Making it easier: taxpayer services, cooperative compliance and tax simplification

Providing tax certainty could – and should – imply multiple aspects, being by nature a multidimensional strategy that endeavors to “facilitate” taxpayer voluntary compliance with their tax obligations. One of the most recent CIAT Working Documents analyzes the reality of the Tax Administrations (TA) in this area, using the most recent data available through ISORA, the International Survey on Tax Administration.

One hundred twenty-five countries and jurisdictions have been considered, grouped by level of income, using the World Bank classification into high (38.4% of the countries surveyed), upper/middle (26.4%), lower/middle (18.4%) and low income (16.8%).

Three dimensions linked to tax certainty are considered in this study: taxpayer services and rights; cooperative compliance strategies and alternative dispute resolution channels; and inquiries/rulings and special regimes/taxpayer segmentation strategies.

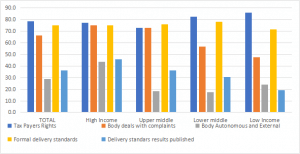

For example, with respect to taxpayer rights and services, the great majority of tax administrations seem to be in line with this strategy for improvement and close to eighty per cent (78.4%) of them declare having a document that formally sets out the taxpayer rights, with no significant differences across income levels (Table1). Nevertheless, there are some outstanding differences concerning the existence of a formal body to deal with complaints (75% of high-income tax administrations; 47% in low-income countries) and, in general, the number of tax administrations where this body is autonomous and external drops dramatically (only 28.8 on average).

Table 1. Taxpayer rights, complaints and application standards (% of TAs)

Likewise, when the presence or not of a formal set of service delivery standards is considered, more than 70% of the administrations answer positively (again, regardless of income levels). However, the percentages decrease drastically when inquired about the publication of the results obtained by applying those standards (only 36%, that range from 45.8 – high income –to barely 19% – low income-).

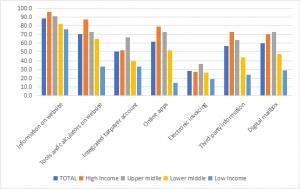

All TAs consider electronic services (Table 2) as an essential tool for promoting voluntary compliance, although the data show different strategies. In this field, the TAs could include successful strategies from other countries, regardless of their relative income level (for example, electronic invoicing is not mainly being developed in countries with high income).

Table 2. Electronic services

These data, together with others included in ISORA, also analyzed in the CIAT Working Documents series, such as those relative to collection, costs and staff, will allow for increased knowledge of the activities of the tax administrations at the world level, as well as for planning improvement strategies based on the best international practices.

2,424 total views, 2 views today

1 comment

My brother has been thinking about getting the right kind of planning for his taxes in order to be a lot more effective. Talking to a professional could allow him to understand the laws around the taxes in order to make better decisions. It was interesting to learn about how he should use alternative dispute resolution channels, special regimes, cooperative compliance, in order to improve his taxes to be better.