New study and tool for assessing risks of illicit financial flows in Latin America

Today, the Tax Justice Network publishes its new study on “Vulnerability and exposure to illicit financial flows risk in Latin America” (the Report). It is the most comprehensive and systematic analysis of illicit financial flows risks in Latin America, and provides the basis for granular policy decisions. Illicit financial flows (IFFs) are transfers of money from one country to another that are forbidden by law, rules or custom. They encompass flows from both illegal origin capital (classic money laundering, arms, drugs, human trafficking, corruption) and legal origin capital (tax evasion and avoidance).

IFFs affect the economies, societies, public finances and governance of Latin American countries – as they do in all other countries. Latin American and Caribbean countries account for a significant share of trade-based illicit financial flows, and are estimated to lose US $43bn annually to global cross-border tax abuse. The urgent need to tackle IFFs is clear. Despite global agreement in target 16.4 of the UN Sustainable Development Goals, the international architecture remains entirely insufficient to support progress – although the UN FACTI panel’s final report, due in February, will identify key gaps and make recommendations for immediate action.

At the national level, a particular challenge in countering IFFs lies in prioritising among the many channels; and within each channel, identifying the economic partner jurisdictions responsible for the vulnerability. We address this research gap by elaborating on an approach pioneered in the report published by the High-Level Panel on Illicit Financial Flows from Africa (“The Mbeki Panel”), which can be used to generate proxies for IFF risk by combining bilateral data on trade, investment, and banking stocks and flows, with measures of financial secrecy in partner jurisdictions. The full dataset is accessible in the TJN online IFF vulnerability tracker portal.

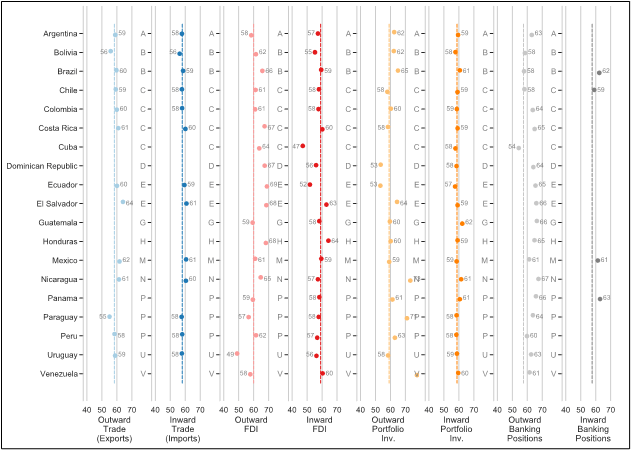

Chart 1 below illustrates the vulnerability in the eight economic channels for the 19 countries in Latin America under review, where zero represents no vulnerability or secrecy in the economic channel, and 100 implies highest vulnerability, or economic flows with an entirely secretive counterparty. The dotted lines represent the global average of vulnerability, so it can be seen that Chile, for example, faces roughly the average risk in most channels, while Mexico is more vulnerable in most.

Chart 1: Latin American jurisdictions’ vulnerability to illicit financial flows in different channels, 2018. Dotted lines represents the global average.

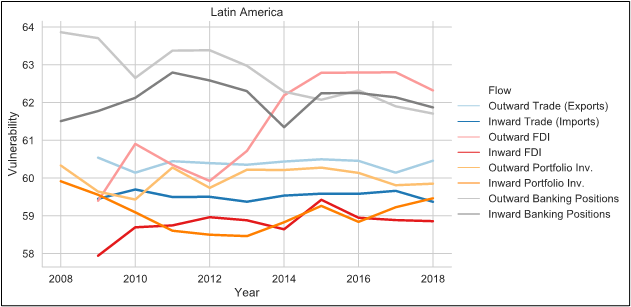

When looking at the development of vulnerabilities in the different channels over time (Chart 2), with the exception of outward FDI, these have remained broadly constant between 2009 and 2018. Banking positions have been, and continue to be, among the most vulnerable channels of Latin America.

Chart 2: Average vulnerability of Latin American states over time, for all economic channels.

Chart 2: Average vulnerability of Latin American states over time, for all economic channels.

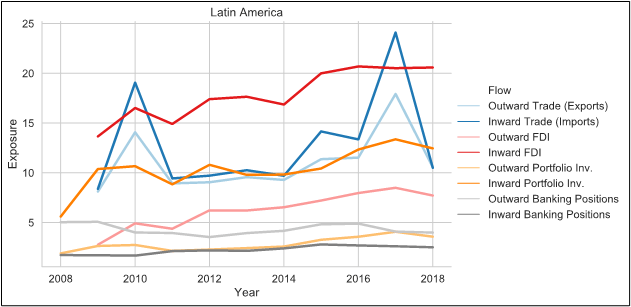

To complement the analysis of the secrecy in the economic channels, we combine the measures of vulnerability with the share of the total volume of the cross-border flows for that channel in a country’s GDP, in order to calculate the country’s overall exposure to IFF risks. Chart 3 illustrates that the most significant economic channel exposing Latin America to most IFF risks is inward FDI, followed by trade and portfolio capital. The increase in exposure across most channels can be attributed to an increased internationalisation of Latin American economies, as cross-border economic transactions represent a growing share of Latin American countries’ GDP. For outward FDI, however, the vulnerability has increased above the global average of 60 (see chart 2 above).

