Climate change and taxes

Summary of the article

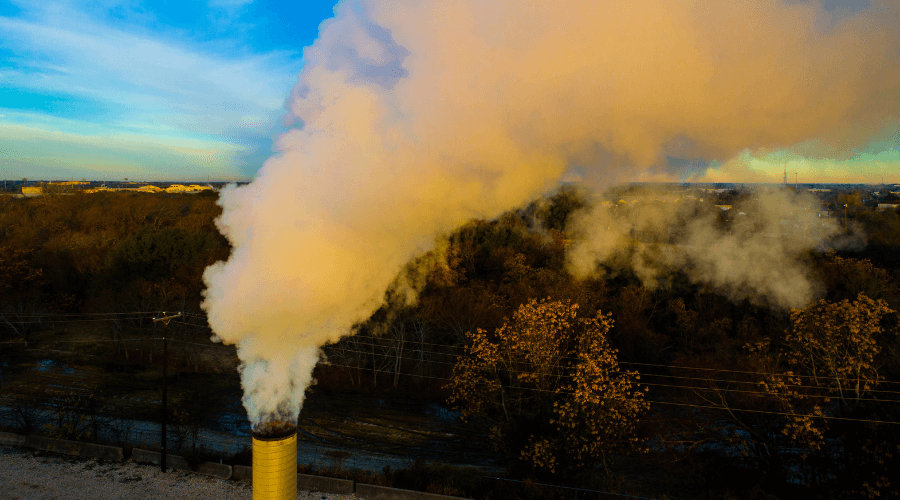

Anthropogenic carbon emissions are a consequence of the burning of fossil fuels. This is related to human activities, the production of consumer goods, transport systems and electricity generation, including those produced by non-sustainable agricultural activities.

Therefore, an international mitigation strategy should be pursued, but considering the magnitude of the economic costs to be faced, an aspect that is related to the characteristics and options for economic development in the coming decades.

Great importance is attached to tax reforms, and currently they have begun to generate tools that encourage consideration of the environmental problem from the tax point of view.

In order to introduce us to the issue of dealing with Climate Change and taxes, we must consider aspects related to the administrative mechanisms and the use of market-based instruments.

The administrative mechanisms (Command-and-control instruments) involve the identification of causes and the application of sanctions, which can lead to closure. They are criticized because with these mechanisms economic activity may be reduced or eliminated, and the issue of pollution can be solved but not with a rational solution.

The advantage of using a direct regulation instrument is based on the possibility that the regulator can control polluting activities.

But it is criticized because:

The economic instruments are market-based and constitute political tools that affect the behavior of economic agents in order to satisfy environmental policy objectives or modify certain behaviors through notices on the market, rather than through regulations on the control of the level or form of pollution.

These instruments can be divided into two groups:

In this regard, taxes are one of the instruments that exist and have been designed to control and manage externalities, in particular those related to environmental pollution. But these mechanisms, which are known as a market-based approach to environmental policy, also include the subsidies that are intended to reduce polluting emissions, the pollution quotas granted by the state and the systems of transferable pollution rights between private agents.

The greenhouse gas emission permits consist of setting a maximum allowed emissions standard, for the volume of which negotiable instruments are issued, and that with the possession of these instruments the emission of the corresponding amount of greenhouse gases is authorized. These permits are issued for one tonne of CO2 equivalent, and are negotiable on the secondary market, with the issuing agent being able to decide their level of emissions, with the condition that they must prove on an annual basis that they are the holder of a sufficient number of permits to cover the emissions made.

This permit system has two advantages:

The difference that exists between the tax system and the permit system, are:

From another point of view, the reduction of greenhouse gas emissions can be obtained with any of the main economic instruments that can establish a price on the carbon unit. For these purposes, the system of emission allowances such as the carbon tax can be used, since both intend the increase in the price of coal, fossil fuels and natural gas. Therefore, it must be decided in what way a result similar to the carbon pricing is achieved, applying taxes (costs) or trading emission allowances depending on the object of reducing emissions (quantity), pointing out that the carbon tax has certain similarities and some advantages over emission allowances:

The political option of using these economic instruments will be fixed between a system that establishes the amount of emissions (companies buy and sell emission rights) and a tax that sets a price for each unit of emission originating contributor.

Carbon taxes put a price on greenhouse gas emissions, and thereby get the broader economy to invest in clean technologies.

From a practical point of view, one way to introduce the “carbon tax” will be by applying a tax on fossil fuels in proportion to the carbon content in said fuels.

In the Tax Reform in Argentina, the fuel tax has been modified to depend on the amount of carbon dioxide emitted, initially affecting liquid fuels and from 2020 onwards applicable to natural gas, liquefied petroleum gas and coal. With this modification, Argentina is approaching its commitment reflected in its participation in the 2015 Paris Agreement and follows the trend of applying environmental taxes (to coal) in Latin America (Mexico, Chile and Colombia).

An environmental tax reform must be oriented towards sustainable development; it can be oriented to the elimination of subsidies, the restructuring of existing taxes and the introduction of new environmental taxes.

We can indicate that:

5,057 total views, 12 views today

2 comments

saludos

Donde puedo adquirir mas información sobre los impuestos ambientales como se aplican quienes pagan y cual es el porcentaje por favor….

Dear Amanda

Attached is the link to see the full article (in Spanish).

Best regards

Edgardo

http://www.economicas.uba.ar/wp-content/uploads/2022/09/cambio-climatico-y-tributos.pdf