Financial disclosure of risks and opportunities related to climate change

On 26 June 2020, the TCFD (Task Force on Climate-related Financial Disclosure) announced the publication of the Spanish version of its recommendation manual.[1]

The TFCD[2] was created in December 2019 by Mark Carney, Governor of the Bank of England and UN Special Envoy on Climate Action and Finance, and Michael Bloomberg, ex- mayor of New York, and founder of the Bloomberg L Publishing Group. P., who stated they wanted to “ provide investors, lenders and insurance insurers with adequate information on how companies are preparing for a low-carbon economy.” More effective, clear and consistent climate risk disclosure is needed from companies around the world”

The recommendations published by TFCD currently are already being used by the ECB (European Central Bank) and the Bank of England, and by the Bill and Melinda Gates Foundation[3], the Swiss Sustainable Finance Board, and various other large financial institutions , and play an important role in the decisions of large financial groups to stop investing in fossil fuels, for example, the decision by the group Blackrock, largest investment group in the world.[4]

The TFCD presentation brochure states that ” climate-related risks are a source of financial risk and therefore fall directly within the mandates of central banks and supervisory authorities to ensure that the financial system is resilient to these risks.”[5]

On September 23, 2019, the TCFD presented a Good Practice handbook on financial disclosure of climate risks for business groups and states. [6]

This manual assesses the risks and opportunities due to climate change in two categories:

Financial sectors are considered particularly vulnerable to the impacts of climate change. As well as executive boards of international business groups, Finance ministries of countries cannot, in the future, ignore these recommendations on how to integrate ” physical risks “and” energy transition risks ” into their budget projections.

The TFCD proposes training courses for the disclosure of climate-related financial risks, as shown in the table below.[7]

Climate-related financial disclosure includes four core elements: governance, strategy, risk management, metrics, and objectives.

| Governance | Strategy | Risk management | Metrics and targets |

| Disclose the organization’s governance around climate-related risks and opportunities, describes the board oversight and the role of executives in assessing and managing climate-related risks and opportunities | Disclose the actual and potential impacts of climate-related risks and opportunities on the organization’s business, strategy and financial planning when such information is relevant | Disclose how the organization identifies, assesses, and manages climate-related risks, describes processes, and how they are integrated into the organization’s overall risk management. | Disclose metrics and targets used to assess and manage climate-related risks and opportunities and measure results against targets. |

We are currently experiencing a pandemic that profoundly affects all aspects of economic and social life. One of the effects of the current crisis may accelerate the much-needed transition to a low-carbon economy. This transition, especially for developing countries, implies a difficult balance between national objectives of limiting or mitigating climate risks and seeking sustainable development of countries that reduce extreme poverty. In order to balance these essential objectives, it is necessary to learn about the risks and the relative capacities of private companies and public organizations to deal with them.

In this blog we can introduce these new approaches and mention here two reports on how countries are already integrating these recommendations into their projections:

The “Fiscal Risk Report” of the UK Public Agency for Budgetary Responsibility:[8]

“Climate-related risks for the economy will clearly be an important indirect source of fiscal risk. Extreme weather events could disrupt economic activity. Diverting investment to adaptation needs could affect investment in productive capital. The same could happen with investment in reducing greenhouse gas emissions, although as green technologies advance, the greatest risk may lie in the lack of production growth if the economy is not well placed to capitalize on such advances or is locked in obsolete infrastructure.”

The direct tax implications of changes in tax revenue and expenditure can arise through several channels. Extreme weather events can generate public expenditure needs to repair damage to private and public assets. Investment in adaptation measures, such as flood defenses and to manage the consequences of coastal erosion, requires significant public expenditure. And mitigation policies often have tax costs in terms of public spending, or, conversely, tax gains when taxes are used to discourage specific activities (i.e. Carbon pricing). In a world where global warming is progressing as state by the Paris Agreement, these direct effects still appear to be relatively modest.

From Denmark, the Climate Risk Disclosure Report assesses six economic sectors:[9]

The banking, insurance, asset managers, and energy, transport and agriculture sectors. A sample of companies is evaluated in each sector, and the report provides a rating for each sector. One of the positive points is that between 2018 and 1019, ratings have evolved very favorably, although most companies partially comply with the recommendations. Strategy and Risk categories have the lowest rating in all sectors. The Banking and Energy sectors have the highest ratings. The most neglected element is “strategy”.

