Memories from Friday, April 26 in Foz do Iguacu: international cooperation is not an option

The cooperation represents the essence and purpose of CIAT. Since its foundation in 1967, numerous cooperation actions with countries and organizations have allowed CIAT to consolidate the pillars that have allowed it to be an organization with a regional focus and global impact, despite the small size of its Executive Secretariat.

The General Assembly is the most important institutional meeting of CIAT and is held every year in the country that assumes the CIAT’s presidency. This meeting is attended by a large part of the CIAT community (member countries and strategic partners of all kinds) and is a favorable place to exchange good practices and discuss cooperation initiatives.

Recently, thanks to the sponsorship of the Secretaría da Receita Federal do Brasil, it was held in a significant place to talk about cooperation – close to the triple border between Argentina, Brazil and Paraguay – Foz do Iguacu, the 58th General Assembly of CIAT, whose central theme was the prevention and resolution of tax disputes.

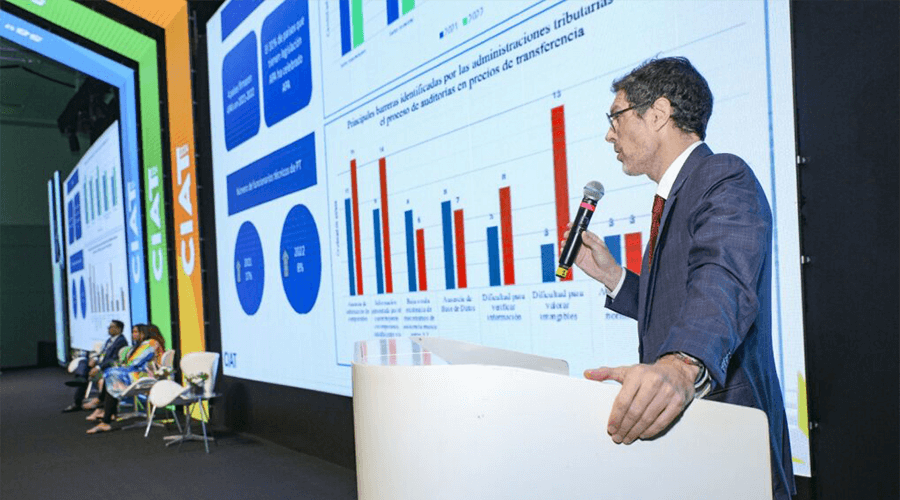

As has been the tradition for more than a decade, on Fridays, after the conclusion of the technical sessions of the CIAT general assemblies, international seminars are held where the CIAT Executive Secretariat announces its initiatives together with its strategic partners and tax administrations. On this occasion I had the pleasure of coordinating a panel on International Cooperation, where with the University of Leiden, the Intergovernmental Forum on Mining (IGF) and the SUNAT from Peru, experiences and cooperation initiatives with various approaches were addressed.

On behalf of CIAT, I presented the latest updates available at CIATData from the Database on Transfer Pricing and the BEPS Monitoring.

