment of taxes is still not considered seriously, mainly because of its volatility in terms of currency exchange rates. With the advent of national cryptocurrencies, this scenario may change.

Blockchain-based systems are systems that never forget… everything stays registered forever, although failures or errors are also reflected. Some specialists believe that this characteristic, which is presented as a fundamental advantage, is not suitable for the real world. In addition, companies like Accenture, are investing in how to “Edit” blockchain chains[3].

The era of intelligent “things” connected to the Internet, possibly in blockchains (IoT), previously presented as a potential source of information for taxation, also presents security threats and attacks, to be considered. Vint Cerf, one of the creators of the Internet, said: “For me, a nightmare headline would be “100,000 refrigerators attack the Bank of America””…

Quantum computers will have a much larger capacity than the current computational power. These computers can quickly factor large numbers. Considering that all of the current system of cryptography is based on this concept, the quantum computer – in case they would be implemented – would place at risk not only the implementation of blockchains, but all the cryptographic infrastructure of the world.

6. HOW TO PROCEED?

The use of blockchain technology is the new technological hype. Prof. Christian Catalini, of MIT, comments that whenever a disruptive arises technology and uncertainty about its use is high, it is seductive to overvalue the benefits and ignore the fact that technological changes take time to thrive and require the adaptation of an[4] entire ecosystem.

In the tax case, advantages and possible applications are perceived, studies and evaluations are performed at academic level, tax administrations express their enthusiasm for the potential, but we must continue making studies and practical assessments in an orderly way.

An alternative would be through international organizations of regional or global scope dealing with taxation, without preventing that individual tax administrations carry out efforts themselves.

These organizations, which have tax administrations among their members (either directly or through their national governments), can take advantage of the national experiences and organizing or directing/financing structuring actions.

The initial step could be one or more meetings with stakeholders – academia, tax administrations, international organizations, consulting – for preliminary discussions and assessment of areas of performance, working groups, projects, funding, etc.

It is proven that the joint effort of the stakeholders is always more effective.

ANNEX

ADDITIONAL REFERENCES

Complementing the references throughout the text, include the following:

- Tapscott & Tapscott, “Blockchain revolution”, 2016, Penguin Books NY

- Laurence, T., “Blockchain for dummies”, 2017, John Wiley & Sons NJ

- The site coindesk.com/information offers descriptive summaries for beginners, on the most varied subjects related to cryptocurrencies: performance, technologies, mechanisms of consensus, ether (cryptocurrency)

- Rojas, H., “technology blockchain: Fundamentals, applications and possibilities”, https://www.slideshare.net/hedugaro/tecnologia-blockchain-fundamentos-aplicaciones-y-posibilidades

- Computerworld, “Blockchain: what it is and e how it works”, http://computerworld.com.br/blockchain-o-que-e-e-como-funciona

- Khan Academy, total of 9 technical videos on bitcoin and concepts associated, https://www.khanacademy.org/economics-finance-domain/core-finance/money-and-banking/bitcoin/v/bitcoin-what-is-it

- Beaver, a., “A short guide to blockchain consensus protocols”, http://www.coindesk.com/short-guide-blockchain-consensus-protocols/

[1] Gulf Cooperation Council – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates (UAE).

[2] Ainsworth, Alwohaibi & Cheetham, “VATCoin: the GCCs cyptotaxcurrency”, Boston University School of Law, Working Paper 17-04, August 2016

[3] https://www.accenture.com/t20160927T033514__w__/us-en/_acnmedia/PDF-33/Accenture-Editing-Uneditable-Blockchain.pdf#zoom=50

[4] http://sloanreview.mit.edu/article/seeing-beyond-the-blockchain-hype/

3,967 total views, 1 views today