“Tax pollution, not people.” Climate Emergency and Public Finance

My message to governments around the world is clear:

First, shift the taxation from salaries to the taxation of carbon. We must tax pollution, not people. Second, stop subsidies to fossil fuels. Taxpayers’ money should not be used to boost hurricanes, to spread drought and heatwaves, to bleach corals or to melt glaciers.

Finally, stop the construction of new coal plants by 2020. We want a green economy not a grey economy in the world.

Antonio Guterres,

Secretary General of the United Nations,

May 15, 2019, to the Maori from the Fiji Islands

threatened by climate change. [1]

The message of the Secretary General of the United Nations cannot be clearer: We live in an age where keeping the silence on the subject of the current climate crisis a crime of non-assistance to persons in great danger.

We all know that our planet is in critical condition and the call of Mr. Guterres, on behalf of the United Nations, demands a radical reform of global public financing. He advocates for a shift — from the taxation of income from labour to the taxation of the environmental costs of human activities.

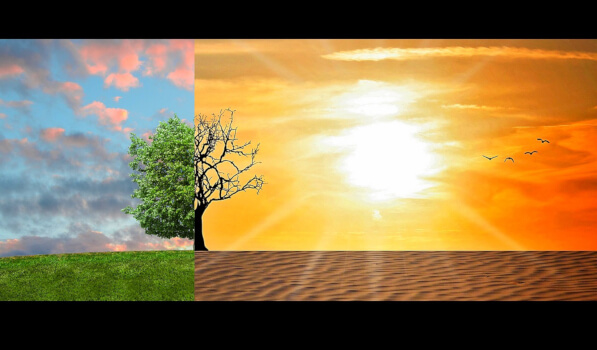

This call, of course, is part of a coordinated effort by many international organizations: a mobilization for our common home, the planet. This blog is not the place to repeat what has been repeated by 98% of climatologists and biologists for more than 40 years. We live in a period of climate emergency and mass extinction of our biodiversity. We know that the cause of this crisis is human activities in an economic system that developed without taking into account the cost of environmental externalities. Correcting the course is vital, and very urgent. Finally. Last week, the British Parliament declared a climate emergency.

On April 18, 2019, Bloomberg published the report of a joint statement by 30 central banks, led by the Bank of France, the Bank of England and the People’s Bank of China: They issued a common declaration stating that the need for action towards a “green economy” is now extremely urgent. [2]

The Insurance Journal relayed the call, announcing losses of 160 billion dollars last year in the United States alone due to weather damage. , Central banks now require a radically new assessment of the risks caused by climate change.

In addition, on May 2, the International Monetary Fund (IMF) published a major study on the costs of ignoring the impact of fossil fuels on health and the environment [3] . he estimate is staggering: the existing gap between the current price of fossil fuels and an “efficient price” (integrating the effects on health, environment and climate) totals 4.7 trillion, or 6.3 % of the world’s GDP. Overall, these hidden subsidies for fossil fuels are present in the 191 countries examined. The biggest “providers” of such subsidies are China (1.4 trillion), the United States (649 billion), Russia ($ 551 billion) and the European Union (289 billion).

As we know, reducing carbon dioxide emissions is a vital component of the policies to mitigate climate change, which 190 countries committed themselves to in the Paris Climate Accord in 2015. Moreover, many countries suffer from air pollution that far exceeds the limits set by the World Health Organization, and most of the use of fossil fuels and loss of forest coverage cause this pollution of the air.

The IMF report’s authors advocate a comprehensive adjustment of public finances of countries based on energy prices that reflect the environmental and health costs resulting from the excessive use of fossil fuels.

The study distinguishes the definitions of subsidies to fossil fuels: the “pre-tax” subsidies corresponding to government programs aimed at maintaining low fuel prices and “-post tax subsidies” which corresponds to externalities – effects on the air, health and climate – and these are almost never integrated in the prices in the countries under study.

The Secretary General of the United Nations calls on governments to change their tax systems to move from taxation based on the taxation of income or wages to taxation based on environmental and social cost of consumption of the products of the world economy.

Could we leave this call without echoing it? Emphatically, the answer is “No”. We need to help to adjust the public finance systems into tax systems where the states are actively involved in the preservation and future of our planet, and stop contributing involuntarily or not, to its degradation. The time when green taxation was regarded as a complement to the pillars of public finance has passed. We cannot delay action. Proclaiming the urgent need for this transformation is easier, however, than to implement it concretely. We need model of legislations that can turn the tide in favour of preserving the planet. This issue will the topic of future blogs.

[1] ” Tax Pollution, not people ,” UN meetings coverage and press release, May 13, 2019 See also Remarks to Maori

[2] Landberg. Reed, “With Rising losses Climate, Greener Central Banks Push Finance”, Bloomberg.com, 17/04/2019

[3] See IMF working paper https://www.imf.org/en/Publications/WP/Issues/2019/05/02/Global-Fossil-Fuel-Subsidies-Remain-Large-An-Update-Based-on- Country-Level-Estimates-46509

2,451 total views, 4 views today