Carbon price initiatives in Latin America and the world continue to grow in 2023.

Trying to stabilize the global climate is an unprecedented challenge for humanity in the 21st century, and progress has been made. Although this progress is slow, in view of the climate emergency, progress is rapid on a human scale. Each economic sector and each country have to play its role, and from here, from CIAT, it is up to us to follow and cover the progress of the tax policies that are proposed to support these multiple efforts to mitigate the global climate crisis. These carbon price initiatives are different, they vary in the G7 countries and in developing countries, but as for the exchange of financial data in the fight against tax evasion, no country has an interest in staying out of the collective effort on climate change.

European Union: Border adjustment of carbon regulation

This 18th from April 2023, the European Union confirmed the approval of a border adjustment mechanism for carbon regulation, which would affect world trade: [1]

“With 487 votes in favor, 81 against and 75 abstentions, the Parliament adopted the rules for the new EU Carbon Border Adjustment Mechanism (CBAM), which aims to incentivize non-EU countries to increase their climate ambition and ensure that the EU’s and the world’s climate efforts are not undermined. by the relocation of EU production to countries with less ambitious policies. The goods covered by CBAM are iron, steel, cement, aluminum, fertilizers, electricity, hydrogen, as well as indirect emissions under certain conditions. The importers of these goods would have to pay any price difference between the carbon price paid in the country of production and the price of carbon allowances in the EU ETS. [2]

In 2021, carbon credit transactions amounted to 1,000 million dollars; the market is expected to reach a value of 50,000 million dollars by 2030. This expected exponential increase is encouraged by voluntary market demand, with initiatives such as the creation of the European Union carbon import border tax. The pact is provisional and is the first time a climate change regulation has been used in global trade.

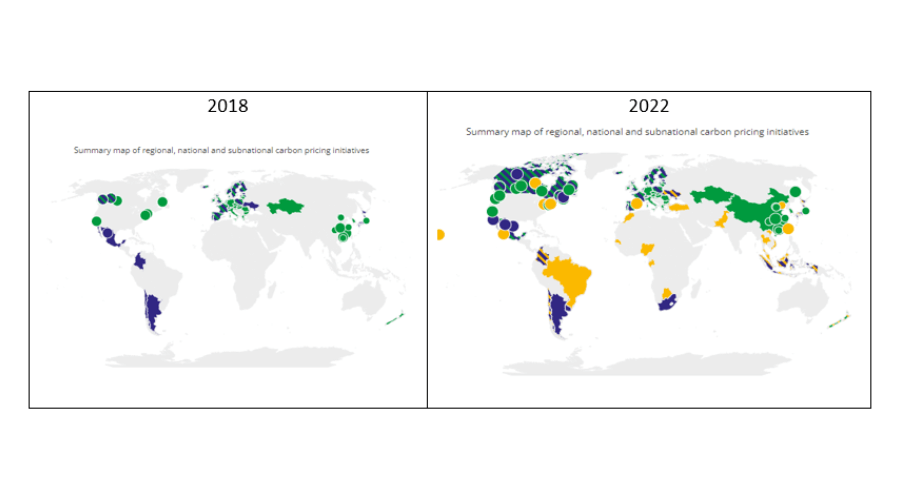

Regional, national and subnational carbon pricing initiatives

According to the World Bank, there are 70 carbon Pricing initiatives implemented by 2023. 47 national jurisdictions and 36 subnational jurisdictions are covered by the selected initiatives. In 2022, these initiatives have covered 11.86 GtCO2e, which represents 23.17% of global greenhouse gas (GHG) emissions. [3]

The evolution of carbon pricing trends:

Source: World Bank.

65 countries, representing about 80% of global GDP, including countries such as China, the United States and most European countries, have already committed to achieving carbon neutrality between 2050 and 2060. At the COP27, held in Egypt in 2022, the discussions progressed, but there is still no standardized global market for carbon credits.

In this article, we continue to review the progress in Latin American countries that apply or consider applying carbon pricing, since it is a tax policy. For trade between the EU and Latin America, the application of these policies in Latin America could avoid the application of border adjustment, but the price of emissions in Latin America will have to increase.

Considering a carbon pricing policy in Brazil

In total, 5.9% of GHG emissions in Brazil are subject to a positive Net Effective Carbon Rate (NER) in 2021, unchanged from 2018. Brazil has not yet imposed an explicit price on carbon. Fuel excise taxes, an implicit form of carbon pricing, covered 5.9% of emissions in 2021. Fossil fuel subsidies cover 1.6% of emissions in 2021.

The new Brazilian government intends to resume its leadership role in promoting the international climate agenda, prioritizing the decarbonization of production chains and achieving the transition to a low-carbon economy. The strategy, led by the Ministry of the Environment, aims at containing greenhouse gas emissions that have not stopped rising around the world.

Brazil occupies a potential leading position in this market. The country alone is responsible for about 20% of the carbon credits potentially generated from natural sources, created either by avoiding deforestation or through reforestation initiatives. Through projects associated with conservation (REDD+) and forest restoration (ARR). With extremely rich biomes, such as the Amazon, the Cerrado, the Caatinga and the Atlantic Forest, the country can lead this market through reforestation and forest protection [4]

Carbon pricing in Colombia

Since 2021, explicit carbon prices in Colombia consist of carbon taxes, which cover 19.4% of greenhouse gas (GHG) emissions in CO2e. In total, 19.4% of GHG emissions in Colombia were subject to a positive Net Effective Carbon Rate (NER) in 2021, compared to 11.9% in 2018.

