Post-pandemic metal super cycle and effectiveness of fiscal instruments

The COVID-19 pandemic, which began in 2020, has brought terrible global economic and social effects, which have triggered or accentuated various events: changes in the demand for financial instruments by international investors, inflation risks due to expansive monetary policies and countercyclical fiscal policies, renewed concern for less polluting energy products and sources, restrictions on the supply of metals, recovery of the Chinese economy, among others.

The confluence of these factors helps to explain the rise in the price of minerals since the second quarter of 2020, which has raised the question of whether we are facing a new “super cycle” of metals, similar to the one that ended almost 10 years ago. Likewise, in the countries that export these raw materials, the debate is renewed on whether the fiscal instruments available to the State are sufficiently effective to capture the income generated by extraordinary profits from mining.

Higher prices with greater intensity

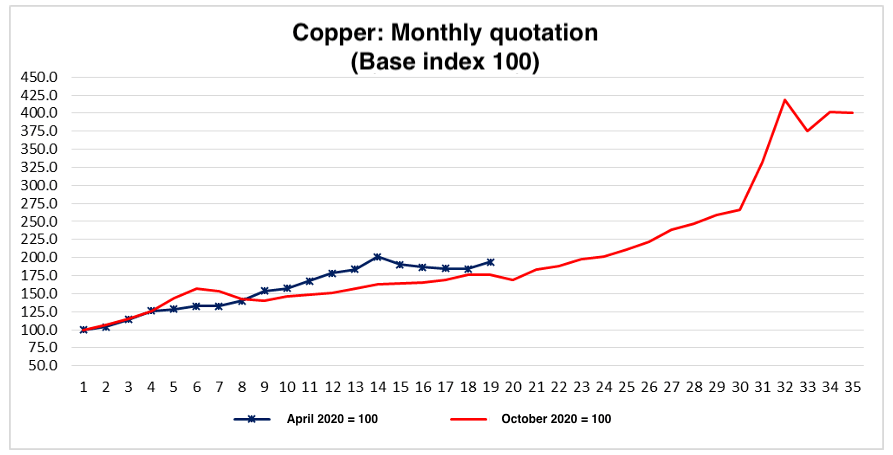

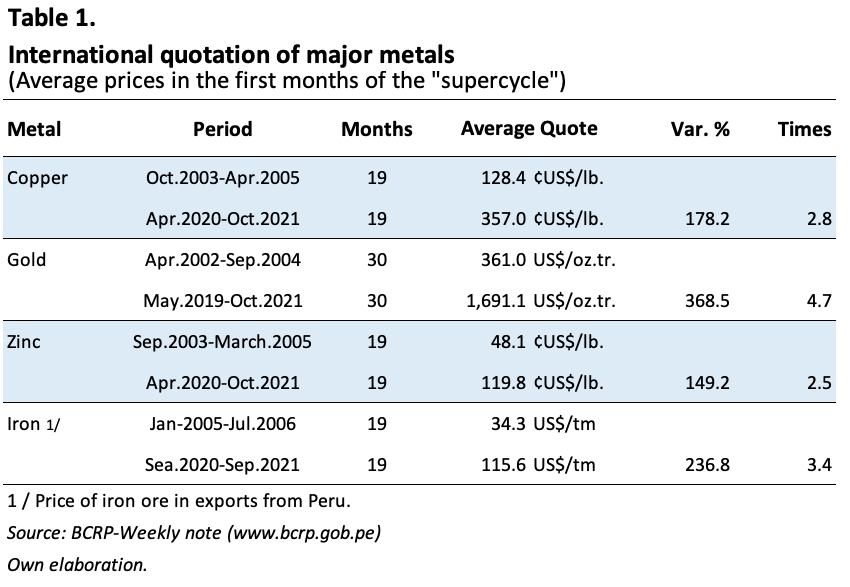

The recent increase in the price of metals has been showing greater dynamism compared to the mining bonanza of the decade 2003-2012. In the case of copper, we will take October 2003 as the base period for the last boom; for the recent price increase the reference period is April 2020. When comparing the period April 2020-October 2021 (19 months) with the first 19 months of the “super cycle” (October 2003-April 2005), it is observed that the recent increase in the price of copper has been more marked than that observed in the past bonanza (figure 1).

