Taxation Program 11ed.

This course seeks to provide tax administration officials and the public in general of the countries of Latin America and the Caribbean, Europe and Africa, general knowledge on the most relevant taxation issues.

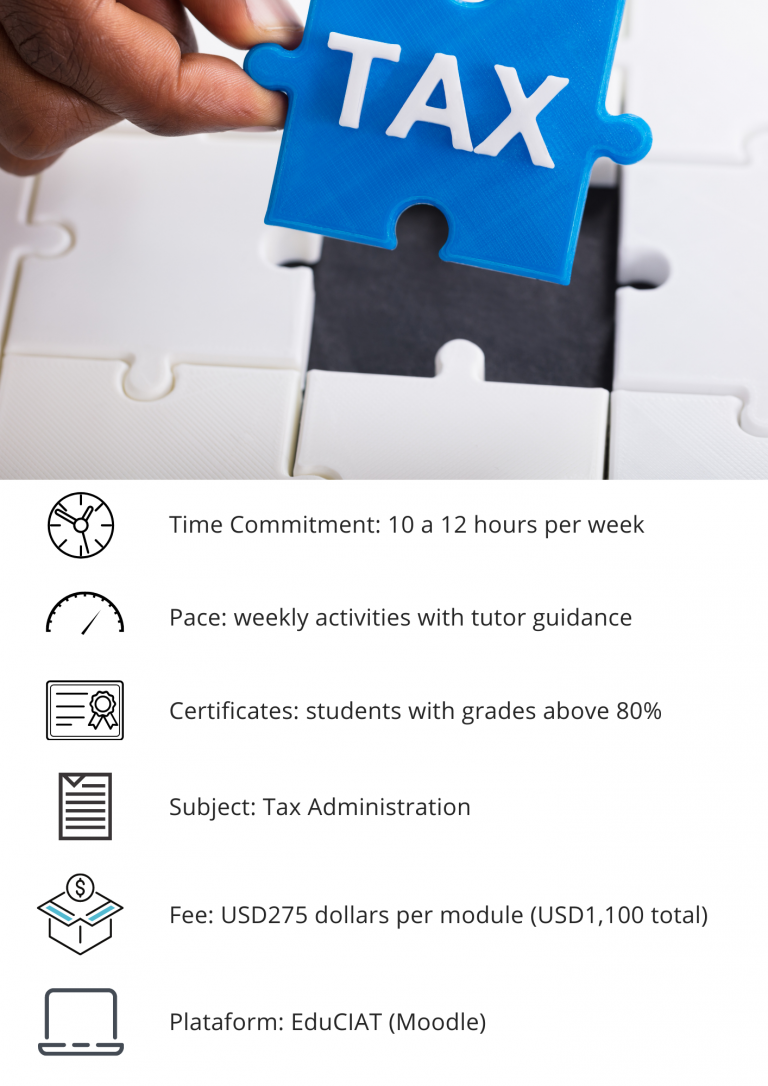

General Information

When: August 01, 2022 to September 10, 2023.

Modality: virtual.

Duration: 52 weeks and 380 academic’s hours.

Target audience: tax administration officials and individuals of the CIAT member countries dealing with taxation issues.

Language: Spanish.

Registration Deadline: July 01, 2022.

Requirements

-

Updated browser (Google Chrome, Mozilla Firefox or Safari).

-

Permission to receive external emails.

-

Adobe Reader.

-

Adobe Flash Player.

-

Java.

-

Zoom, is the tool to perform synchronous sessions.

Content

The course will develop the following topics:

Module I

– Lesson 1. Tax Policy and the Basic Principles of Taxation

– Lesson 2. Basic Tax Concepts and structures

– Lesson 3. Models and Design of Tax Systems

– Lesson 4. Income Taxation

– Lesson 5. The Taxation of Business Earnings

– Lesson 6. Taxation of assets

– Lesson 7. Consumption Taxation

– Lesson 8. Taxation and levels of Government

Module II

– Lesson 1. Tax Law

– Lesson 2. The Taxes

– Lesson 3. Constitutional Tax Law

– Lesson 4. Material or Substantive Tax Law

– Lesson 5. Formal or Administrative Tax Law

– Lesson 6. Procedural Tax Law

– Lesson 7. Criminal Tax Law

– Lesson 8. International Tax Law

Module III

– Lesson 1. Introduction to International Taxation

– Lesson 2. Harmful Tax Practices

– Lesson 3. Transfer Pricing

– Lesson 4. Taxation of Electronic Commerce

– Lesson 5. Control of International Tax Planning

– Lesson 6. International Administrative Cooperation

Module IV

– Lesson 1. Conceptual Aspects of the Tax Administration and its scope of action

– Lesson 2. Conceptual Aspects of the Organizational Design: General aspects and Aspects of Organizational Structure

– Lesson 3. The Tax Administration Processes. The Substantive Processes: Collection and Taxpayer Assistance

– Lesson 4. The Tax Administration Processes. The Substantive Processes: Examination

– Lesson 5. The Tax Administration Processes. The Substantive Processes: Determination, Administrative appeals and collection

– Lesson 6. The Tax Administration Processes: The support processes

– Lesson 7. Human resources

– Lesson 8. Concepts of Planning and Control