Tax measures to reduce plastic pollution: What measures are being developed by CIAT member countries?

Plastic pollution is one of the most pressing environmental challenges of the 21st century. Plastic waste is a social justice and human rights issue that, in addition to being an environmental and ecological problem, threatens food security, human health, and economic development. Countries in the Global South are disproportionately affected by plastic pollution. At the tax level, how are countries driving solutions to address this problem?

Faced with the slow pace of global agreements[i], many countries have begun to use fiscal instruments to discourage the use of single-use plastics, promote the circular economy and finance waste management systems. Many CIAT member countries have implemented their own policies, such as bans on single-use plastics, plastic bag taxes, and extended producer responsibility (EPR) systems that require producers to finance waste collection and recycling. The following are relevant examples and types of measures that could inspire a better coordination among CIAT tax administrations on these policies.

Summary of tax rates and objectives:

Examples of taxes or incentives on plastics in force in CIAT member countries:

- Brazil: A new regulation gradually bans the use of conventional single-use plastics, such as bags, cutlery, cups and disposable containers, and from 2023, tariffs on imported plastics rose from 11.2% to 18%, excluding certain types of glass.

- Chile: Chile implemented a total ban on single-use plastics through Law No. 21,100, known as the Chao Plastic Bags Law. It also promotes recycling through tax incentives and robust EPR systems.

- Ecuador: The 2012 Redeemable Tax on PET bottles is a standout example of a tax regulation actively supporting recycling and pollution reduction. In December 2020, it also enacted the Organic Law for the Rationalization, Reuse, and Reduction of Single-Use Plastics complemented by a circular economy framework providing ample legal support for environmental fiscal policies.

- United States and Canada: Plastics regulations are primarily enforced at state, provincial, or municipal levels. Several cities and states, such as California and Quebec, have bans or fees on plastic bags, promoting localized solutions in the absence of nationwide federal taxes.

- Spain and Italy have laws with tax provisions on plastic packaging; Spain’s came into force in 2023 and applies €0.45 per kilogram of non-recycled plastic contained in products. Italy postponed the full implementation of similar laws to 2026.

- Mexico: at least 29 of the 32 states have passed laws to ban, restrict or penalize the use of single-use plastics, including plastic bags. Although not all apply direct taxes, several states have opted for fines or financial penalties akin to tax rates..

- Peru: Taxes plastic bags and requires recycling of plastic bottles. The country is also developing EPR schemes for plastic packaging

- Colombia: applies taxes on plastic bags and has implemented Extended Producer Responsibility (EPR) schemes, requiring producers to finance system-wide recycling efforts

- Panama: Companies that convert their activity by replacing plastic products with biodegradable materials are eligible for an import tax exemption on equipment and machinery and an income tax reduction of 15%.

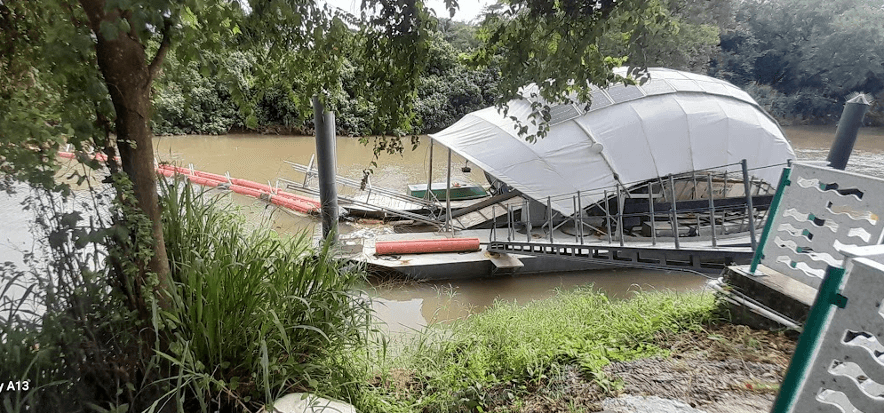

Barriers to plastic recycling polluting the Juan Diaz River, Panama.( photo: by the author)

Coordination between these policies:

The implementation of plastics taxes often coincides with the implementation of environmental levies on REP products and systems, linking fiscal instruments to mandatory recycling targets. However, global efforts remain fragmented. The increasing diversity of national policies, although progressive, shows the challenge of coordinating a global unified response[i]. Increased regional and global cooperation- including financial mechanisms, technology transfer and regulatory harmonization- is needed to amplify impact.

Environmental tax harmonization on plastics and NDCs.

Plastic tax measures are not only environmental policy tools, but also key instruments for meeting mitigation and adaptation targets set out in NDCs (Nationally Determined Contribution Plans). Their explicit inclusion in national climate plans can strengthen coherence between fiscal and environmental policy.

What are the incipient regional coordination mechanisms for LAC countries?

One example is Chile’s Extended Producer Responsibility (REP) Law, enacted in 2016, establishing mandatory recycling targets for priority products such as plastic packaging. The Ministry of the Environment sets annual recycling rates, and producers must finance the management systems. This model has been observed in other countries such as Colombia, Peru and Mexico, which have adopted similar schemes, although with different levels of control and coverage. Harmonization occurs through regulatory imitation but still lack a formal regional framework.

There is also a circular economy coalition for LAC, driven by UNEP and the German Metrology Institute. This coalition promotes shared quality infrastructure, such as certifications, seals and technical standards for recyclable plastics.

In Europe, fiscal harmonization is more advanced: The European Union requires all member states to implement fiscal measures, bans or REP schemes for single-use plastic products. Although each country can choose the instrument, harmonization is given by supranational legal obligation, with common reduction and recycling targets..

CIAT supports projects such as regional guides for applying Pigouvian taxes and REP taxes, along with joint training for tax administrations on environmental taxation and the circular economy.

References:

[i] https://globalsouth.org/2024/04/the-politics-of-plastic-pollution-and-the-impact-on-the-global-south/

[ii] The UN is negotiating a global treaty on plastic pollution that aims to take a comprehensive life-cycle approach (design, production and disposal). The last round of talks, held in August 2025 in Geneva (INC-5.2), failed to reach agreement due to deep divisions: Most countries want strict regulations on the production and use of plastics, but a group of oil-producing countries opposes such limits, as they supply feedstock for plastics. Talks on the treaty will continue, but face uncertainty due to competing interests, delaying a binding global agreement.

11,224 total views, 9 views today