Figure 1

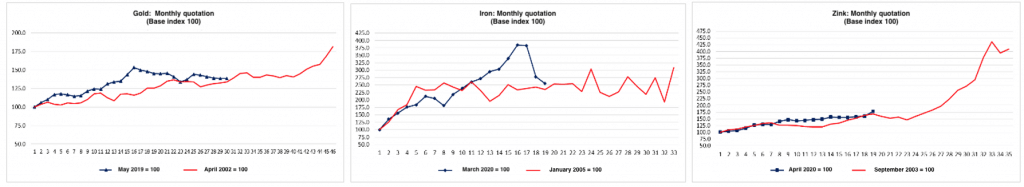

Although with comparison periods that differ in their start and duration, the prices of gold, iron and zinc have also been registering more pronounced growth rates compared to the 2003-2012 “super cycle” (figure 2).

Figure 2

The recent increase in the price of metals is not only more intense but has also started from a higher price floor. In the case of copper, 19 months after the recent increase, the average price (¢ US $ / lb. 357.0) is 2.8 times higher than the average price of the first 19 months of the “super cycle” (¢ US $ / lb. 128.4) (table 1).

In the “super cycle”, the rise in the price of metals began in 2003 and lasted – in general terms – for a whole decade. In the recent increase in the price of metals, the projections are more conservative, although they point to prices above pre-pandemic levels. According to the World Bank (2021)[1], the price of metals would fall by 5% in 2022, after an estimated increase of 48% in 2021. For the medium and long term, it is estimated that the copper price will remain approximately 25% above its 2020 price.

Extraordinary income: The case of Peru

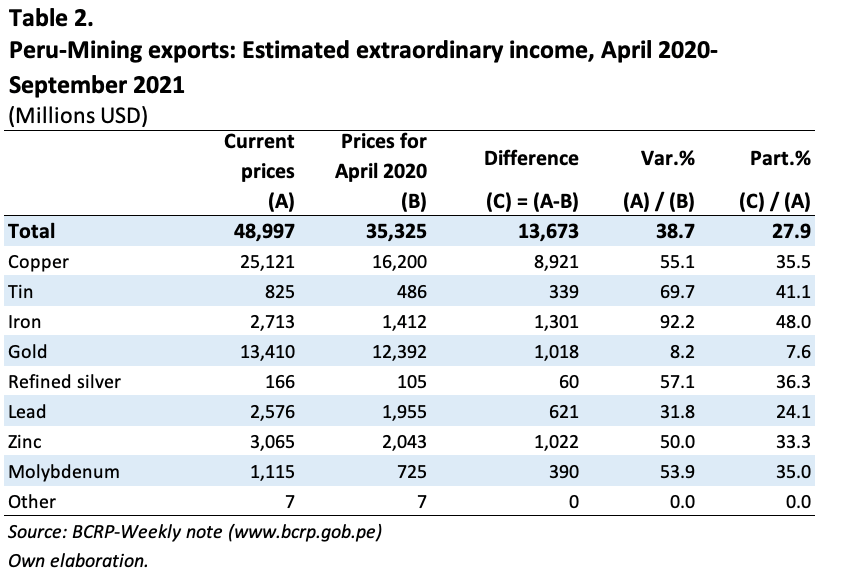

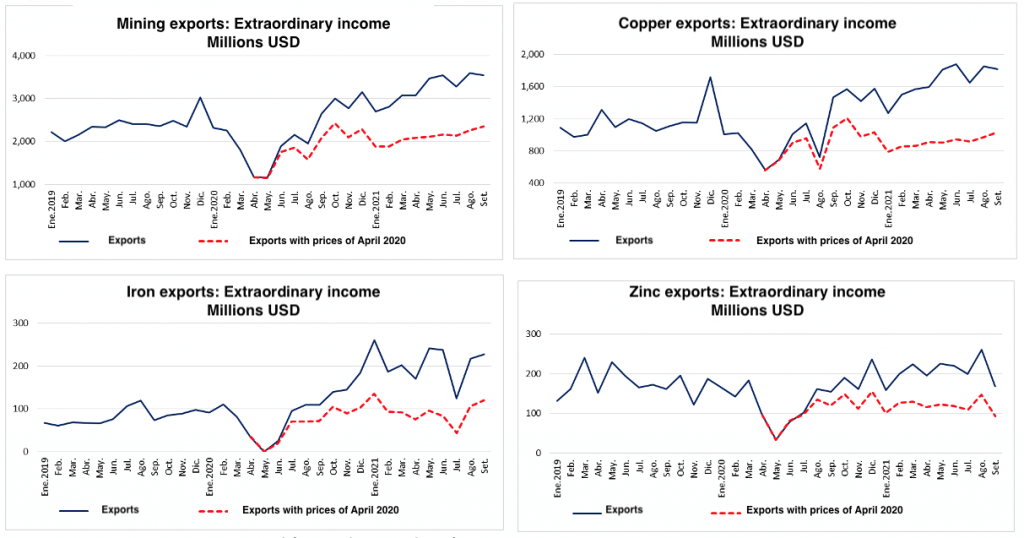

To approximate a quantification of the extraordinary income, which the mining sector has been registering due to the higher prices of metals, we are going to take Peru as a reference and set the prices of its mining exports as of April 2020. This period is what we have identified as the beginning of the recent rise in the price of copper, therefore, it is representative for Peru, since this metal contributes more than half the value of its mineral exports.

