Gartner Hype Cycle and the new technologies of interest to the tax administrations

The Gartner Hype[i] Cycle provides a graphic representation of the maturity and adoption of technologies and applications, which in addition to having relevant potential for solving institutional problems, allow for anticipating new opportunities. This methodology affords an overview of how a technology or application will evolve through time, thereby providing a sound source of knowledge to manage its implementation within the context of the business objectives[ii].

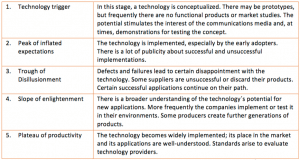

According to Gartner´s proposal, the new technologies follow a specific cycle, divided into five stages that range from their conception up to the development of useable products. Throughout this course, they may progress or become irrelevant. It begins with stage 1, when the “technology trigger” takes place. Some of them become hype and achieve stage 2 which is known as the “peak of inflated expectations”. If the technology thrives, it will go through two additional stages until arriving at the “plateau of productivity”; that is, when the adequate uses are better defined and the products available in the market are presented. In addition, the methodology anticipates the estimated years required for a specific technology to achieve the “plateau of productivity”.

Table 1: Life cycle of the technologies (Gartner Hype Cycle) – adapted[iii]

Annually, between July and August, Gartner publishes its vision of the updated Hype Cycle, with evolutions and new technologies being positioned in the stages of the cycle. By way of example, in 2013, the Big Data technology which is currently essential for the tax administrations (TAs), was located on the “peak of inflated expectations” stage.

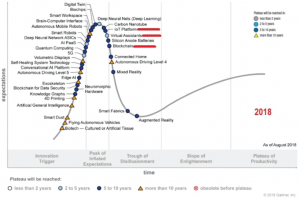

For 2018, the Hype Cycle presents the following composition:

Figure 1: Gartner Hype Cycle 2018

Source: Gartner Group

Three technologies of great interest for improving tax policies and management were selected for a summarized analysis: Internet of things platform (IoT), virtual assistants and blockchain[iv].

Internet of things (IoT) Platform

IoT is a series of devices containing electronic circuits, sensors and software with network connectivity, which allow devices to compile and exchange data. These devices generate data for real time monitoring and measurements and the trend is that their analysis may be part of the usual way of conducting businesses.

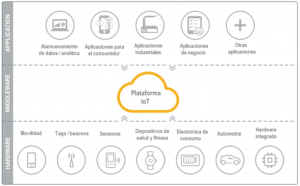

An IoT platform is a multilayered technology that allows the direct collection of data, the administration and automation of the management of devices connected within the universe of the Internet of things. It basically connects the hardware, although of varying kinds, protocols and origins, to the cloud by means of flexible connectivity options, high level security mechanisms and expands the data processing capacity. In short, it facilitates communication, data flow, the management of devices and the functionality of the applications.

It is anticipated that devices that include identification technology may automate the management and tracing of goods in the management of taxes dealing with the transit of goods such as VAT and customs administration. In Brazil, the Brasil-ID[v] Project uses the RFID technology and traffic sensors associated to the electronic fiscal documents of goods and transportation vehicles to examine the Tax on the Circulation of Goods and Services (ICMS) in the transfer of goods between states. Towers installed along the highways compile the data issued by the RFID labels in the goods and vehicles and send them to the control centers for their processing. This experience is supported by private initiative, which also obtains data for controlling its vehicles to thus minimize deviations or cargo thefts.

But when there is need to obtain information from multiple sources, in an environment with a considerable diversity of devices, firmwares, protocols and security challenges, the IoT platforms reduce complexity and are also essential.

Figure 2: IoT Platforms

Source: Kaaproject (adapted)

The 2018 Hype Cycle shows that these platforms are still at the “peak of inflated expectations”, there being in the market initial versions, although without a clear definition of trends. The technology expects to achieve the “plateau of productivity” in 5 to 10 years.

Virtual assistants

A virtual assistant (VA) is a computer-generated conversational “character” which simulates a conversation for providing voice or text-based information to a user through a Web, kiosk or mobile interface. A VA incorporates natural language processing, artificial intelligence, dialogue control, knowledge of the domain and visual appearance (such as photographs or animation) which change according to the contents and context of the dialogue. The main methods of interaction are text to text, text to voice, voice to text and voice to voice[vi].

