The crisis resulting from COVID-19 has created an unprecedented historical situation that makes information more necessary than ever for our situational awareness and the design of responses.

The information collected comes from the tax administrations of the CIAT member countries, in most cases published in the form of monthly or quarterly bulletins, and must be interpreted due to its advantages in terms of proximity in time but also with its particularities given the sources and the context in which we find ourselves (the different responsibilities among institutions – internal and external taxes, social security -; the different monthly collection and accounting calendars; the effects of deferrals granted to taxpayers; publication times and formats; etc.)

-

Collection has fallen monthly (compared to the same month of the previous year) since mainly March when the containment measures began to apply. After slight increases in January and February (4.5 and 3.5%), in March average revenue fell by 3.3%, in April by 27.7% and in May by 24.8%. The largest declines occur in the U.S.A and Panama in April, above 50%, followed by Peru, Ecuador, Colombia, Spain and El Salvador, above 30% in the same month. The rest of the countries with data for April or May reach losses of 20% or higher.

-

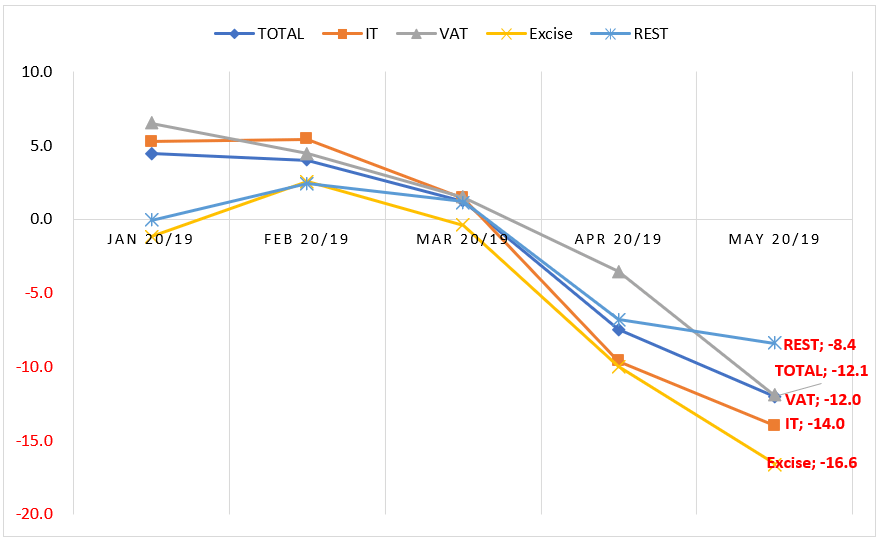

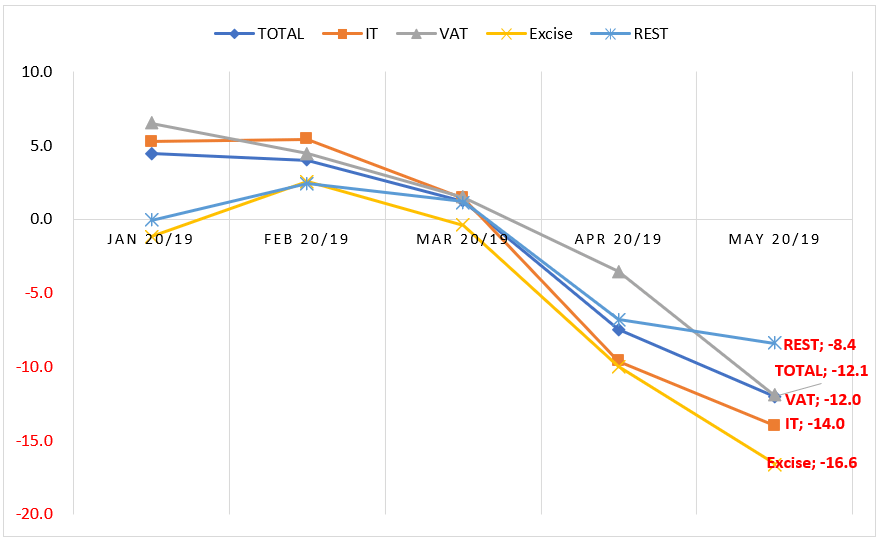

In terms of cumulative collection up to the different months, the average revenue has followed a clearly downward trend from the positive data in the first quarter (4.5% in January, 4% in February, 1.2% in March) to the negative data in April and may (-7.5% and -12%). Panama and the U.S. again. recorded the largest falls, slightly above 20%, followed by Ecuador, Peru and Argentina (16; 15; and 12%, respectively). All other countries are also in negative territory, with the exceptions of Mexico, Morocco, and Italy (the latter with data only until March).

