Massive or intensive controls? What should be the strategy of tax administrations?

The purpose of sharing these thoughts with you is to analyze some trends in the control function of the Tax Administrations (TAs) to answer the question of what kind of controls should be currently prioritized. Currently, it means determining if they must be massive, extensive, or otherwise intensive or deeps audits.

We can say that the audit is the action by which TAs seek to prevent taxpayers from committing tax evasion or fraud and, if they occur, to detect them, prove them and eliminate them.

Its goal is to maximize the perceived risk, defined as the probability of being controlled, considering the importance of the penalty.

However, the percentage obtained as a direct collection from control actions does not exceed 2% to 3% of total revenue, therefore as we said its goal is to generate risk, fighting tax evasion and modifying the behavior of taxpayers so that voluntary compliance is increasing.

While there is no precise definition of the mass or extensive controls, we can say that they are tax controls taking advantage of computers and modern technology. They can detect material errors and formal errors made by taxpayers in their tax returns and inconsistencies in data reported in contrast to the data available to the tax authorities (TA) of a country.

They are characterized by their immediacy, generality, and short duration. They take place in the offices of the TA, where the own and third party data are contrasted, and they aim to reach a larger number of taxpayers.

On the other hand, intensive controls apply to more complex forms of fraud, performing a thorough analysis of the statements of the taxpayers, generally older fiscal periods are verified, they last longer, fewer taxpayers are audited and the task of research and preliminary selection is highlighted.

Intensive controls are usually defined as the last frontier in the fight against tax fraud.

In some countries, the tax codes define themselves both types of controls, specifying the powers of each control type, their duration and other aspects.

Other countries however do not have this delimitation in tax codes but different controls are defined in the annual audit plans, annual collection plans or tax control plans, which in some cases are officially published and not in others.

We all know that the TAs increasingly have fewer resources (human and material) and are required greater efficiency and effectiveness in their main goals of tax collection.

Therefore, first we must determine what should be the TA’s strategy.

In this regard, since I started more than 20 years ago in the teaching TA, I always turn to a work the Organization of American States (OAS) entitled “Control of taxation in developing countries in America”, of the year 1976, which in spite of its seniority, is still effective today.

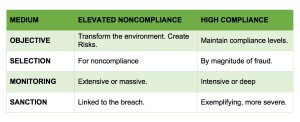

Based on the conclusions of this work we developed the following table:

According to this scheme, simple but illustrative, the types of controls to be implemented depend on the environment faced by a TA.

When we are confronted with environments where failure is high, we should prioritize extensive controls over intensive, seeking to make a greater number of audits, fast, not so deeply aiming to reach more taxpayers in order to transform the environment, creating risks so the voluntary tax compliance should increase.

In this case, the selection of audits should be linked to breaches and penalties imposed linked to such breaches.

By contrast, in those countries where compliance is widespread, the goal should be to maintain such levels so the adequate path is that of intensive or deep, where the selection of cases is based on the magnitude of the fraud, and consequently the audit are exemplifying and more severe sanctions are applied.

Obviously, our topic is not black nor white but every situation and context of each country must be analyzed in detail to see that kind of control must have priority.

I understand that there is no single recipe but in each case will have to see what is best for the TA to achieve a more effective implementation of the tax system.

Key issues to be analyzed are the census of taxpayers, which must be complete and updated, the size of the TA (human, material) the number of taxpayers and the territorial distribution, the activities developed and the availability of own data and third parties data, which increasingly plays a more important role in control actions.

Any control strategy formulated must be inserted into the overall strategy of the entire AT, which must seek a balance between the control function and service function, always trying to increase levels of voluntary compliance, modifying behavior towards to achieve social acceptance of the tax system.

Both the control function and the service function must be executed by the different areas of the TA, working together and coordinated so that the TA improves day by day its effectiveness and efficiency.

Today it is common that in most TAs the collection areas deal with the control of omitted (registered taxpayers who do not have file their return on time) and control of defaulters (taxpayers filing their returns without entering the correct tax amount).

In this regard, it is also wise to stress the idea of full cycle since all the areas involved in the control process should ensure the collection of taxes, everyone must work not only to determine the taxes owed but also to charge them (precautionary measures, joint liability, among others).

It is also key that the control system must be unique, irrespective of the control procedures determined by each TA.

The various types of controls should be coordinated, both to avoid duplication of action as well as avoid the so-called “gray areas” i.e. taxpayers who fall outside both types of controls. TAs must have clear rules to coordinate both types of controls.

For example, intensive controls should be performed once large breaches are detected.

Moreover, if a taxpayer already being examined by an intensive control and a new inconsistency is detected, it is logical that it falls within the same intensive audit control.

It can also happen that an audit is started as mass control and then derived to intensive monitoring, i.e. mass control using as a screening method of intensive control.

On the other hand, I think the unpredictability of control systems is important, because that way I consider that the sense of risk is optimized.

Risk is the best ally of voluntary compliance, which is why the risk management of a TA should be directed to maximize compliance, whereby each actuation should be measured under the goal of voluntary compliance.

