2021: The carbon emissions taxation year?

An unprecedented succession of natural catastrophes has swept the planet in July 2021. There have been severe floods in China and Western Europe, heat waves and droughts in North America, massive melting of the Artic ices and wildfires in the subarctic.“A summer of extraordinary climatic events” is the headline of “El Pais” and what awaits us if we do not act decisively will be much worse.[1]

At the time of writing this blog, the report of the UN Panel on climate was just published this Monday, August 9 2021[2].

The leading scientists and government officials met online to agree on the synthesis text and the meeting ended on time, a rare achievement for a multilateral event of such magnitude. Among its main conclusions, the attribution of extreme weather events to human activity is emphasized. In the past eight years, the science of attribution has developed rapidly, with models used to quantify the probability or severity of a flood, drought, or heat wave due to climate change. So far, the political response has not been as effective as the scientific warnings. It is mentioned that several of the main emitters, to date, did not meet the UN deadline to present their national climate goals for 2030. It is expected that the recent climatic disasters could bring some changes in this regard.

“Stabilizing the climate will require strong, rapid, and sustained reductions in greenhouse gas emissions, and reaching net zero CO2 emissions. Limiting other greenhouse gases and air pollutants, especially methane, could have benefits both for health and the climate,” concludes Mr. Zhai, co-Chair of the Press release of the IPCC.

In term of financial and fiscal policies, In April of this year the IMF/OECD presented a report for the G20[3] Finance Ministers and Central Bank Governors. Here are some of the conclusions:

To drive decarbonization and meet the goals of the Paris Agreement, carbon emissions prices must be generalized and grow rapidly. A recent analysis shows that 60% of CO2 emissions from energy use in OECD and G20 countries are unpriced.[4] The industrial and electricity sectors have very low rates and are further weakened by support for fossil fuels and where fossil fuel-free allocation rules and free permit allocation rules favor carbon intensive technology. Policy action measures varies from country to country, depending on level of ambition, energy mixes, and different starting points, but “reaching the emission reduction targets defined in the Nationally Determined Contributions (NDCs) requires measures equivalent to carbon prices of $ 25-75 / tCO2 or more by 2030 in many G20 countries”.

To improve the effectiveness and acceptability of mitigation strategies, a comprehensive package of measures is needed, in addition to carbon pricing. These policies could include a balance between carbon pricing and strengthening sectoral instruments; support for public investment and technology policies; the productive and equitable use of revenues from carbon pricing; and measures for a just transition, to address industrial competitiveness and to reduce greenhouse gas emissions in general.

– It provides blanket incentives for businesses and households to reduce carbon-intensive energy use and shift to cleaner fuels.

– Provides the essential price signal to mobilize private investment in clean technologies.

– Is more flexible than regulatory approaches: Unlike energy efficiency and other standards, prices leave households and businesses with a wide range of options to reduce emissions. This greater flexibility reduces the public costs.

– Provides ongoing mitigation incentives: For some policy tools, such as standards, the pressure to reduce emissions disappears once a standard is met, while prices continue to induce the mitigation effort as long as emissions as positive.

– Mobilizes government revenue: Unlike most other mitigation instruments, carbon pricing increases public revenues, and the administrative costs of collection are much lower than those of broader fiscal instruments.

– Generates internal environmental benefits, such as reduced mortality caused by local air pollution: Carbon pricing, like other mitigation instruments, results in cleaner air that is a tangible and immediate benefit of reduction from the combustion of coal and fuels, especially in metropolitan areas.