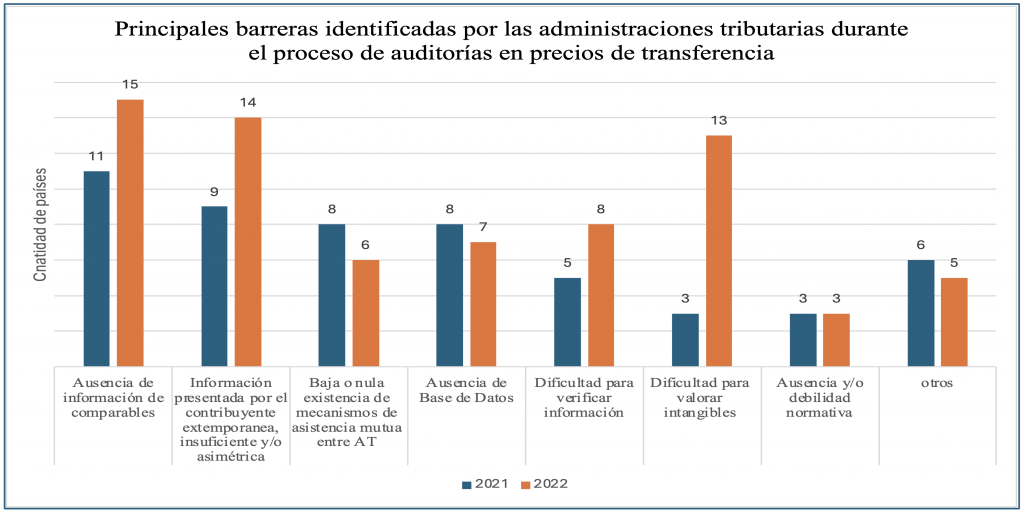

The database on Transfer Pricing it is made up of more than 100 tables that provide a detailed detail of the rules for the control of transfer prices of 25 countries in Latin America and the Caribbean, and some useful data and statistics on the way in which tax administrations are organized to implement these rules and conduct control actions. The data currently available show that the vast majority of countries in the region have standards for transfer pricing control and apply them, but there are challenges in terms of access to information, information verification, control of intangibles and adoption of mechanisms to simplify, generate certainty and avoid double taxation. The following graph shows the evolution of the challenges reported by the tax administrations that make up this database, for the years 2022 and 2023.

I invite you to consult the updated data as of August 2023 .

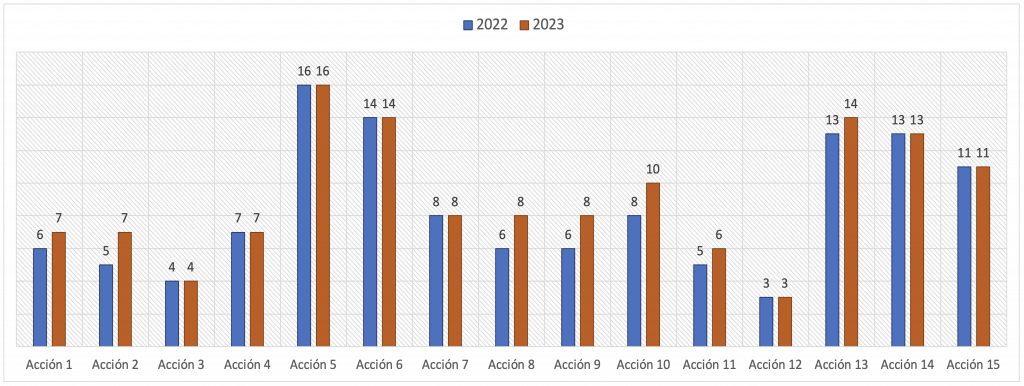

The BEPS Monitor contains data on the situation of a selection of 37 CIAT member countries regarding the adoption of measures inspired by the recommendations of the BEPS Action Plan. In Foz do Iguacu, data corresponding to September 2023 were presented for a selection of 19 countries in Latin America and the Caribbean. The vast majority of these countries are part of the BEPS Inclusive Framework and have adopted the recommendations of the minimum standard, which involves Actions 5, 6, 13 and 14. Likewise, the BEPS Monitoring shows the interest of many countries in the region in adopting measures inspired by optional actions, in particular those related to the control of transfer pricing (Actions 8, 9 and 10), the control of transactions involving hybrids (Action 2), the deductibility of financial components (Action 4), the control of artificial avoidance of the permanent establishment status (Action 7) and the adoption of methodologies to collect and analyze data on base erosion and profit shifting (Action 11). The following graph shows, for 19 countries in Latin America and the Caribbean, the evolution between 2022 and 2023 of the measures inspired by the BEPS Action Plan.

If you want to check the updated data to 2021 . Data for the year 2024 will be published soon.

Both the transfer pricing database and the BEPS Monitoring are available in English and Spanish and are the result of coordinated work with tax administrations of CIAT member countries and the support we have received for years from strategic partners, such as the German Cooperation (GIZ) and EUROsociAL+.