Of the total revenue from mining exports accumulated from April 2020 to September 2021 (18 months), 27.9% was due to the higher price of metals. That is, an additional US $ 13,673 million just for a price effect (table 2).

Most of the additional income (65.2%) was due to copper, whose exported value increased by 55.1% due to the rise in the international price. Consequently, in Peru these extraordinary income from the mining sector is mainly explained by a price effect.

Figure 3

Collection and effectiveness of tax instruments

The rise in the international price of metals increases the income of mining companies, which has the positive effect of higher tax payments.

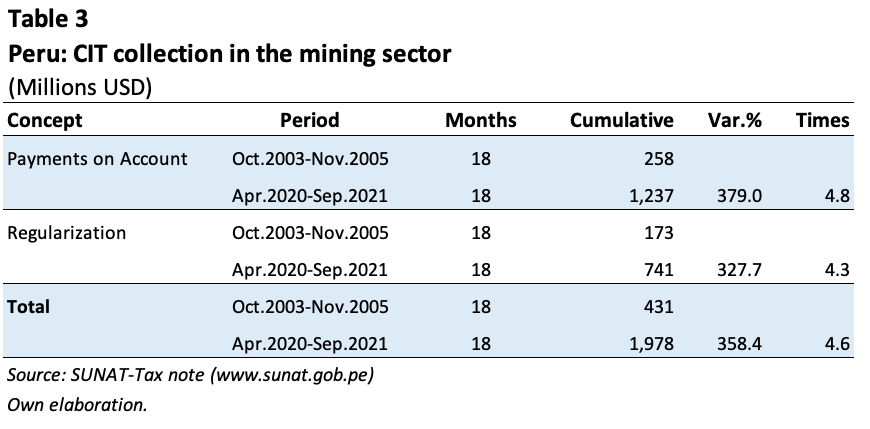

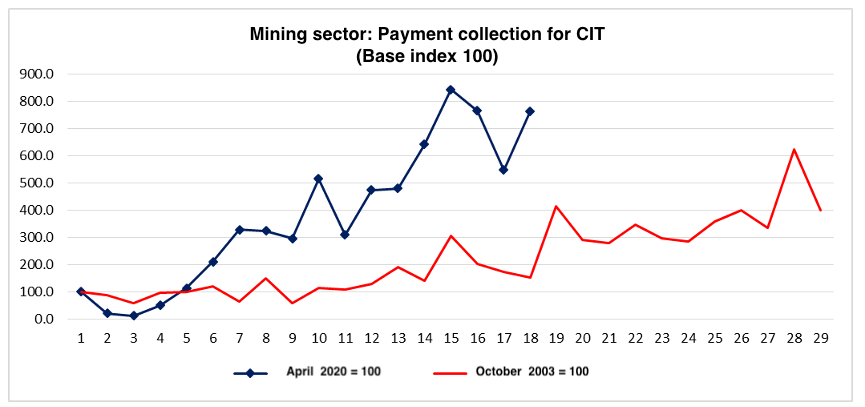

Next, the intensity of this positive effect in the recent conjuncture (April 2020-September 2021) is compared with that observed in the past boom (October 2003-March 2005). The analysis is conducted for the collection of the corporate tax (CIT), since the new fiscal instruments that currently also tax the mining activities were only implemented in 2012, when the “super cycle” had almost ended: the new mining royalty (NRM), special mining tax (IEM) and special mining levy (GEM).

The CIT collection has been increasing at a rate much faster than that observed during the past bonanza (figure 4). If we compare the payments on account of September 2021 with those of the base period April 2020, the collection for this concept increased by about 8 times. On the other hand, during the past bonanza, the payments on account of March 2005 compared with those of October 2003 increased by only 1.5 times.

Figure 4

In accumulated terms, the total CIT collection (payments on account plus annual regularization) during April 2020-September 2021 is greater by about 5 times the amount collected during the first 18 months of the last boom (October 2003-March 2005) (Table 3).