So how do we get carbon pricing to where it needs to be in ten years? A new IMF document, prepared by Vitor Gaspar and Ian Parry, proposes the creation of an international carbon minimum price agreement that complements the Paris Agreement, as follows:[6]

So how do we get carbon pricing to where it needs to be in ten years? A new IMF document, prepared by Vitor Gaspar and Ian Parry, proposes the creation of an international carbon minimum price agreement that complements the Paris Agreement, as follows:[6]

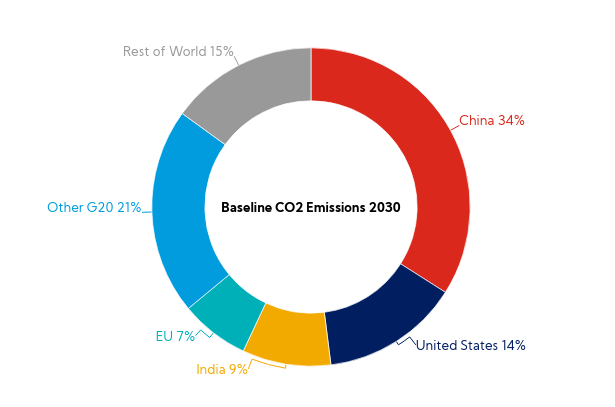

The proposal develops an example of reinforcing the promises of the Paris Agreement with a minimum price of three levels among only six participants (Canada, China, European Union, India, United Kingdom and United States) with prices of $75/ton for the advanced economies, $ 50 and $25 for the middle- and low-income emerging markets, respectively. In addition to other current measures, this could help achieve a 23% reduction in global emissions below the baseline by 2030. Regarding the emissions prices, the OECD document announces higher reference prices: “120 euros per ton is a new benchmark that allows evaluating progress towards carbon prices in the near future that are in line with targets. current decarbonization.” Currently, only some countries such as Sweden and Switzerland reach these reference level, while the European Union has a steadily growing price.

A judicious use of revenues from carbon pricing can make climate policy more inclusive and effective, while containing the costs of clean energy transitions for the economy. Increasing carbon prices, as part of a policy package that buffers adverse impacts, providing immediate benefits to vulnerable households, workers, businesses, and regions, can increase the chances of successful implementation.

We can conclude this blog with the words of John Kerry, the U.S Presidential envoy on Climate on July 20 in his speech “On the urgency of climate action” delivered in London: “Simply put: the world needs to reduce emissions -particularly greenhouse gas CO2 emissions- by at least 45% by 2030 in order to be on a scientifically credible path by midcentury to net zero. That is what the IPCC showed us. 45%, not just in some countries or regions, but worldwide. They have found that 45% is the minimum that the world must reduce. That makes this the defining decade. And it makes 2021 a decisive year. And most of all, it must make COP 26, to be held this year in Glasgow, a pivotal moment for the world to come together to face and master the climate challenge. ”[7]

Although the tax administrations of CIAT member countries are not in charge of deciding these policies, they have to stand ready to implement the decisions that national and international leaders are poised to take and be prepared to collect the public revenues needed for the accelerating transition towards a “green recovery” from the pandemics, and toward the essential goal of preventing more catastrophic climate disruption.

[1] https://elpais.com/elpais/2021/07/21/album/1626882192_983926.html#foto_gal_2

[2] “A Climate report to deliver stark warning on global warming” https://www.reuters.com/business/environment/un-climate-report-jected-deliver-stark-warnings-global-warming-2021-08-05/

[3] “Tax Policy and Climate Change”, April 2021, Italy see https://www.oecd.org/tax/tax-policy/tax-policy-and-climate-change-imf-oecd-g20-report-april-2021.pdf

[4] Effective Carbon rate 2021, OECD, see https://www.oecd-ilibrary.org/sites/0e8e24f5-en/index.html?itemId=/content/publication/0e8e24f5-en

[5] Source: Tax Policy and Climate Change”, April 2021.

[6] A proposal to scale up global carbon pricing” “Una propuesta para aumentar la fijación de precios del carbono global” https://blogs.imf.org/2021/06/18/a-proposal-to-scale-up-global-carbon-pricing/

[7] https://www.state.gov/remarks-on-the-urgency-of-global-climate-action/ Cop 26, the 2021 United Nations Climate Change Conference, is scheduled to be held in the city of Glasgow from 31 October to 12 November 2021 under the presidency of the United Kingdom.

3,516 total views, 6 views today