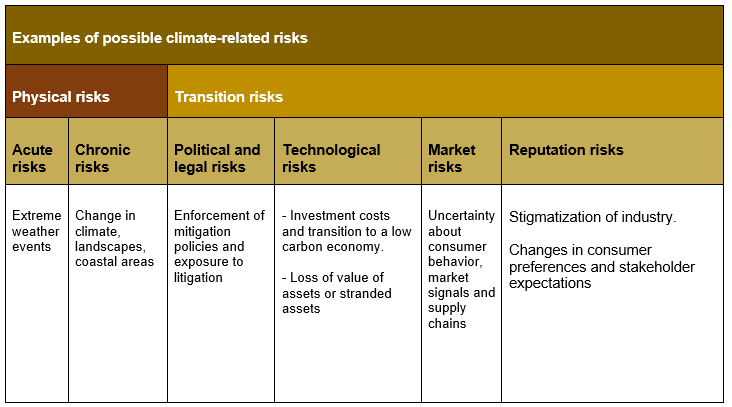

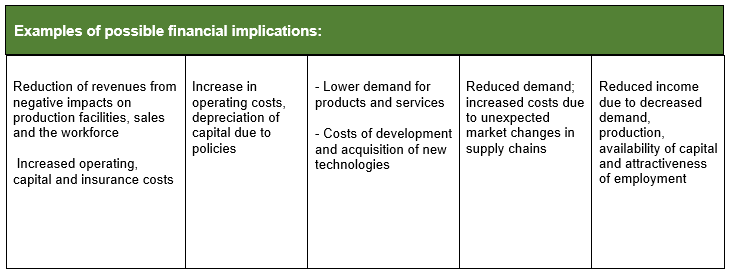

Finally, and to conclude, we present a table from the report of the Swiss Sustainable Finance Board [10]. This table describes some of the main financial risks related to climate risks for companies. A similar table, in said report, presented in the references, describes the opportunities that appear for companies that comply with the recommendations.

Example of a table presenting the main financial risks for enterprises

Are states and financial systems responding to the situation? There is a great disparity between the levels of preparedness of states. Strategies for the future that await us vary greatly depending on whether we are anticipating a world where each state or bloc tries to determine priorities separately, or whether we are in a world seeking international cooperation and coordination, more necessary than ever to face these unprecedented challenges.

[1] See Bloomberg: https://www.bloomberg.com/latam/blog/tcfd-lanza-recomendaciones-traducidas-al-espanol / and https://www.fsb-tcfd.org/wp-content/uploads/2020/06/PR-TCFD-Spanish-Translation_FINAL-ENG_6.26.20.pdf

[2] Brochure presenting the TFCD https://www.fsb-tcfd.org/wp-content/uploads/2020/03/TCFD_Booklet_FNL_Digital_March-2020.pdf

[3] Bill and Melinda Gates add climate to the priorities of the fundación https://www.bloomberg.com/news/articles/2020-02-10/bill-melinda-gates-add-climate-gender-to-foundation-priorities

[4] The Guardian, 14 January 2020 https://www.theguardian.com/business/2020/jan/14/blackrock-says-climate-crisis-will-now-guide-its-investments

[5] Network for greening the financial system, first full report, April 2019 https://www.ngfs.net/en. At The” One Planet Summit ” in Paris in December 2017, eight central banks and supervisors established the network of central banks and supervisors for greening the financial system (NGFS). Since then, the number of members of the network has grown dramatically, across the five continents

[6] TCFB, Good Practice manual (see charts) https://www.cdsb.net/sites/default/files/tcfd_good_practice_handbook_web_a4.pdf

[7] Financial disclosure courses offered by TCFD https://learn.tcfdhub.org/login/signup.php –https://learn.tcfdhub.org/course/view.php?id=3

[8] UK Fiscal Risk Report: https://obr.uk/docs/dlm_uploads/Fiscalrisksreport2019.pdf

[9] Climate Risk Disclosure for Denmark https://www.ey.com/Publication/vwLUAssets/Climate_Risk_Disclosure_Barometer_Denmark_2020/$FILE/ey-climate-risk-disclosure-barometer-2020.pdf

[10] Measuring climate-related risks in investment portfolios 12 pages https://www.sustainablefinance.ch/upload/cms/user/2019_03_04_SSF_Focus_Measuring_Climate_related_Risks_in_Portfolios_final.pdf

4,418 total views, 8 views today

1 comment

Overall, the quality of banks’ climate risk disclosures lagged behind leading sectors, such as telecommunications and energy, but received the highest score for quality in the financial sector.