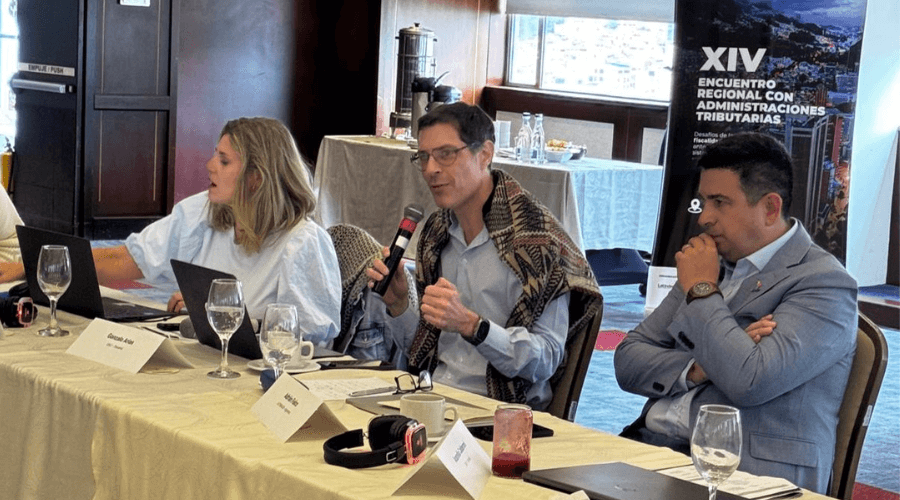

XIV Regional Meeting on International Taxation in Bogotá, Colombia

From October 1 to 2, 2025, the XIV Regional Meeting with Tax Administrations on International Taxation was held in Bogotá, Colombia. The event was organized by the Latin American Network for Economic and Social Justice (Latindadd), the Colombian Tax and Customs Administration (DIAN), and the Inter-American Center of Tax Administrations (CIAT), with the collaboration of the Inclusive Societies Program – FIAP, the Latin American and Caribbean Tax Justice Network (RJF-LAC), and the Financial Transparency Coalition.

Over the two days, participants discussed the challenges of reaching a ‘consensus’ on the future of international taxation in the context of global transformations marked by the digitalization of the economy and the need to strengthen the control of multinational enterprises. The forum focused on advancing toward fairer, more transparent, and sustainable tax systems, reinforcing the ability to mobilize domestic resources and implement rules that help combat tax evasion and avoidance. It also addressed issues related to tax administration management, such as international cooperation, digital economy control, dispute prevention and resolution, and access to beneficial ownership information, among others.

The program featured a dynamic format combining roundtables and presentations. Within this framework, nine thematic panels were developed, focusing on different topics, including:

• Global and regional initiatives on international taxation.

• Identification and control of tax crimes.

• Digital economy and tax administration.

• Beneficial ownership registers and fiscal transparency.

• Prevention and resolution of tax disputes.

• The sustainability of BEPS in Latin America and the Caribbean.

More than 50 representatives from tax administrations participated, with presentations from DIAN (Colombia), SUNAT (Peru), SII (Chile), DGI (Uruguay), SAT (Guatemala), DGI (Panama), TAJ (Jamaica), Receita Federal do Brasil, SRI (Ecuador), DGII (Dominican Republic), and DNIT (Paraguay), along with tax experts and representatives from the United Nations, ECLAC, Tax Justice Network (TJN), TJN Africa, Global Alliance for Tax Justice, IDB, EURODADD, ITRC (Colombia), the Cadastre of Spain, and Spain’s IEF.

The CIAT Executive Secretariat expresses its gratitude for the trust of our partners and the active participation of the tax administrations, experts, and organizations that joined us.