Equivalent Tax Pressure (ETP) in Latin America and the Caribbean. IDB-CIAT

There is a significant amount of information and easily accessible. Nevertheless, the abundance of data generates challenges of data relevance, organization and interpretation which we aim to contribute to solve with the IDB-CIAT ETP Data Base (2017), for the 1990-2015 period. The main innovation sought with this database is to level down the measurement of all resources available in the countries for financing public services.

For this purpose, to the traditional tax pressure (the sum of tax revenues and public social contributions) we add obligatory private contributions (publicly regulated and whose payment is obligatory) and the resources available to the public sector resulting from natural resources and infrastructures (royalties, dividends and other public revenues, even though lacking the juridical nature of tax revenues). The aggregate is known as Equivalent Tax Pressure (ETP). In addition, the ETP is calculated for the different government levels and collection institutions. There is no intention to substitute any of the already existing definitions of tax burden, but rather to provide additional information on the resources available, beyond their juridical configuration. In quantitative terms, this information is very relevant in Latin America and the Caribbean (LAC).

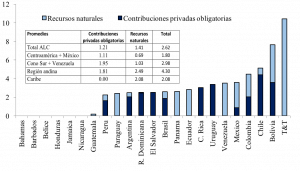

Graph 1. Revenues from natural resources and obligatory private social security contributions (% of GDP). 2011-2015

Source: Prepared by author with IDB-CIAT (2017) base.

Source: Prepared by author with IDB-CIAT (2017) base.

In fact, Chile (4.4 points of GDP), Bolivia (3.6), Uruguay (3.4) and Costa Rica (3.0) in the 2011-2015 period headed the LAC countries, which in average devoted more revenues to private social security contributions. Standing out with respect to tax revenues from natural resources are Trinidad and Tobago (10.4 points of GDP), Bolivia (4.0) and Venezuela (3.4). The sum of both resources implies according to LAC average, 2.7 points of GDP, with a maximum in Trinidad and Tobago (10.4 points of GDP), followed by Bolivia (7.6) and Chile (5.1).

If one compares the average tax revenues of LAC, they are 21.7% of GDP, vis-a-vis 34.7% in the OECD, using their methodology. While, if one considers the ETP, the mean for LAC is 24.4% and if weighted according to GDP in purchasing power parity (PPP) it amounts to 27.5% (31.2% at the OECD). In other words, the difference in average tax revenues between the OECD and LAC is very high, 13.0 points, while if it were measured using the ETP, it may be reduced to only 3.7 points in weighted average. In fact, LAC has increased collection in the past 25 years by over 30%, going from 18.8% (1990-1992 average) to 24.7% of GDP (2013-2015 average).

In addition, this database includes a document on ETP which analyzes the historical evolution by type of tax and establishes an international comparison. Additionally, and as an example of its use, an estimate is made of the response of revenues measured through the ETP to the cyclic evolution of the economy (short and long-term buoyancy) at the subregional level.

Lastly, the data were organized for quick and simple inquiries through an interactive tableau, to facilitate orderly access to the information according to the user’s needs.

2,113 total views, 2 views today