Tax Administration 3.0: IDB open-source software leverages digital accounting data to facilitate and increase compliance

Digital transformation is changing how government agencies relate to citizens, allowing them to meet their constituents’ needs faster, fairer, and more transparently. One promising area for governments is the creation of Tax Administrations 3.0 by using digital technologies to provide a more seamless and frictionless service for citizens and firms[1].

Tax administrations (TA) have usually been at the forefront of digital transformation in several countries. For example, almost all TAs in the Americas already receive 100% of their tax returns online, many already have electronic invoicing, and some even have introduced electronic payroll.

However, to reach the next level of digitization, known as Tax Administration 3.0, TAs must further capitalize on data and automation to improve their services and processes. In this sense, digitally collecting accounting information from companies is crucial to enable TAs to better measure business activities, such as operations, financing, investments, the performance of companies, and their contractual relationships.

These key factors can impact profitability and the types of taxes firms pay to governments. High-quality data can pave the way for gaining better insights and facilitate the TA’s job of ensuring that companies pay what they owe. Furthermore, it can also help improve the service TAs provide for companies. By accessing accounting data digitally, TAs can move forward with the implementation of pre-filled Corporate Income Tax declaration, which will help firms file their taxes faster and more accurately, reducing their compliance costs.

To support TAs on this front, the Inter-American Development Bank (IDB) has developed an open-source software called CACAO, to digitally capture accounting data and generate the intelligence necessary to improve compliance.

What is CACAO?

CACAO stands for Accounting and Organizational Data Storage and Consultation System. It[1] is a fully flagged system for receiving, storing, and analyzing accounting data, with a web interface and computer-to-computer APIs (Application Programming Interfaces).

CACAO allows taxpayers to send their accounting data, such as the chart of accounts, opening balances, journals, and ledgers to the TAs, using different formats (for instance, XLS, JSON, CSV). It facilitates tax compliance for taxpayers quickly and safely, eliminating the use of paper and without any additional cost for users.

Once the data is submitted to CACAO, it undergoes a validation process to check its integrity against the TA’s rules and templates and, once validated, the data is made available for analysis by the TA officers.

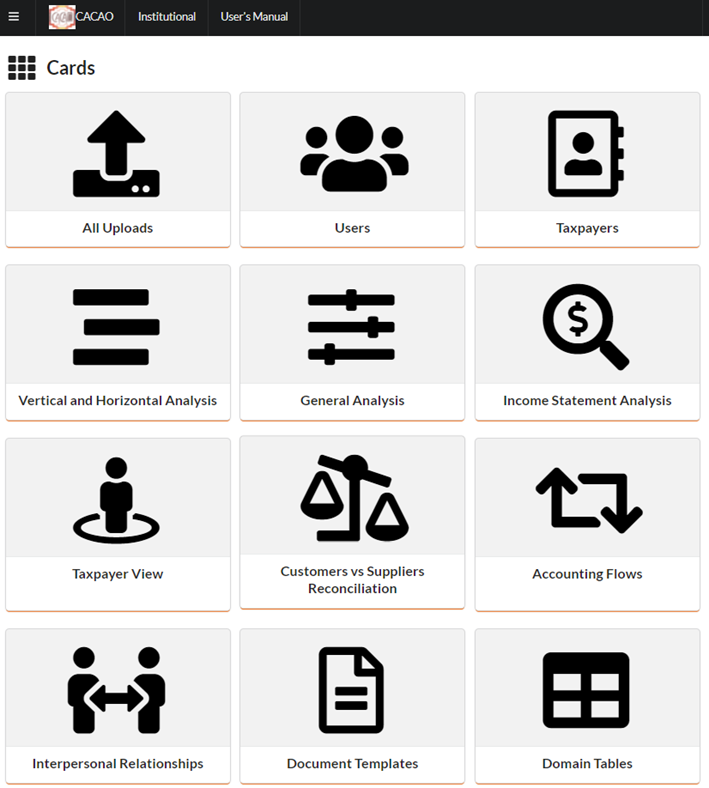

For instance, CACAO provides from the get-go operational functionalities for managing system users, reviewing uploaded data and accessing taxpayer registry. It also allows the creation of custom-made document templates and domain tables (Figure 1).