The national carbon tax was created in Colombia with the aim of responding to the country’s need for economic instruments to encourage compliance with GHG mitigation goals. It was created in 2016 and entered into force on January 1, 2017. It is a levy on the carbon content of all fossil fuels.

Since January 2023, the carbon tax has a value of COP 20,500 pesos (USD 4.53) per ton of CO2e and has a tariff considering the CO2 emission factor for each fuel, expressed in unit of mass (KgCO2) per energy unit (terajoules). This price will continue to increase.[5]

Carbon pricing in Mexico

Since 2021, explicit carbon prices in Mexico consist of carbon taxes, which cover 42.4% of greenhouse gas (GHG) emissions in CO2e. In total, 42.4% of GHG emissions in Mexico are subject to a positive Net Effective Carbon Rate (NER) in 2021, compared to 40.6% in 2018. The proportion of emissions covered by an explicit carbon price has increased by 1.8 percentage points since 2018. Fuel excise taxes, an implicit form of carbon pricing, covered 22.7% of emissions in 2021, up from 22.1% in 2018.[6]

A characteristic feature of Mexico is that it applies carbon taxes at the subnational level: Zacatecas, Tamaulipas, Querétaro, Yucatán and the State of Mexico maintain the application of the tax in force. (Courtesy of BMV). The average price is 262 MXN (USD 14.62) [7]

Carbon prices in Chile

In 2021, explicit carbon prices in Chile consist of carbon taxes, which cover 33.2% of greenhouse gas (GHG) emissions in CO2e. In total, 55.8% of GHG emissions in Chile were subject to a positive Net Effective Carbon Rate (NER) in 2021. Fuel excise taxes, an implicit form of carbon pricing, covered 5.9% of emissions in 2021. Fossil fuel subsidies cover 1.6% of emissions in 2021, unchanged from 2018.

In January 2023, the IMF proposed to increase the carbon tax: Currently the Chilean price is an equivalent of $5 per ton of CO2. the IMF proposes four scenarios for increasing the carbon tax.[8] A “moderate” one, which implies taking it to US$ 15 per ton of CO2 by 2025, and then steepening to US$ 50 in 2035, but exempting the land transport sector; a “base” scenario that increases the tax to US$ 15 by 2024 and to US$ 60 in 2023, excluding in the tax on emissions to gasoline and diesel but increasing the rate to the latter fuel from US$ 0.05 per liter in 2024 to US$ 0.37 in 2030); a “hybrid” scenario, where the carbon tax is applied to the energy sector, starting at US$ 5 per ton in 2024, to US$ 11 in 2027 and to US$ 60 in 2035, and with an emission trading system of rights: and finally, a scenario of “social costs of carbon”, where the tax is fixed at US$ 35 per ton of CO2 from 2024 and rises linearly to US$ 75 in 2030 .

We will conclude this brief review by mentioning IMF’s blog on financing to address Climate Change. “Countries that have already set a gradual trajectory of increasing carbon taxation should stay the course; the projected increases are much smaller than recent price swings, which stem from global shocks. Revenues should be used to ensure that all workers and communities benefit from the green transition. At the international level, reaching agreement on a carbon price floor (or equivalent measures) is urgent.”[9]

[1] Source: https://www.retema.es/actualidad/aprobado-un-nuevo-mecanismo-de-ajuste-fronterizo-de-carbono-de-la-ue

[2] This price is variable, in May 2023 it is at 90 euros, or 98.50 USD/ton.

[3] Source: https://carbonpricingdashboard.worldbank.org/

[4] April 2023: source: https://www.tmf-group.com/en/news-insights/articles/2023/april/brazil-carbon-credit-market/

[5] Source: chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.mexico2.com.mx/uploadsmexico/file/Impuesto%20al%20Carbono%20en%20Colombia_ENERO_2023_docx.pdf

[6] https://mexico2.com.mx/noticia-ma-contenido.php?id=805#:~:text=Baja%20California%2C%20Tamaulipas%2C%20Quer%C3%A9taro%2C,precio%20t%C3%ADpico%20de%20MXN%20262.

[7] https://www.bloomberglinea.com/2022/12/16/mexico-tendra-ocho-estados-que-implementaran-el-impuesto-al-carbono-sin-ser-una-carga-tributaria/

[8] https://www.terram.cl/2023/01/reforma-tributaria-fmi-sugiere-a-hacienda-aumentar-el-impuesto-a-emisiones-de-carbono-e-igualar-gravamen-al-diesel-con-la-gasolina/

[9] https://www.imf.org/es/Blogs/Articles/2022/04/12/blog041222-sm2022-fm-ch2

19,473 total views, 1 views today

1 comment

In Latin America, there are currently four countries with carbon pricing initiatives in place: Chile, Colombia, Mexico, and Costa Rica. Chile has had an ETS in place since 2010, and Colombia and Mexico implemented carbon taxes in 2016 and 2019, respectively. Costa Rica’s carbon tax is scheduled to take effect in 2024.