Chart 3: Average exposure of Latin American states over time, for all economic channels

Chart 3: Average exposure of Latin American states over time, for all economic channels

Risks associated with Foreign Direct Investment

The Report discusses how the data-driven vulnerability profiles for individual Latin American countries relate to, and can be used to help identify, real cases of tax avoidance, evasion, money laundering and corruption. For instance, the risks stemming from outward Foreign Direct Investment (FDI) are such that domestic companies and individuals can make false statements about the relationship, owners, and accounts of their foreign businesses or activities in tax returns. This may be done for round-tripping purposes. That is, to nominally invest abroad with the ultimate destination being the domestic economy, to exploit tax treaties or other provisions only available to foreign investors, or to pay kickbacks for securing contracts abroad. For example, in 2019, Joaquín Guzmán Loera (a.k.a. “El Chapo”) was found guilty by a District Court in Brooklyn, United States, of drug trafficking and money laundering. According to the United States Drug Enforcement Administration (DEA), one of the methods used by El Chapo for laundering billions of U.S. dollars of drug proceeds consisted of using insurance companies and controlling numerous shell companies in the United States, into which El Chapo invested.

There are many other examples of FDI risks further examined in the Report. While this macro-level analysis signals red flags which in some occasions might be sufficient to begin investigating the FDI stock into and from highly secretive and notorious corporate tax havens, the next level would consist in applying the same analysis to micro-level investment transactions and intra-group trade transactions. By applying this vulnerability analysis to transaction level data, administrations can sift through large volumes of data and implement an advanced analytics risk mining of their datasets. This model could be applied for example to controlled transactions in transfer pricing returns filed by multinational companies, to customs declaration forms, to suspicious transaction reports, or to SWIFT money transfer data, etc. By focusing limited audit capacity on transactions with the highest composite secrecy risks and with the greatest financial values cloaked in secrecy, both the revenue yield and the compliance impact of audits could be greatly enhanced. TJN currently partners with tax administrations to pioneer and evaluate the effects of this approach and is working towards its expansion.

Geopolitical Implications

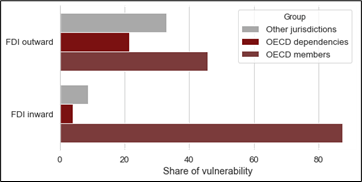

Another important finding of the Report concerns the responsibility of OECD member states and their dependencies in the vulnerability (not only) of FDI in Latin America (see chart 4). In 2018, 91 per cent of Latin America’s vulnerability risk in direct (inward) foreign investment stemmed from OECD countries and their dependencies.[1] The implied political economy of international tax governance points to the need for vigilance in the current “BEPS 2.0” negotiations around reform of the taxation of multinational companies under the Inclusive Framework of the OECD. More ambitious proposals for comprehensive reforms, such as those made by the Intergovernmental Group of Twenty-Four (G24) and by the Independent Commission for the Reform of International Corporate Taxation (ICRICT), have been sidelined, as has become evident in the blueprints published in October 2020 by the OECD. Latin American countries should carefully evaluate their political representation at the OECD and the Inclusive Framework, and assess the potential for an enhanced role through a UN tax body and convention, not least through the FACTI panel.

Chart 4: Vulnerability in direct investment (inward and outward (derived)) 2018 – Top suppliers of secrecy risks faced by Latin America, by OECD membership and dependencies

Offshore tax evasion and automatic exchange of information

An even higher concentration of risks in OECD member states can be found in the outward banking deposits of Latin America (as exemplified in the 2019 “El Chapo“ case above). The Latin American countries participating in this unbalanced (often non-reciprocal) exchange system might consider working towards a joint position for tweaking the parameters of the system to meet their needs. For example, requiring public statistics could be an effective means to increase compliance of reporting obligations in major OECD controlled financial centres. In addition, the artificial legal constraints the OECD places on the use of data for criminal corruption and money laundering investigations could be revisited. Furthermore, options to achieve fully reciprocal information exchanges should be explored.

All data underlying the report is available freely in the Tax Justice Network’s Illicit Financial Flows Vulnerability Tracker (https://iff.taxjustice.net/). In February 2021, the website will be updated, providing increased granularity and a user-friendly data explorer.

Policy recommendations

The Report offers three broad policy recommendations to counter IFFs more effectively. In each of the chapters, more granular policy recommendations are provided.

[1] OECD Dependencies include UK Overseas Territories and Crown Dependencies and US and Dutch Overseas Territories: Anguilla, Aruba, Bermuda, British Virgin Islands, Cayman Islands, Curacao, Gibraltar, Guernsey, Isle of Man, Jersey, Montserrat, Puerto Rico, Sint Maarten, Turks and Caicos, and US Virgin Islands.

9,580 total views, 3 views today