- Working Missions

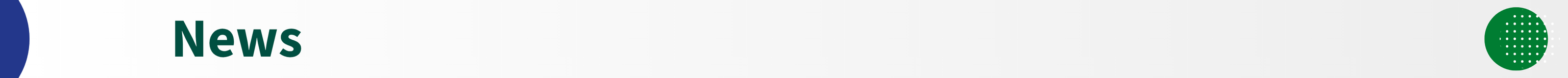

On March 18-19, 2025, the West African Tax Administration Forum (WATAF) held a meeting on “Country Correspondents Conference and Training for Heads of Corporate Communications” in Abuja, Nigeria. Within the…

- Featured

- Publications

This report systematizes the main tax reforms in Latin America during the 2024 period—relating both to legislation and tax administration—classified by countries, topics, and status of processing (announced; in progress;…

- Featured

- The Executive Secretary in the Press

On March 13 and 14, 2025, the CIAT Executive Council met in a hybrid format (face-to-face and virtual) from Panama City. The meeting was attended by Ms. Adriana Gomes Rêgo,…

- Working Missions

March 4 and 5, 2025 a Regional Workshop on the General Anti-Avoidance Rule (GAAR) was held in Lima, Peru, sponsored by the World Bank Group, CIAT, and the National Superintendency of Customs…

- Featured

- Publications

The CIAT Executive Secretariat invites you to download and read chapter “5.4. Initiatives regarding corporate responsibility and fiscal governance” written by The Internal Revenue Services of the United States (IRS).…

- Events

- Featured

- The Executive Secretary in the Press

Panama, February 20, 2025. After three days of in-depth analysis and enriching presentations, the 3rd NTO Technical Conference concluded in Panama City, consolidating itself as a key space for the exchange…