CIAT has participated in the 8th meeting of the Punta del Este Declaration, with the purpose of promoting transparency and information exchange in Latin American countries

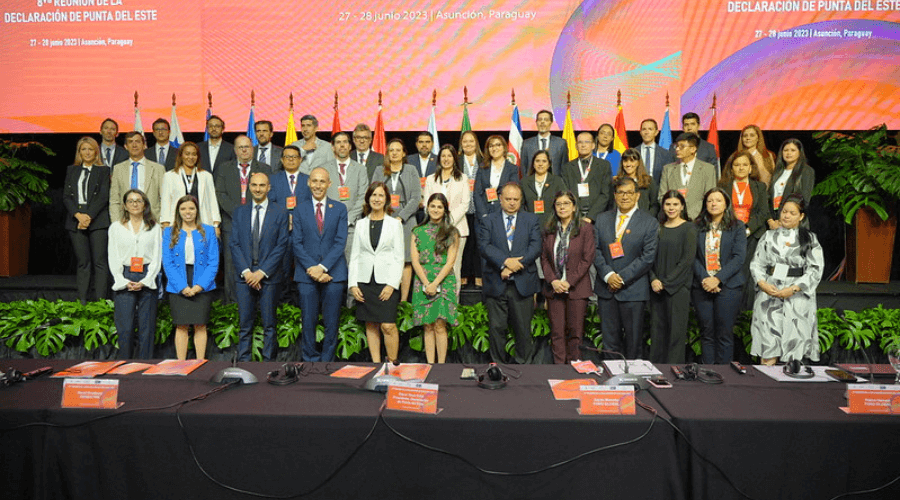

On June 27 and 28, 2023, under the auspices of the Republic of Paraguay and with the words of Mr. Mario Abdo Benítez, President of the Republic of Paraguay and Mr. Oscar Llamosas, Minister of Finance, the 8th meeting of the Punta del Este Declaration was inaugurated in Asuncion.

This meeting was led by Mr. Oscar Orué Ortiz, Vice Minister of Taxation of the State Secretariat of Taxation (SET) of Paraguay, in his capacity as Chairman of the Punta del Este Declaration; and co-sponsored by the Global Forum on Transparency and Exchange of Information for Tax Purposes, represented by Ms. Zayda Manatta, Head of the Secretariat of the Forum, and members of her team.

The meeting was attended by 60 delegates from tax administrations, finance ministries and diplomatic representations from Latin America and Europe, international organizations and non-governmental organizations.

The meeting presented updated data on the status of tax transparency in Latin American countries and their respective achievements, discussed various areas where progress is needed and ways to address them, based on the experience capitalized by member countries of the Global Forum, and discussed other cooperation mechanisms, with the aim of making a leap towards mutual assistance mechanisms. We invite you to download the Declaration of Results of the 8th Meeting of the Punta del Este Declaration, which contains more details on the issues discussed and the conclusions reached.

The Declaration of Punta del Este currently includes 15 signatories, one observer country and five partners, including the Inter-American Center of Tax Administrations (CIAT). This Declaration seeks to implement effectively international standards of transparency and exchange of information, to maximize the effective use of the information exchanged, including considering a broader use of information exchanged by treaties for non-tax purposes, to address corruption and other financial crimes, and to improve international tax cooperation. The overall objective of the Declaration is to ensure that jurisdictions in the region can fully and quickly benefit from transparency and EOI for tax purposes and translate it into domestic resource mobilization.

1,648 total views, 3 views today