Therefore, I think it is appropriate to use different forms of selection of cases from traditional planning to risk analysis mostly used today, supported by modern technology.

Risk management compliance is crucial today in the TA and involves a structured approach to the identification, evaluation, prioritization and mitigation of the risks.

It should be part of the strategic planning and operational planning.

It is good practice to collect information relating to the risk of both internal and external sources, such as analyzing audits and returns of taxpayers, third party information, and studies of behavior and attitudes of taxpayers with regard to taxes, and sectoral evasion studies.

It is also appropriate to make an identification, evaluation and classification of compliance risks by segment of taxpayers.

In addition, the TAs should perform evasion studies by sector in order to focus even better its control strategy, using for instance such sectoral control registers to identify the key players of the most important productive activities of a country and changing the behavior of these strategic sectors.

It is useless to know the general level of fraud in a country if we do not know which sectors or activities are producing it.

A theme also usually discussed in doctrine is to know where massive or extensive controls should be located; which area of the TA should perform them.

The solutions are internationally multiples since in some countries they are performed by collection areas, in others by control areas, and in some by both areas jointly.

As I said earlier, it is important, that control policy should be unique and that both types of controls are carried out independently of the area that perform them.

Regarding human resources to affect to the control, I think that with modern technologies, TAs today have a historic opportunity because they can redirect resources toward both extensive and intensive controls.

This happens because many of the traditional functions of a TA will be simplified or removed directly. For example, the taxpayer’s assistance, which with virtual offices will be increasingly virtual.

In this case, the priority is training, ongoing training and knowledge management of the staff dedicated to controls.

A fundamental pillar of controls is the information available to the TA, which has grown exponentially in recent years, both provided by the taxpayer, by third parties or resulting from national and international collaboration.

Today’s the TA is an information manager, which is the cornerstone, especially to address efforts towards the areas of greatest non-compliance.

Investment in IT resources to improve the information system should be the guide for the coming years of the TAs.

However, today many TAs do not have a single, integrated information system, reliable and of quality.

Usually they have a lot of information but it is scattered in different areas and no systematic work is done to improve their quality. One example is that few TAs update regularly their inventory of information.

When we develop annual audit plans we believe it is very important that the TAs require not only the estimated revenue of the various collection actions to carry out but also determine targets in the number of actions to perform according to different types of control.

This, because setting goals for amounts does not ensure that control actions reach many taxpayers but ensure that audits are time-consuming and few taxpayers are audited.

As a result, with the available resources, few taxpayers will be audited and increasingly it will become more difficult to transform the environment.

A current criticism made to many TAs regarding control is that they are always dedicated to “hunt in the same zoo” or “fish in the fish tank” in the sense that the same taxpayers are always subjects to the control procedures.

I understand that the TAs must make permanent actions to detect unregistered taxpayers, such as using third-party information to identify newly established business and activities of non-registered businesses and conduct surprise checks, to discover unregistered traders and/or workers.

Massive controls should aim a corrective effect to achieve greater accuracy in the information declared by taxpayers, but also have a deterrent objective to increase the perceived probability of detection and application of sanctions by the TA; they also should serve to gather more information than is already available by identifying new noncompliance risks and confirming those already detected.

Regarding intensive controls, we must seek their effectiveness as a means of generating risks to increase the levels of voluntary compliance.

It is preferable to study fewer cases but orienting them to forms of fraud that are more complex (e.g. transfer pricing, apocryphal electronic invoices) but they must conclude in criminal complaints with concrete sanctions.

As final thoughts, I note that the control system must be unique, and above all must be suited to the characteristics of the medium in which it is applied; all areas of TA must be involved and a permanent feedback process must be available to correct what went wrong and enhance the successful controls.

If I had to make a prediction, I would say that in the coming years we will see an exponential increase in massive controls, product of new technology and more information available to the TAs from all the cooperation that exists both nationally and internationally.

I think the massive controls should be the best bet of the TAs, especially in countries where non-compliance is widespread and on the rise, and inequalities increase daily because all the countries seek to attract capital by introducing tax cuts for the large companies and, on the other hand, the tax burden to the workers remain the same.

With regard to intensive controls, I think that they will be dedicated to more complex forms of fraud and in many cases, mechanisms of cooperative compliance that seek to establish and promote a relationship based on transparency and mutual trust between the tax administrations and certain companies will increase. This already exist in some European countries (UK, France, Sweden, Holland, Spain), and the OECD’s multilateral pilot plan for transfer pricing (International Compliance Assurance Program ICAP[1]) and APAS (Anticipated pricing agreements) are already existing in many countries, among other measures to that effect.

Surely, I may have omitted many more aspects that may address the issue; I only tried to convey some concepts to open a debate.

[1] It is a voluntary program through which multinationals can submit their transfer pricing determinations for review, so the TAs simultaneously evaluate if there are tax risks in such determinations. TAs from Australia, Canada, Italy, Japan, Netherlands, Spain and the US have already initiated this pilot program under the OECD Forum.

3,040 total views, 2 views today