Whether higher prices translate into higher tax revenues will also depend on the effectiveness of the tax instruments with which they are collected. We will approach this issue from the percentage of export earnings that the mining companies allocate to pay taxes.

Whether higher prices translate into higher tax revenues will also depend on the effectiveness of the tax instruments with which they are collected. We will approach this issue from the percentage of export earnings that the mining companies allocate to pay taxes.

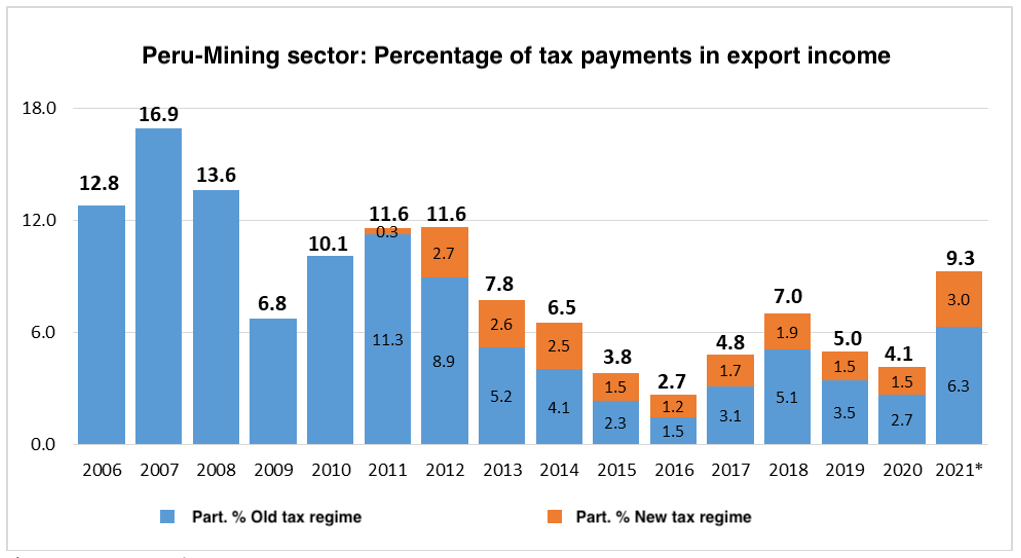

In the best years of the past bonanza (2006-2011), what was collected under the old tax regime, made up of the CIT and the old royalty -still in force- that is applied on mineral sales, represented -on average- 12.0% of the exported value (figure 5). Since then, this share has declined steadily, reaching the floor of 2.7% in 2016. This was the case despite the fact that, since 2012, the old tax regime was “reinforced” with the new tax regime composed of the IEM, the NRM and the GEM, instruments whose common denominator is that their taxable base is the operating profit determined according to accounting standards.

Figure 5

The recent rise in the price of metals has favored a recovery in the part of export earnings that mining companies use to pay taxes: from 4.1% in 2020 to 9.3% during 2021 (January-September). However, this result is still below the 16.9% registered in 2007, when only the old tax regime existed, which was ineffective in adequately capturing the extraordinary profits of the sector during the 2003-2012 “super cycle”.

The new mining tax regime, inaugurated in 2012, was designed to correct this scenario and capture extraordinary income in periods of price bonanza. However, it has not been fulfilling that function with the same intensity that is observed in the old tax regime. In statistical terms, the latter correlates better with the exported value, compared to the new tax regime.

In other words, mining companies have been obtaining higher extraordinary income compared to the past boom, but the percentage of their total income that they use to pay taxes does not yet show a similar dynamism.

Conclusions

On more than one occasion we have opined that the growth and development of a country should not be subject to tax revenues that originate mainly from the export of raw materials, as this makes it very vulnerable to the ups and downs of the international market. However, this perspective does not contradict the right that every State has to optimally capture the income generated by the exploitation of its natural resources. In this context, the effectiveness of fiscal instruments is a sine qua non requirement.

[1]World Bank (2021). Commodity markets outlook. Urbanization and commodity demand; October 2021. Washington, DC: World Bank.

2,385 total views, 6 views today

1 comment

In recent years Latin America has focused on the environment for the improvement in mineral investment, which has promoted environmental and social processes with an increase focused on mineral exploitation, some measures that have implemented deferring the paymento of taxes or royalties, since the perspective is a recovery of minerals to feed the clean and renewable energy matrix, all of the above trying to ensure that global warming generate by some extraction processes can be stopped.