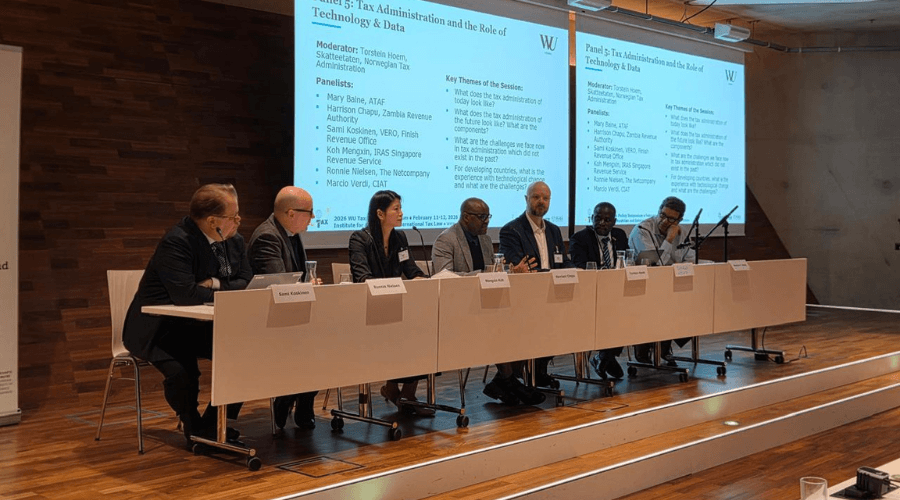

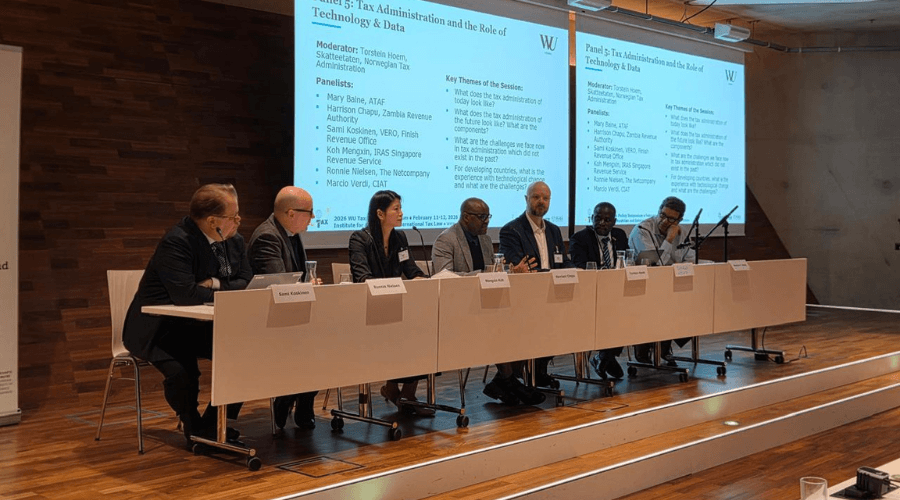

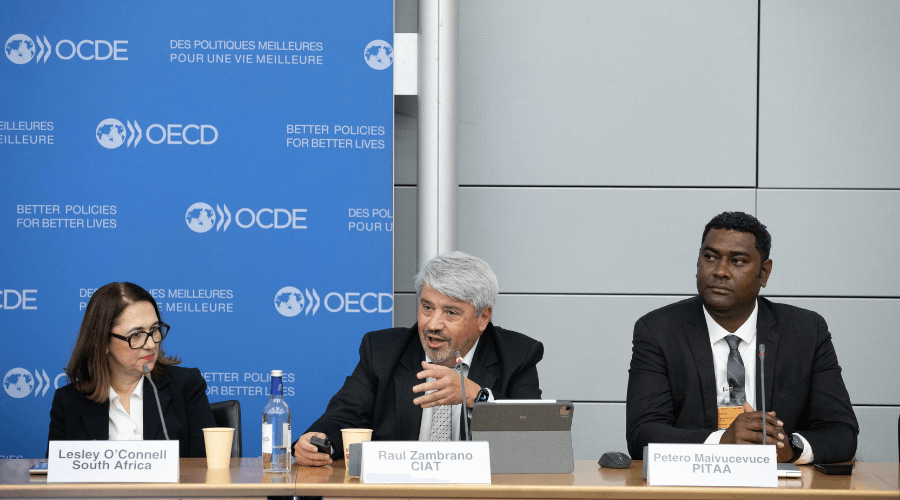

CIAT participated in the symposium “The Future of Taxes”

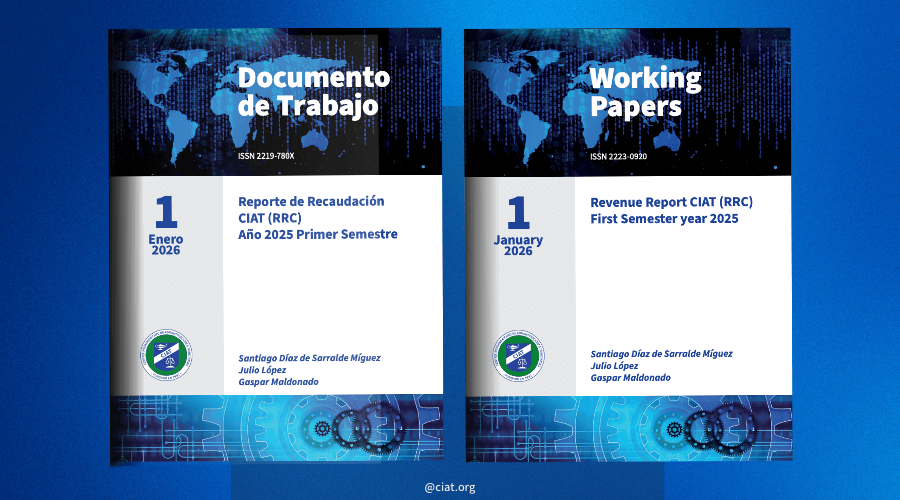

Browse through the site without restrictions. Consult and download the contents.

Subscribe to our electronic newsletters: