Value Added Tax: its application in America

The importance of VAT in the tax structure of the countries of America is significant. Its application began in the 1960s in Colombia and Brazil, followed in 1972 with Uruguay, and so on until it reached most of the countries of the continent, including the English-speaking Caribbean countries[1].

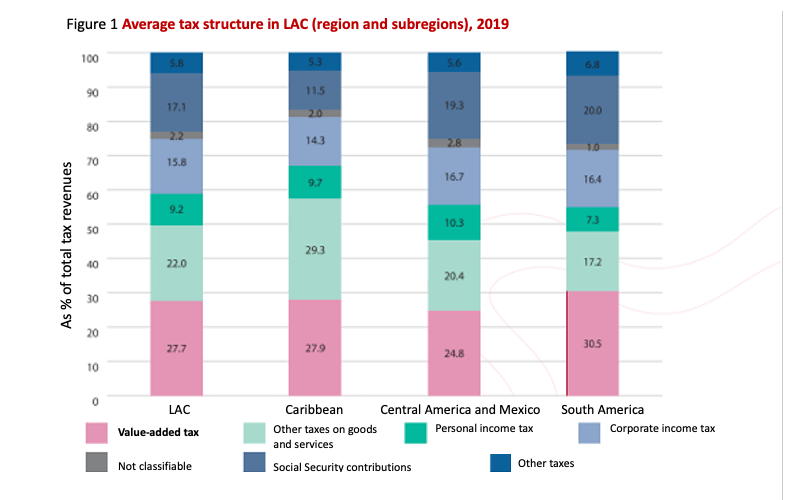

Regarding the importance of its collection specifically in LAC according to the OECD / ECLAC / CIAT / IDB (2021), it can be noted that it implies 27.7% of total tax revenue (30.5% in South America). As a percentage of GDP, said revenues increased significantly in the last decade, from 2.2% of GDP in 1990 to 6.0% in 2019[2].