Figure 1: An Overview of CACAO’s Main Functionalities

All source code from CACAO is open software, available for member countries to study or inspect, and developed with scalability and security as priorities. CACAO can help quick-start the adoption of electronic accounting data by tax administrations in IDB member countries either by being a production-ready software for those countries that desire a turn-key solution or by providing a case study for the improvement of existing solutions.

CACAO’s Data Analytics

As for analytical functionalities, the solution offers some of the most important ones for TA officers, including an overview of the taxpayer’s operations, accounting data inspection and validations, like the vertical and horizontal analysis and the Income Statement Analysis.

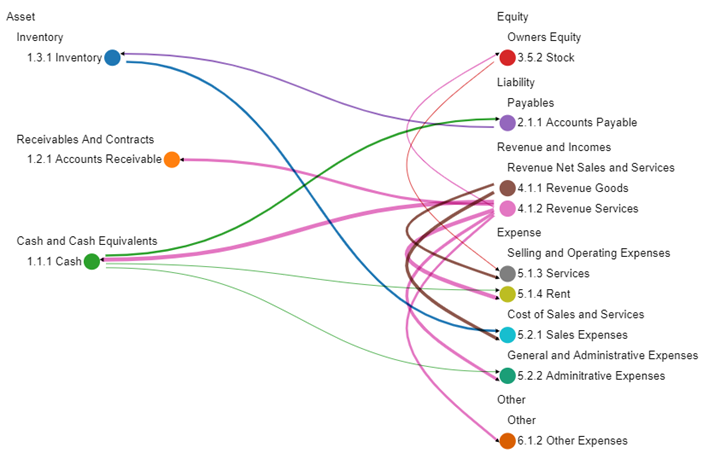

Moreover, CACAO is equipped with a complete data visualization and dashboard creation tool, which allows TAs to build new and specific visualizations of all data stored in CACAO. One example is the accounting flows diagram that shows how the resources from a given taxpayer move from each account, as seen in the Figure 2 below.

Figure 2: Accounting Flows Chart

Such accounting flow charts allow TAs to track the financial flow (depicted in Figure 2 as arrows) for every aspect of a company’s business activity, such as the income subject to taxation, expenses that deduct the tax calculation, payment of salaries to employees, etc. It allows tax officers to easily review accounting operations registered on the general ledger to identify possible incorrect, or event fraudulent, operations. More specifically, the arrows allow tax officers to quickly and easily visualize values transferred from two different accounts that should not interact with each other directly.

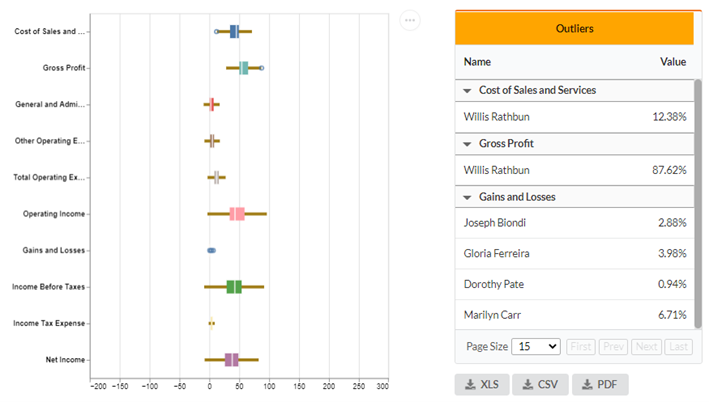

Accounting data can be analyzed for each taxpayer, or for a group of taxpayers that share common features, allowing TA to detect or flag outliers for closer inspection, as seen in the Figure 3 below.

Figure 3: Detecting Accounting Data Outliers

To sum up, CACAO is an open-source software that allows tax administrations to speed up the adoption and analysis of digital accounting data, supporting capacity-building initiatives and advancing digitalization efforts by governments as they move towards the creation of Tax Administrations 3.0 to better serve society. The Fiscal Management Division is working with tax administrations in Latin America and the Caribbean to help implement this solution.

Join our virtual event on March 1st 2023 at 10:30 a. m. ET time to learn more about the solution.

Check out https://cacao.iadb.org/ to learn more about CACAO.

Learn more about the IDB’s work with tax administrations.

This article was reproduced with the authorization of the authors (Monica Calijuri – Andrés Muñoz-Juliano Brito da Justa Neves-Gustavo Henrique de Britto Figueiredo), originally published on the IDB blog.

“Collecting Well-Being”

8,276 total views, 4 views today