Autumn 2024: Multiple global events for the SDGs, highlighting tax alignment and carbon pricing.

- The Summit of the Future.

This week the 2024 Summit of the Future[1] is a high-level event organized by the United Nations, scheduled to take place on September 20-23, 2024, at the UN headquarters in New York. This summit aims to forge a new international consensus “to deliver a better present and safeguard the future”.

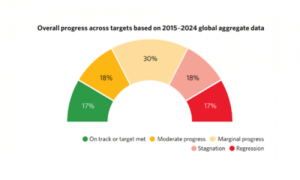

It will address critical challenges and gaps in global governance, reaffirm commitments to the Sustainable Development Goals and seek to revitalize multilateralism. The SDGs, Sustainable Development Goals, are 17 goals adopted in 2015 unanimously by UN member countries, have been critically assessed in the 2024 SDG Report [2]. Only 17% of these global sustainable goals of the 2030 agenda are on track to be achieved.” The report highlights where action must accelerate, particularly in critical areas undermining SDG progress – climate change, peace and security, inequalities among and between countries, among others”.

The climate crisis directly affects these goals: Food security, health, even education (extreme climate events reduce the number of school days in developing countries, and abnormal temperature gravely affects children’s learning. “Given that climate change is thwarting the achievement of the SDGs, the best action we can take is to accelerate the reduction of greenhouse gas emissions that make our world warmer. The most effective tool to achieve this is to put a price on carbon. If the revenue generated by a carbon price is redistributed to citizens, a policy known as ‘climate rent’, the low-income households will not be the ones paying the economic impact of the higher energy costs associated with a carbon price,” writes Joe Robertson, director of the NGO CCI [3].

Source: UN Report, Sustainable Development Goals

- ECLAC workshops on carbon pricing in Latin America.

In the regional plan of LAC countries, recognizing the importance of carbon pricing as a policy tool to incentivize the reduction of greenhouse gas emissions and facilitate the achievement of countries’ Nationally Determined Contributions (NDCs), a training workshop held by ECLAC [4] in Santiago de Chile shed light on the fundamental role of carbon pricing systems in the climate policy mixes of numerous jurisdictions, and the publication of the study “Economic Policy and Climate Change: Carbon Pricing in Latin America and the Caribbean”.

It highlights in particular the growing interest of emerging economies and developing countries to take measures to develop such systems and expand the coverage of global emissions. In this regard, a recent study on 1,500 climate policies to reduce carbon emissions was published on August 23, 2024 [5], with a dashboard of policies by country. According to this study, only 63 interventions in 25 countries have achieved significant reductions in carbon emissions, generally by combining several policies. It is worth noting that carbon pricing is considered to be among the most effective instruments for reducing carbon emissions, with no need to be combined with other measures.

ㅤ

- UNDP’s Sustainable Development Goals Tax Initiative: how to align tax policies with the Sustainable Development Goals

Tax revenues play a crucial role in financing the Sustainable Development Goals (SDGs). They decrease the need for international aid and enable the repayment of debts, ultimately strengthening a country’s capacity to withstand external shocks.

Since 2022, in partnership with Finland and Norway, UNDP launched the Tax for SDGs Initiative (TAX for SDGs [6]) with the aim of helping countries improve domestic resource mobilization and advance the achievement of the SDGs. Under the Initiative, taxation is seen both as a tool for raising revenue and as a policy instrument to promote sustainable growth strategies and influence behavior towards desired outcomes related to climate, nature, well-being and governance.

In 2023, the initiative made significant progress, signing a total of 22 Country Engagement Plans (CEP). Tax for SDGs supports governments in the fight against tax avoidance, tax evasion and other illicit financial flows, in particular through technical assistance and facilitation of cooperation. It also helps them align their tax and fiscal policies with the SDGs and incorporates developing country perspectives into regional and international tax debates. In addition, Tax for SDGs has launched the draft SDG Tax Framework (Diagnostic), a tool designed to help national governments effectively assess and align their tax systems with the SDGs [7]. This September 2024, the results of the initiative will be presented at the Summit of the Future in New York [8].

ㅤ

The fiscal framework for the SDGs works in 3 stages:

1. Self-Assessment Report Governments are helped to understand and self-assess the linkage of their current fiscal policies to the SDGs through a Self-Assessment Report (SER).

2. Recommendations: National authorities receive ideas and recommendations to better align the fiscal system with the SDGs based on the results of the SER.

3. National support plan Based on national priorities; a national support plan is developed for the implementation of the agreed areas.

In the words of Mr. Achim Steiner, UNDP Administrator: “The success of the SDG Tax Initiative is a testament to the collaborative efforts between nations, international organizations, academia and civil society. Together, we have shared best practices, knowledge and lessons learned, creating a community dedicated to enacting real change.” The SDG Tax Initiative includes the joint OECD-UNDP Tax Inspectors Without Borders (TIWB) initiative, which operates 59 ongoing programs in Africa, Asia and the Pacific, the Arab States, Europe and Central Asia, and Latin America and the Caribbean. With the support of international partners and countries, including France, India and Italy, TIWB is estimated to have secured $230 million in additional tax revenue collected by developing countries and $1.11 billion in additional tax revenue assessed by 2023.

ㅤ

Measurements of three outcomes

According to the 2024 executive summary, three outcomes are defined:

Outcome 1 assesses the improved capacities of TAs to tackle tax avoidance and evasion and combat illicit financial flows (IFFs).

Outcome 2 measures how governments align their fiscal and tax policies with the SDGs, for which the initiative launched the draft SDG tax framework [6], an instrument designed for governments to optimize this alignment.

Outcome 3 aims to support the generation of evidence and insights from developing countries, forging peer-to-peer exchanges and exploring tax measures that can drive sustainable development.

ㅤ

CIAT has participated in the dialogue on tax and SDGs organized by Columbia University in November 2023. At present, the main features of the SDG Tax Framework are still being developed: Diagnostic assessments: the STF provides diagnostic assessments to help governments understand how their current fiscal policies align with the SDGs, and the framework provides customized recommendations to optimize fiscal strategies to achieve specific SDG targets.

ㅤ

In conclusion, as we cover the Summit of the Future, it is imperative that we recognize the interconnectedness of climate action and sustainable development. The pressing challenges outlined in recent reports underscore that without adopting robust mechanisms like carbon pricing and leveraging tax policies to support the SDGs, we risk falling short of our global commitments. By prioritizing these strategies, we can create a comprehensive approach to address climate change while ensuring that economic growth and equity are at the forefront of our efforts. The time to act is now; our collective future depends on the choices we make today.

[1] https://www.un.org/en/summit-of-the-future

[2] https://unstats.un.org/sdgs/report/2024/

[3] https://citizensclimate.earth/

[4] https://www.cepal.org/en/notes/carbon-pricing-workshop-enables-dialogue-among-countries-region-explore-strategies-strengthen

[5] https://www.ox.ac.uk/news/2024-08-23-effectiveness-1500-global-climate-policies-ranked-first-time

[6] https://www.taxforsdgs.org/

[7] https://www.taxforsdgs.org/stf

[8] https://dashboards.sdgindex.org/chapters/part-1-recommendations-of-the-un-sdsn-for-the-summit-of-the-future#1-2-the-sustainable-development-agenda-should-be-properly-financed

6,036 total views, 1 views today