Taxpayer assistance continues to be one of the most important challenges for the TAs and virtual assistants are considered highly promising to support this task. The TAs of some countries already use virtual assistants, still in basic versions if compared with all of the technology’s expected potential. The Australian TA developed a virtual assistant called “Alex” for this purpose. In the first 18 months Alex conducted over 2 million conversations, with a first contact resolution rate (FCR) of 88%. The reference in the industry is between 60 and 65%[vii]. The government of Singapore also developed a generic VA to be distributed among its agencies.

En el Hype Cycle 2018, this technology is in the limit of the “trough of disillusionment” stage, when some initial VA platforms may disappear or be adapted to new achievements in the area, pressured by technological improvements or the entry of new players. The technology hopes to achieve the “plateau of productivity” in 2 to 5 years.

Blockchain

Blockchain is a public registry wherein transactions between two users are stored in a safe, verifiable and permanent manner. The data related to the exchanges are kept in cryptographic blocks hierarchically connected among themselves. This creates an endless chain of data blocks, that allows for tracing and verifying all the transactions carried out.

There is a great potential in the applicability of blockchain for the modernization of tax policy and management, which is still being evaluated in concrete terms. Concept tests, pilot projects and theoretical evaluations are being carried out in the world: a concept test is being carried out in Singapore in relation to the import of computer goods that involve the customs administration, as well as IBM and Maersk, which covers the entire supply chain.[viii] The United Kingdom’s Office for Science proposes the creation of a blockchain data base to manage the European VAT, in order to reduce the main types of noncompliances that comprise the existing tax gap.[ix] The government of China announced that its electronic invoicing system will be based on blockchain[x].

In the 2018 hype cycle, the blockchain technology begins its route in the “trough of disillusionment”, when the initially imagined potential will be reduced, with some applications following their course of tests and evaluations, by providing increasing understanding of the entire context of use of the technology. The blockchain expects to achieve the “plateau of productivity” in 5 to 10 years.

Final comments

Although there are criticisms regarding the importance of Garner’s hype cycle for disclosing the real trends of a technology[xi], it continues to be an important tool for institutions to guide their decisions in the technological area, according to their risk exposure.

In 2018, there appeared new technologies in the initial stages of the cycle and some may probably be of interest for improvements in the fiscal area and are worth being followed up, such as: Edge AI (Artificial Intelligence on the edge), with AI algorithms processed locally in their own devices; Conversational AI (conversational artificial intelligence), aimed at outstanding improvements in understanding and generating human language; Digital Twins (digital replicas), which combines AI, learning the operation of devices and data analysis for creating virtual replicas of processes, physical assets and polyvalent systems updated in real time.

Additionally, international agencies with functions in the fiscal area (such as CIAT, IADB, IMF, World Bank, IOTA, …) publish complementary information on the use of new technologies in the fiscal area, in their blogs, articles and books, which provide the TAs important information for making decisions in the area of technology.

[i] According to the Oxford online Dictionary, hype means intensive or extravagant publicity or promotion (Oxford Dictionaire on-line)

[ii] https://www.gartner.com/en/research/methodologies/gartner-hype-cycle

[iii] https://whatis.techtarget.com/definition/Gartner-hype-cycle

[iv] A better understanding perspective of these and other innovative digital technologies for the fiscal area may be found in the book “Panorama del uso de las tecnologías y soluciones digitales innovadoras en la política y la gestión fiscal” (Seco & Muñoz, 2018), published by IADB and which may be downloaded in its PDF version at: https://publications.iadb.org/handle/11319/9073

[v] For additional information, visit: http://brasil-id.org.br/

[vi] Gartner on-line Dictionary

[vii] https://whatsnext.nuance.com/customer-experience/government-ato-virtual-assistant/

[viii] https://www.youtube.com/watch?v=LeKapqAQimk (vídeo de descripción)

[ix] UK Government, Office for Science, “DLT – Beyond Blockchain” (2016, pp 70-71)

[x] https://futurism.com/china-to-start-using-blockchain-to-collect-taxes-and-send-invoices/

[xi] https://www.linkedin.com/pulse/8-lessons-from-20-years-hype-cycles-michael-mullany/

7,810 total views, 17 views today

2 comments

Antonio como puedo contactar contigo? Muchas gracias

Great read! The Gartner Hype Cycle provides valuable insights into the exciting new tech trends that will impact the tax industry, helping professionals stay ahead of the curve.