Another of the initiatives that I presented in Foz do Iguacu was the Guide on “Trusts and other complex structures. Risks to transparency, tax avoidance and evasion,” coordinated by CIAT and LATINDADD, with the support of the Norwegian Cooperation (Norad). This guide arises as a result of discussions held at the meetings annually sponsored by CIAT and LATINDADD, on the need to understand how the complex structures and the figures that facilitate tax evasion, evasion and fraud work; given that there is currently no need to register trusts in many countries, preventing them from knowing their impact worldwide, their true beneficiaries and the assets that are managed through them. This Guide provides an explanation about the figure of the trust, its parts, the differences of this figure between Anglo-Saxon law and civil law tradition countries, and its legitimate and illegitimate uses, focusing on its illegitimate uses. It also describes, using real cases, how complex structures can be achieved to hide the true beneficiaries and facilitate the evasion or avoidance of corporate income tax, personal income tax, wealth tax, inheritance tax, capital gains tax, etc. In addition, the Guide provides proposals to avoid the opacity of the trust, tax evasion and avoidance. If you would like to obtain this document in English or Spanish, click here .

Finally, I highlighted the advances related to the Manual for the Control of International Tax Planning, coordinated by CIAT, with the support of EUROsociAL+ and GIZ. The Manual deals with the main behaviors tending to evasion and avoidance, measures to contain them and aspects related to the management of tax administrations. It has 42 sections written by 48 experts and organizations. Due to the extensive content of the Manual, the sections have been published periodically as independent documents. To date, 29 sections have been published, which are available in English and Spanish, here .

The University of Leiden he presented on this occasion the Toolkit on the Design and Application of General Anti-Abuse Rules. This document, published in 2022, is the result of the coordination of efforts between CIAT, Leiden University, GLOBTAXNET, EUROsociAL+ and GIZ, and aims to meet a growing need. The general anti-abuse rules (GAAR) have gained specific weight in recent years, given the complexity of the operations and the recommendations of Action 6, which constitute a minimum standard within the Inclusive BEPS Framework – the Main Purpose of the Transaction. It can be especially useful both for countries with experience in the application of general anti-abuse standards (GAAR), which want to improve the objectivity of their application and prevent conflicts; and for countries that need to design this type of standards or implement them for the first time. The Toolkit provides a theoretical framework on the design and application of GAAR and a self-assessment guide that facilitates the identification of aspects to be strengthened, for which international good practices and examples that can serve as a source of inspiration for countries are presented. If you would like to consult the Toolkit in Spanish or English, here .

The IGF it is an intergovernmental organization, with 84 member countries rich in mineral resources from four continents and that helps governments to develop capacities to manage mining activity. For several years, CIAT and IGF, together with other strategic partners, have coordinated efforts to meet the needs of tax administrations in Latin American countries. In Foz do Iguacu, IGF presented its Global Initiative on Mining Taxation, whose objective is to generate capacities to design regulatory frameworks of countries and protect their tax bases; through technical assistance actions, practical orientations and training. All this, within the framework of collaboration with relevant actors in different regions. If you want to know more about this IGF initiative.

Finally, the SUNAT from Peru he presented the impact of international cooperation actions with peers, in particular, those related to the exchange of information under the automatic modality, within the framework of the Common Reporting Standard (CRS) and the Country-by-Country Report (CBCR), as well as the use of the data taking advantage of the exchange upon request. The SUNAT has taken measures with an impact on the organizational culture, significantly increasing the amount of data exchanged through these mechanisms and adopting techniques that have allowed an optimal use of them to identify risk cases and increase compliance. This approach will be strengthened in the coming years, given that SUNAT, in its Strategic Plan 2024-2027, proposes improvements in risk management, digital transformation, international taxation and collaborative compliance.

The common denominator of all the topics discussed in this panel is the cooperation, whether it is between tax administrations, at the operational level, or between organizations of various profiles (international organizations, NGOs, academia, tax administrations). These achievements would not have been generated without joint efforts. Therefore, in times characterized by great challenges, cooperating and coordinating efforts is not an option, it is a necessity.

My gratitude to Irma Mosquera, Jaqueline Taquiri and Palmer de la Cruz for sharing your experiences and joining me on this panel and of course to the Secretariat of Receita Federal do Brasil for hosting our General Assembly.

5,134 total views, 5 views today