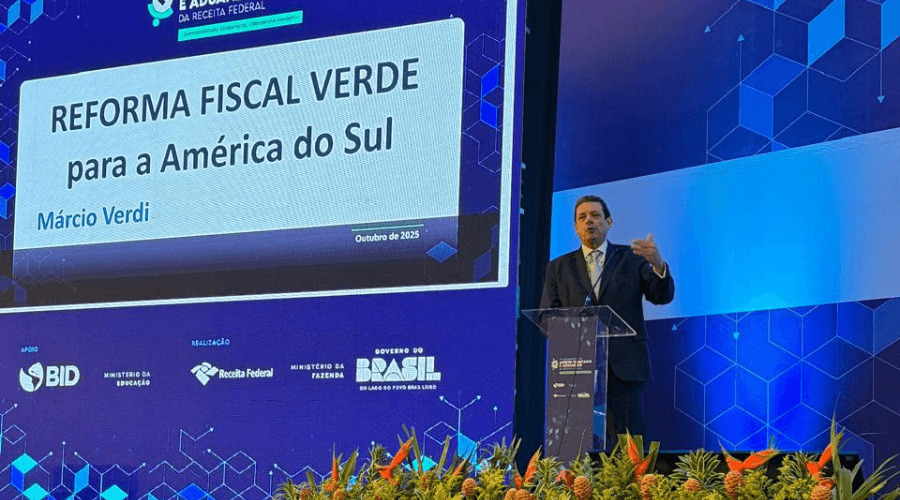

Tax administrations around the world discussed challenges of the digital economy and emerging taxes.

Browse through the site without restrictions. Consult and download the contents.

Subscribe to our electronic newsletters: