Corporate Tax: its application in America

The taxation of corporate income has several aspects of interest to analyze in order to know the tax strategy of the countries of the continent, especially on the application of the jurisdictional principle of taxation (territorial vs world income) and the level of rates.

Territorial taxation vs world income

In a territorial tax system for corporations, taxation is limited to the national tax base, while a global tax system also includes the profits that resident multinational companies make in foreign countries[1], while the territorial or source principle applies to non-residents.

The US, which applied the full world income, changed its strategy from the “TCJA” of 2017[2], by means of which territoriality was applied to certain foreign income of its companies (mixed principle), while Canada, on the other hand, maintained its principle of world income.

This change in the US entailed a logical loss of tax resources[3], mitigated by new tax measures such as the application of a transitional tax[4] and two rules: “GILTI”[5] and “BEAT”[6].

It should be noted, as Clausing (2020) indicates, that this strategy did not achieve the proposed ends, due to the fact that the territorial system and the absence of repatriation taxes increased incentives for the transfer of benefits abroad.

Most of the countries of the continent are net capital importers and especially those with the highest wealth, have adopted the principle of world income to tax their companies with the application of high tax rates to obtain higher tax revenues, while the lower income countries apply the territorial principle or source of income.[7], through which they sacrifice income in order to attract investments.

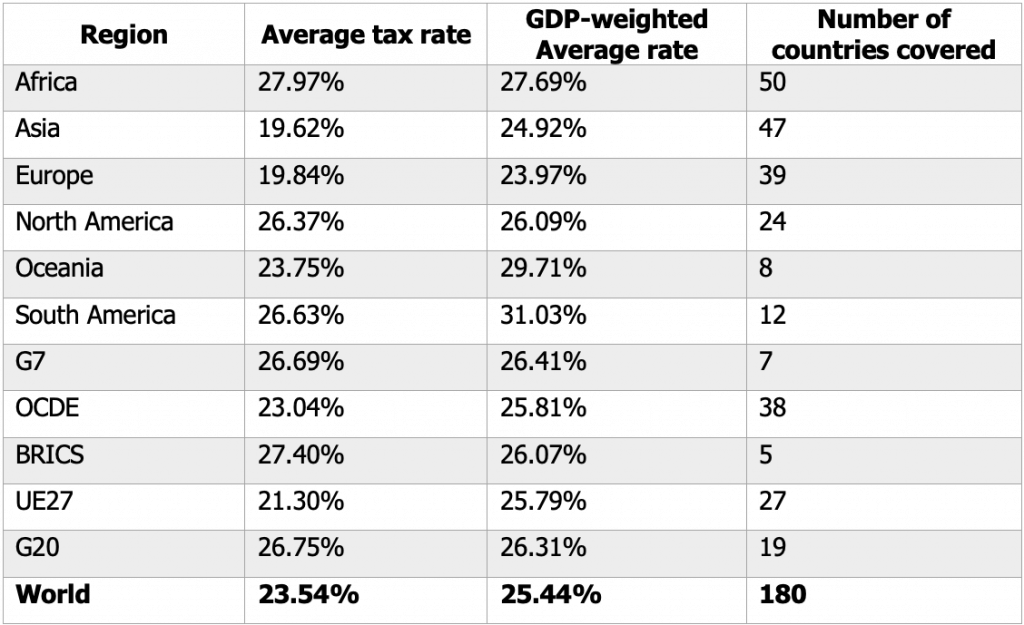

Regarding the rates, it should be noted that the countries of South America on average have the highest aliquots in the world, although many of them lower than they had in previous decades[8].