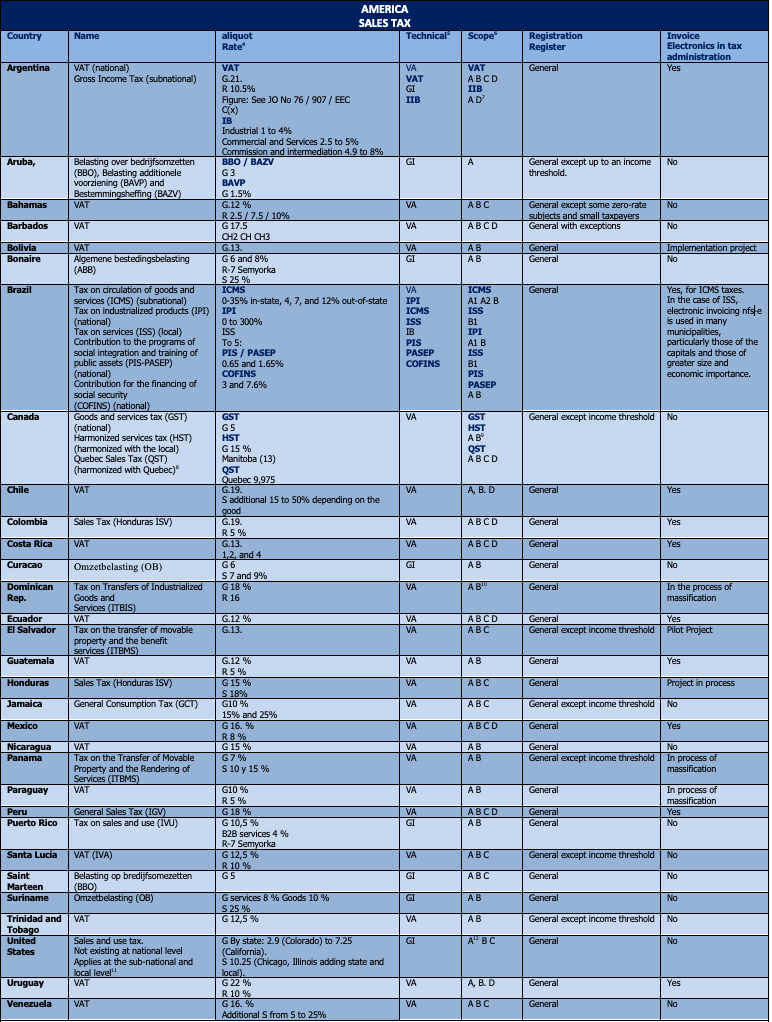

With respect to the American continent, the analysis of 31 countries shows that 24 apply it, and the remaining 7 countries (5 Caribbean, Suriname, and the United States) tax general consumption through a tax on gross income (“turnover tax “,” revenue tax “,” sales and use tax “).

With respect to the American continent, the analysis of 31 countries shows that 24 apply it, and the remaining 7 countries (5 Caribbean, Suriname, and the United States) tax general consumption through a tax on gross income (“turnover tax “,” revenue tax “,” sales and use tax “).

At the beginning of its application, the manual of good practices indicated for its better application and management that the original taxable events based on the importation and sale of movable goods should be generalized to services (importation and provision within the country), sale of real estate and locations. Currently, the topic of interest is its extension to the sale of intangibles and the provision of services through digital media abroad[3]. The ideal generalization also involves minimizing tax exemptions.

Below is a table on the application in America of general consumption tax, either through VAT or taxes on gross income or turnover (multi-phase or single-phase).

The final column on the electronic invoice identifies whether the tax administration receives all the documents that generate tax credit (or at least the documents that generate tax credit) in almost real-time. It is not a question here about whether the use of electronic invoicing is, for example, accepted in a country without any regulation, but rather about the use of electronic invoicing by the tax administration for both control and service provision purposes.

Source: own elaboration based on data from “Worldwide VAT, GST and Sales Tax Guide 2021”, EY, April 2021 https://www.ey.com/en_gl/tax-guides/worldwide-vat-gst-and-sales-tax-guide and CIAT

In the synoptic table, the ideal generalization would be for each country to include the taxable events indicated as A, B, C and D. As can be seen, only 6 countries and one region are those that at the time of writing this post cover all four aspects, although there are processes in many of them to achieve their expansion.

With regard to the rates, from a strictly theoretical approach, benefits are seen in the application of a single general rate for all types of goods and services, to facilitate the control of the Tax Administration and avoid abuses, and the application of the zero rates (except for exports[13]), since the return of supplier credits, forces the tax administration to apply extensive controls and complex processes to avoid fraudulent maneuvers increasing the costs of the administration and taxpayers

Also, the facilitation of control would recommend a single general rate instead of differential rates (higher or lower), once again the reality has exceeded the technique, and the need to reduce the tax on essential goods and services or to increase it in certain goods and services has been imposed in practice. For this reason, the table shows that only six countries apply a single general rate.

Regarding the tax powers to tax general consumption, in federal countries, this has had the logical complexity of its attribution between the national and the subnational entities. In Argentina it was resolved with the exclusive application of VAT at the national level and the Gross Income Tax at the sub-national level, in Canada at the same VAT through the application of an additional rate by sub-national entities, in Brazil with exclusive powers to the federation (national) of the IPI, PIS / PASEP and COFINS, the states (subnational) the ICMS and the municipalities (local) the ISS, in Mexico with VAT under the exclusive competence of the Federation and in the USA granting exclusive power to states (subnational) and counties (local).

Regarding the administration of this type of tax, in our opinion, it is advisable to apply a general registration of taxpayers (without exceptions for billing amounts) and the general use of electronic invoices in which the tax administration receives all the documents.

