Revisiting Personalized VAT: A Tool for Fiscal Consolidation with Equity

The economic contraction tracked by the COVID-19 pandemic has created large fiscal imbalances that will lead Latin American and Caribbean (LAC) governments to pursue fiscal consolidation policies to increase revenues and reduce expenditures.

In the tax realm, questions inevitably arise as to the adequacy of tax revenues and the equity of the proposed measures. That calls for analysis of how to mitigate taxes’ distributive impact to favor certain segments of taxpayers and ensure the simplicity of the measures’ implementation.

With these issues in mind, this blog proposes strengthening tax revenues by using Personalized Value Added Tax (P VAT), a proposal for an increase in VAT revenues that offsets its distributive impact through relief for those with lower incomes.

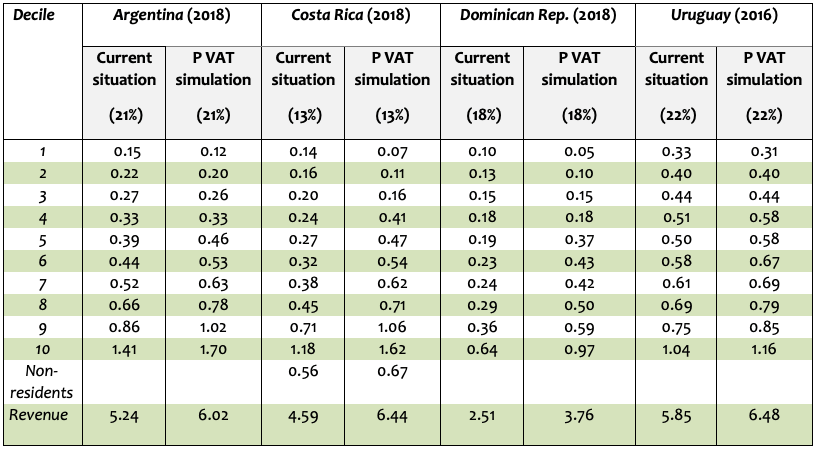

VAT is the main source of tax revenue in LAC. It accounted for an average of 5.9% of GDP in the 2017–2019 three-year period , which is comparable to the share raised by VAT in the 37 countries of the OECD in the same period.

Table 1. Tax Burden as % of GDP (average, 2017–2019)

Fuente: Revenue Statistics OECD-CIAT-ECLAC-IDB (2021): https://publications.iadb.org/en/revenue-statistics-latin-america-and-caribbean-2021

Characteristics of VAT

In most countries, VAT is set up as a general consumption tax. One characteristic of consumption taxes, however, is their regressivity. Analyses of VAT’s distributional impact show that poorer households spend a higher percentage of their income on the consumption of taxed goods and services (and therefore on paying VAT) than higher-income households.

To counter VAT’s regressivity, most countries have followed the “universal” strategy of providing relief to taxpayers by:

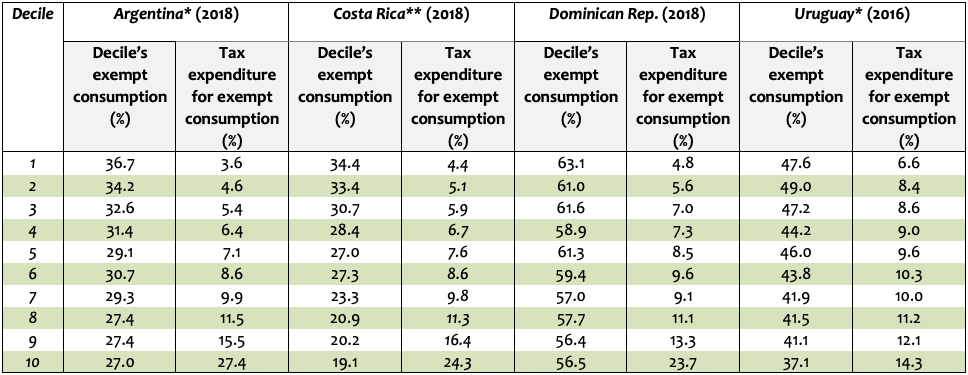

The “universal” solution is not an effective response to the problem posed by VAT’s regressivity. Its weakness stems from the fact that tax relief measures effected through exemptions and/or multiple rates confer greater benefits, in absolute terms, on those who consume the most—that is, individuals in the upper deciles of the income distribution, as shown in Table 2.

