The so-called “6th. Method”

A great Argentine invention that has been generalized in Latin America.

Several years have gone by since the Federal Administration of Public Revenues of Argentina (AFIP) began to give heed to a tax evasion scheme whose main objective is to manipulate the prices of primary products (e.g.: cereals, soya bean, etc.) in order to loosen the tax base in the exporting country.

Several years have gone by since the Federal Administration of Public Revenues of Argentina (AFIP) began to give heed to a tax evasion scheme whose main objective is to manipulate the prices of primary products (e.g.: cereals, soya bean, etc.) in order to loosen the tax base in the exporting country.

Basically, the scheme consists of the export of primary products from the producing country, through the use of intermediaries of no economic substance located in low or null taxation and/or opaque jurisdictions. In addition, the exporter agrees on the prices of products at times when they are lower due to their seasonality, through the use of term contracts and the “actual” export takes place when the prices are increased.

In response to this, in 2003 Argentina implemented the “6th Method” at the normative level. This basically involves taking the higher price between the one agreed by the parties and that of the “transparent market” where the product is negotiated at the time it is shipped, when the tax administration verifies that the aforementioned evasion scheme has taken place. The regulation implemented by Argentina exempts the local exporter from this measure, only when it can prove that the intermediary complies with a series of requisites showing that the “international intermediary” has economic substance.

This method has brought about good results by discouraging the behavior that leads to this type of tax evasion in a key sector of the country’s economy.

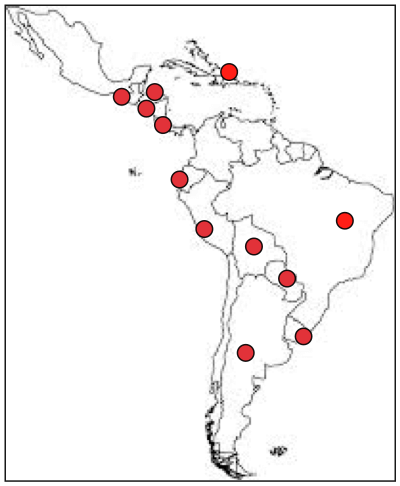

Thanks to the dissemination of this measure by regional organizations such as IDB and CIAT and AFIP’s motivation for disseminating this good practice, it has currently been implemented in twelve countries of the region, with Uruguay and Ecuador being the first ones.

The following graph shows the countries that adopted this measure

After analyzing nine of the twelve existing measures, I concluded that when we talk about the “6th method”, we are not referring to a unique development. The differences are more than significant and may lead us to very different results.

The countries with the greatest experience in the application of the “6th method” are Argentina and Uruguay. Most certainly we will have to wait some months or years to determine the impact which the “6th method” has caused in the different countries that have implemented it.

It is evident that this measure responds to tax risks that may be generated in various “key” sectors of the Latin American and Caribbean countries, where a not quite significant decrease in the level of taxation may imply substantial tax resources in absolute terms.

The following TABLE shows the main differences and similarities between the regulations adopted by nine Latin American countries. The way of combining the different criteria adopted will significantly influence the impact to be caused by the regulation, as well as the administrative actions which should be taken by the tax administration. Shown below is a summary of the main differences found in the different aspects of the regulation:

|

Aspect |

Different approaches adopted |

| Transactions to which the measure is applied |

|

| Nature of the measure |

|

| Products or goods to which the measure is applied |

|

| Relationship condition | The relationship condition between the exporter and importer and/or the actual recipient, is expressly provided by the majority of countries |

| Condition that there be an international intermediary | The condition that there be an international intermediary without economic substance in order to apply the measure is expressly provided in most of the countries. |

| Hierarchy of methods |

|

| Prices to be consi dered |

Some countries accept the price agreed by the parties if the contract is presented to the tax administration or other governmental entity a few days after having being signed. |

| Exceptions to the application of the measure |

Some measures implemented in the region afford the local individual the possibility of proving that the intermediary has economic substance, although the criteria is not the same in all cases. |

2,511 total views, 1 views today