It is observed that 9 countries still have an income threshold for registration, which can favor fraudulent maneuvers aimed at reducing or avoiding invoicing so as not to be obliged to comply with the obligations as responsible for the tax, which not only makes it difficult to control the tax administration but unbalances the conditions with which other compliant actors in the economy compete.

In order to improve the control of compliance with tax obligations, with respect to electronic invoicing, it is noted that more than a dozen countries in Latin America have solid implementations, while a massification space is opened (Panama, Paraguay, or the Dominican Republic) or fully implemented (Bolivia or El Salvador).

As a characteristic note, it can be noted that the United States is the only country that does not have a general consumption tax at the federal (national) level, which is in the exclusive tax authority of the States and Counties (“Sales and Use Tax”) which have their own facts and tax base, rates and scope, therefore there are more than 13,000 tax jurisdictions that apply it.

Synthesis

Undoubtedly, the prevalence of the application of VAT, its generalization, the application of differentiated rates, and the mandatory nature of both taxpayer registration and the issuance of electronic invoices is observed as a trend in the taxation of general consumption.

On the other hand, technological developments, and in particular electronic invoicing, have made it possible to implement important innovations in compliance issues: the SII in Chile, a pioneer in electronic invoicing, has pre-filled since 2017 the monthly VAT returns that are accepted without modification by more than 90 percent of the taxpayers and keep the records of purchases and sales in the computer services of the tax administration, replacing the traditional purchase and sales books. Other administrations follow the example: in Ecuador, the SRI already pre-fills fields of VAT returns and in Colombia, the DIAN has announced an electronic book of purchases and sales, while in several administrations such as Mexico, electronic invoices support elements to pre-fill or check deductions in direct taxes. At the same time, the use of electronic invoicing and the efficient control capacity allows to significantly shorten the processes of returns to exporters or tourists or, even faster, such as the recently implemented online VAT refund to the elderly or people with disabilities. by the SRI in Ecuador.

If this process takes place, it seems to us that VAT will continue to be the main tax for the tax revenues of this continent’s countries and that the tax pressure that it entails will increase, but the relationship between taxpayers and the administration will be increasingly close and continuous on transactions.

Greetings and Godspeed.

[1] GONZÁLEZ, Darío (1998) “Estudio Comparado del IVA en los países miembros del CIAT”. CIAT.

[2]OECD / CIAT / ECLAC / IDB (2021), “Tax statistics in Latin America and the Caribbean 2021”, https://dx.doi.org/10.1787/96ce5287-en-es.

[3]OECD / GBM / CIAT / IDB (2021) “Digital VAT Toolkit for Latin America and the Caribbean. Highlights and main recommendations”.

[4]Rate or aliquot: G) General or standard, R) Reduced, S) Superior.

[5]Taxable technique: VA) Value Added, and GI) Gross income or business volume (invoicing).

[6]Taxable events: A) Sale of movable goods and services in the country (A1 Sale of movable things in the country A2 services in the country), B) Import of goods, C) Import of services and D) Services of digital services from abroad.

[7]Only in some jurisdictions.

[8]The provinces of Manitoba and Saskatchewan continue to impose their own retail sales tax, while the province of Alberta and the three Canadian territories do not impose a tax on retail sales.

[9]In project the application of the tax to the digital economy.

[10]The application to foreign digital services is suspended.

[11]Of 50 states, 45 have a sales and use tax. Only Alaska, Delaware, Montana, New Hampshire, and Oregon don’t apply it. There are 13,000 jurisdictions with tax authority in sales tax incorporating local jurisdictions. For interstate sales the authority is the state of destination (use tax).

[12]Includes sales with physical or remote presence after the ruling of the CSJ Wayfair (2018). Only Missouri and Florida do not include remote.

[13] All countries apply it, although with different and misleading names such as exemption, exoneration, exclusion, liberation, etc. This is so because technically only the zero rates allow the return of tax credits.

8,521 total views, 10 views today