In addition to this undesired impact, the “universal” solution has two other negative effects:

Table 2. Distribution of Exempt Consumption and Tax Expenditures by Income Decile (4 Countries)

Notes: (*) Average consumption taxed at rates of 21 percent, 10.5 percent, and exempt in Argentina and 22 percent, 10 percent, and exempt in Uruguay. (**) For Costa Rica, the consumption of “non-residents” was assigned proportionally among residents.

Personalized VAT

Personalized VAT (P VAT) makes it possible to overcome VAT’s regressivity without puncturing the tax base as the “universal” solution does. It consists of three elements:

P VAT refund is a tax refund and not a transfer which can be self-funded via broadening its base and/or a rate change. Tax administrations can play a crucial role in improving the identification of beneficiaries and the fight against fraud by expanding electronic invoicing and similar technologies. Moreover, P VAT is a mechanism which strengthens transparency, budget control, and social support from those who do not benefit directly.

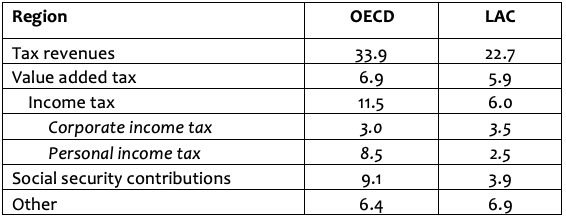

P VAT simulations for Argentina, Costa Rica, the Dominican Republic, and Uruguay

In contrast to the “universal” solution, P VAT makes it possible to preserve, and even increase, the revenue from LAC’s main tax pillar, aiding fiscal consolidation and compensating the most vulnerable sectors of the population. This is readily apparent in the simulations outlined in Table 3, which show that the incidence of VAT would be proportional to income level. We estimate revenue and equity impacts exclusively on private household consumption.

Table 3. Payment by Income Decile, % of GDP

In sum, we believe that implementing Personalized VAT could be a valuable instrument to support LAC governments’ processes of fiscal consolidation with equity. As well as the simplicity of applying this kind of tax, governments in the region already have access to the technologies and high-quality information they need to identify and deliver the proposed relief to the vulnerable sectors in each country.

This blog is based on the article “Revisiting Personalized VAT: A Tool for Fiscal Consolidation with Equity.”

Bibliography

- BARREIX, A., BÈS, M. and ROCA, J. (2010); “El IVA Personalizado. Aumentando la recaudación y compensando a los más pobres”; EuroSocial-Fiscalidad, Madrid.

- BARREIX, A., BÈS, M. and ROCA, J. (2012); “Resolviendo la Trinidad Imposible de los Impuestos al Consumo. El IVA Personalizado”, in Reforma Fiscal en América Latina: ¿Qué fiscalidad para qué desarrollo?; CEPAL and CIDOB.

- RASTELETTI, A. (2021); “IVA personalizado: Experiencia de 5 países y su importancia estratégica para la política y la administración tributaria.” Blog; IDB.

[i] The typical example is financial intermediation services. These are exempt because it is technically impossible to impute VAT accurately for the services that the financial intermediary provides to its depositors and borrowers. Moreover, in order to equalize the treatment of investment in physical assets with human capital formation in a consumption-based VAT, we propose not to tax education in VAT’s taxable base, except for equity considerations.

[ii] While few exemptions and a single rate facilitate VAT administration, P VAT can be implemented by relaxing both constraints.

3,040 total views, 5 views today