A fast-changing international panorama of climate policies in 2022

Global temperatures keep rising. On May 9, 2022, the World Meteorological Organization announced that the average global temperature will most probably reach 1.5° above industrial level for at least one of the next five years, and the likelihood is increasing with time [1]. This 1.5° threshold indicates the point at which climate impacts will become increasingly harmful for people and the planet.

Do we doubt this? At the time of writing this blog, heat waves in India and Bangladesh are now followed by terrible floods. Heat waves have hit Antarctica, reaching up to 37°C degrees above normal during at least three days in March 2022. Sea levels are gravely threatened by melting polar ice caps, with short-term consequences for coastal housing insurances.

I would like to briefly present some updates on the evolution of the international climate policies:

- The Climate Vulnerable Forum and the CCPI index

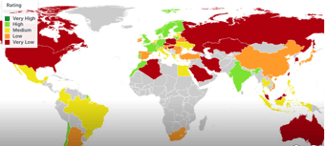

The Climate Vulnerable Forum (CVF) is an international partnership of developing countries highly vulnerable to a warming planet, founded by the Maldives, joined by 48 countries and currently chaired by Bangladesh. They have released a report, “Midnight Survival deadline for the climate” with this map listing of countries according to their progression in formulating and implementing their Nationally Determined Contributions (NDCs) for climate goals and climate policies. In the two last years, 73 countries have submitted, enhanced or updated climate policies. [2]

A performance index world map, covering 60 countries that represent more than 90% of the global emissions, has been developed and updated for 2022 by the organization CCPI (Climate change performance index)[3]. In their ranking, the three first countries are non-existent, because nobody is in fact doing enough. Here is the current world map for the countries that they follow:

Climate Change performance index 2022:

- In dark green: Strong NDC in both emissions and resilience.

- In light green: Strong or improved NDC.

- In yellow: Medium NDC.

- In orange: Low: Low NDC committed or submitted.

- Dark red: Extremely low NDC.

It is striking to see that some regions that are the most vulnerable to climate change, at risk of becoming uninhabitable, have not reviewed their NDCs. Regarding Latin America, countries such as Chile, Argentina, Colombia and Costa Rica appear to have enhanced both their emissions targets and their resilience programs. At the time of writing the present blog, the elections in Australia have delivered a new government determined to enhance significatively the reductions of emissions in Australia. In the European Union, the price of the carbon allowances in May 2022 is fluctuating between 77 and 87 euros/ton of CO2 emissions.

It is striking to see that some regions that are the most vulnerable to climate change, at risk of becoming uninhabitable, have not reviewed their NDCs. Regarding Latin America, countries such as Chile, Argentina, Colombia and Costa Rica appear to have enhanced both their emissions targets and their resilience programs. At the time of writing the present blog, the elections in Australia have delivered a new government determined to enhance significatively the reductions of emissions in Australia. In the European Union, the price of the carbon allowances in May 2022 is fluctuating between 77 and 87 euros/ton of CO2 emissions.

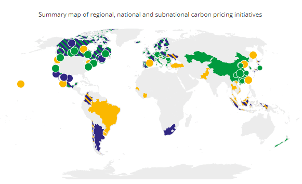

- The World Bank’s Dashboard of carbon pricing policies

These developments lead us to review the updates to this second instrument briefly presented here through the carbon pricing dashboard of the World bank: an interactive map of the two main public instruments to regulate carbon emissions in the world; the Emissions Trading Schemes (ETS) and the Carbon Taxes. The map presented by the World Bank, whose image is presented here, allows to easily switch to check the different status of the policies (implemented, scheduled or under consideration), as well as the type of instrument (Carbon Tax or ETS) and the type of jurisdiction in charge of the rules (National, Regional or Subnational). The largest program is the ‘EU ETS’ the emission trading scheme of the European Union. The strong increase in carbon prices during the last year is a reminder that the right to release carbon in the atmosphere is becoming an economic scarcity, which is reflected in the higher price. The resulting revenue received by the member states were above 14 billion euros in 2019 alone, and 78% of the income was used for climate and energy-related purposes.[4]

- Private Financial and corporate world: the ESG – (Environmental, Social and Governance) reporting is becoming essential and required for decision-making.

Acting on climate change requires international standards for reporting the action. At this time, multinational companies use various and uncoordinated frameworks for reporting on the sustainability of their policies. In international standards, the COP 26 (Conference of the Parties) has established a broad global baseline of sustainability information for capital markets, however, much remains to be organized for its implementation.

Stakeholders must be able to make comparisons “apples to apples,” critical for investments and understanding the impacts. If credible and comparable data are lacking, the risk of “greenwashing”[5] remains a serious barrier to progress in the low-carbon transition.

Global accounting groups such as Deloitte and KPMG, among others, are coordinating metrics to standardize reporting on ESG issues.[6] The World Economic Forum meetings (in Davos 2020 and 2021) have seen 120 of the world’s largest companies supporting the creation of a core set of common metrics and reporting standards for their investors and stakeholders.

- Public finances and climate change in 2022.

In March 2022, the annual Conference of the European Fiscal Board (EFB) focused on the linkage between public finances and the climate change mitigation policies. [7]

Climate change and extreme weather events are posing a grave threat for fiscal sustainability, but these risks are still not fully understood and may be underestimated. A mix of carbon pricing systems and investment is required to reach carbon neutrality. In this post-pandemic period of high indebtedness of states, there is a temptation of postponing, measures to mitigate the climate change, but this result extremely costly in the near future.

One of the main obstacles to the greening of economies is that carbon pricing systems remain much lower than fossil fuel subsidies and that their current design continues to disproportionately disadvantage the poorest populations.

In addition, there is little to no consequences for not taking measures, and electoral considerations tend to lead to decisions in favor of easy solutions such as preferring subsidies to taxation.

Countries still lack a comprehensive assessment of the impact of climate transition on fiscal sustainability. We need plausible estimates of climate-related fiscal risks.

In the USA, the Office of Management and Budget has taking steps to “better integrate climate-related financial risks into the investments and core business practices of the Federal Government,” providing a list of recent actions. [8] One of these action is to ensure that the Federal supply chain minimizes the risks of climate change. For instance, by issuing clear regulations on the ESG and climate reporting of the supply chain providers?

In conclusion, in 2022 the extreme weather events are propelling climate policies, and these are increasingly taking center stage in national elections, even without being at the center of the public discourse. The recent elections in Australia are an example in this sense, where even if these policies were not much discussed in the campaign, they have taken the center stage in the changes announced by the winning coalition. Despite international tensions and wars, we can see that these efforts to preserve our viable planet for our descendants will not be relegated to the background. The danger is too high to delay further collective action.

[1] See WMO, probability of Global temperature reaching 1.5 degrees threshold

[2] See the interactive map of the Climate vulnerable forum cvf.org

[3] See https://ccpi.org/

[4] European Commission report: https://ec.europa.eu/clima/eu-action/eu-emissions-trading-system-eu-ets/auctioning_en

[5] Eco-laundering, or greenwashing, involves deceptively promoting a perception that an organization’s products or policies are environmentally friendly.

[6] Weforum. Org https://www.weforum.org/impact/stakeholder-capitalism-50-companies-adopt-esg-reporting-metrics/

[7] European Fiscal Board, https://voxeu.org/article/public-finances-and-climate-change-post-pandemic-era

[8] “Taking action to address climate-related Fiscal Risk” https://www.whitehouse.gov/omb/briefing-room/2021/10/15/taking-action-to-address-climate-related-fiscal-risk/

2,028 total views, 1 views today