Jurisdictional principles and aliquots

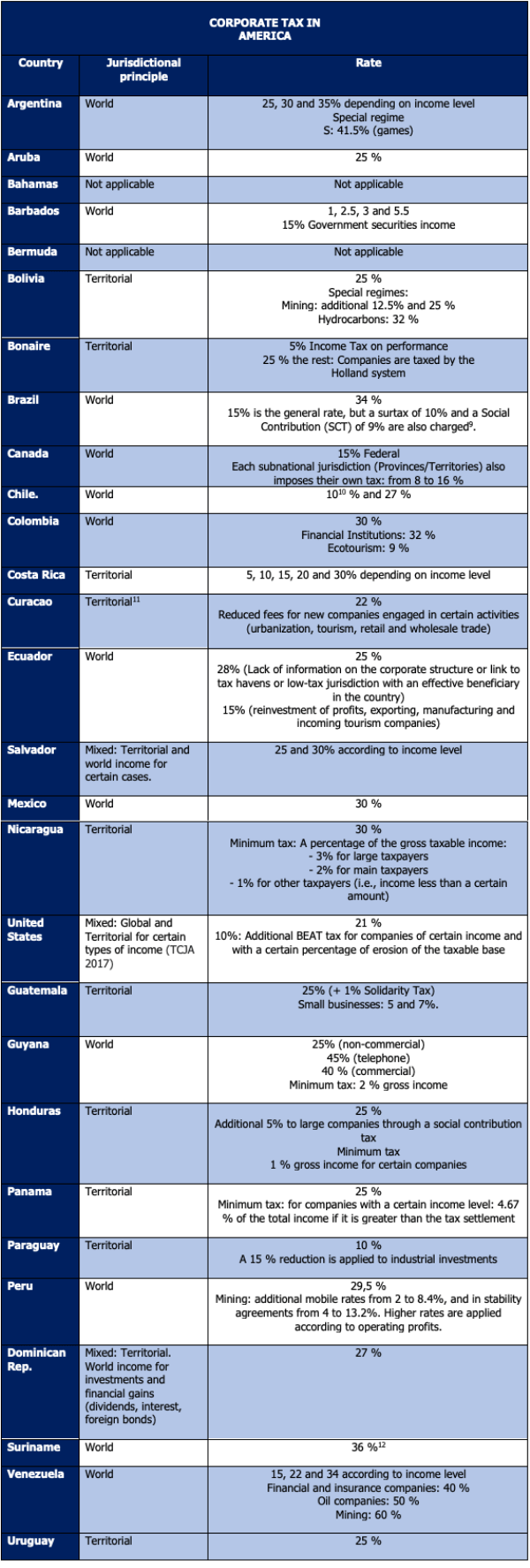

In the following table it will be observed with respect to the Corporate Tax of 27 countries of the continent, the principle they apply and what is their legal rate:

As outgoing data can be noted, which apply:

Source: The corporate income tax rates of official companies are from the OECD. “Table II.1. “Legal rate of the corporate income tax”; KPMG, “Table of corporate tax rates”: Bloomberg Tax: “Country guides: corporate tax rates”; KPMG: “Corporate tax tables”; I researched individually, consulted Tax Foundation: “worldwide corporate tax rates”. The GDP calculations are from the U.S: Agricultural Department “International macro-economic data set” Source: TAX FOUNDATION (2021)

The following graph, prepared from TAX FOUNDATION, shows the different strategies for applying aliquots to societies, according to the regions of the world:

Summary:

The quality of capital exporter or importer, and of the latter, their economic size, have been the variables to determine the trend in the continent of the strategy for the application of the jurisdictional principle of taxation.

The developed countries base the design of their tax systems on applying low rates to companies, but high rates to dividends, while the developing countries of the continent, conversely, apply comparatively higher rates to companies, but lower to dividends.

The objectives of both strategies vary, since one emphasizes the competitiveness of companies and the attraction of capital and investments, while the other focuses on obtaining greater fiscal resources[13].

In Memoriam by Jorge Eduardo Corradine

[1] It should be noted that many developed countries that applied world income had limited their taxation to the return of dividends to the country (deferral) and not when they were generated. Many, in turn, adopted the deduction or applied a tax credit to 100% of those dividends, so the difference between the source and the world income system was quite blurred in those assumptions.

[2] The “Tax Cuts and Jobs Act” was approved by the US Congress at the end of 2017 and signed into law by President Trump on December 22, 2017, with effect in many cases from the year 2018. As a first step, it reduced its federal corporate rate from 35% to 21%.

[3] K. Clausing (2020)” Profit Shifting before and after the Tax Cuts and Jobs Act”, National Tax Journal. he mentions an approximate reduction of USD 100 billion per year.

[4] To regularize the accumulated previous profits (” transition tax”) of 15.5% for the cash portion and 8% on the rest.

[5] The “GILTI” (“Global Intangible Low-Taxed Income”) constitutes a rule by which North American shareholders must tax – at an effective rate of 10.5%, which increases to 13.125% from 2026 – the “intangible” income obtained by corporations from abroad at the time of its accrual.

[6] The “BEAT” (“Base Erosion and Anti-Abuse Tax”) is an alternative tax (only applicable if it exceeds income tax) calculated at a rate of 5% for 2018, 10% in 2019 and then at 12.5% from 2026, applicable for companies with average sales over u$s500 million.

[7] Of these, 3 apply a mixed principle.

[8] Darío González (1997)”“Estudio Comparado del Impuesto sobre la Renta de los países miembros del CIAT”, CIAT.

[9] There are higher rates for certain economic activities.

[10] Years 2021 and 2022 for small and medium-sized enterprises. In the following years, 25% is applied.

[11] As of 1/1/2020. It used to be world income.

[12] It corresponds to 2022. During 2021, a rate of 46% was applied for income above a threshold.

[13] They start from the basis that the fiscal factor in general is not the determining factor to attract direct investments. In cases that consider it effective, they apply specific tax benefits to the economic activities they wish to promote.

4,699 total views, 6 views today