-

The income taxation of individuals and corporate registered on average increases in the collection in the first months to enter later in negative figures (5,3; 6,4; -3,0; -24,8; -16.7%). It should be borne in mind that in this case the collection schedule is very different and in many countries one of the strongest periods of revenue is April, which makes especially relevant the fall of 24.8%, largely due to the postponement or extension of the deadlines for the tax return filing or payment. By country, Argentina and Ecuador show declines in revenue almost every month, while the most significant declines occur in the US. In April; (-79% in April, -55.9% in May) and Panama (-45% in March), with maximum declines around 30% in most other states.

-

In terms of cumulative Income Tax Revenue, the average has followed a downward trend from the positive data in the first quarter (4.5% in January, 4% in February, 1.2% in March) to the negative data in April and May (-7.5% and -12%). The U.S.A. Recorded the largest cumulative fall in IT, reaching -37.6% in May, followed by Argentina (-18.5), Ecuador (-17.8), El Salvador (-17.4) and Panama (-16.4%).

-

VAT, the main tax in most of the countries analysed, recorded the second largest monthly drop in May (only surpassed by Excise taxes), an average of 30.4%, following previous declines of 23.9% in April and 4% in March. By countries, the declines in Panama (-62% in April), Ecuador (-47%, May), Peru (-39.5%, May), Colombia (-38.6%, April) and Costa Rica (36.1%, April) stand out, with most countries exceeding a 20% fall.

-

In values accumulated up to May, the decrease in VAT revenues is aligned with that of global revenue, reaching 12%, after a positive first few months until March. The cumulative declines in Panama (-25.2%), Ecuador (-18.5%), Peru (17.2%) and Argentina (16%) stand out, as well as, in the opposite direction, the continued increases- up to April – in Mexico (16.2%), Morocco (9.6%) and Costa Rica (6.6%).

-

The restrictions to mobility and the paralysis of the leisure and restoration activities have caused that the Excise Taxes register the strongest monthly collection falls, reaching -42.8 and -45.7% in April and May. The U.S.A. recorded the largest drop in May, by 95%, followed by Panama (-79.3%), Costa Rica (-74%), Peru (-61.6%), Ecuador (-58.8 in April) and Colombia (-56.6%).

-

The average cumulative Excise Taxes revenue also recorded the largest declines, reaching -16.6% in May, four and a half points higher than the average of global revenues. The U.S.A. The United States recorded the largest decline in accumulated revenue (-36.1% to May), followed by Panama (-28.7% to April), Costa Rica (-24.3% to April) and Ecuador (-20.3% to May), with only two countries showing a positive trend (Mexico to April and Italy to March).

-

The aggregate chapter of other revenues has less analytical importance given its heterogeneity, however, in some administrations its weight is much more relevant than in the average given its extended collection attributions (Argentina, Brazil and USA mainly).

-

The average monthly evolution is in line with that of global revenues, with a maximum fall of 29.4% in May. By country, the sharpest monthly declines were in Guatemala in May (-75%), Panama in April (-63.5%) and Colombia (-46.2% in April).

-

In a cumulative way, the fall in Other Revenues is the lowest among the categories of revenues analyzed (-8.4% on average in April). Panama recorded the largest cumulative fall (-32.5% up to April), followed by Peru and Spain (-20 and 18% up to May). The countries where this chapter is most relevant recorded moderate falls (Argentina -8.2%, Brazil -6.7%) and even revenue increases ( In the U.S., +4.6% until May; which helps to moderate in its overall revenue the large falls recorded in Income Taxes and Excise Taxes).

-

Annexes 1 and 2 provide additional detailed and information on the monthly and provide cumulative evolution-in constant and current values – of all tax administrations analyzed.

Figure 1. Evolution of cumulative average collection

Source: Author’s elaboration based on official information from tax administrations

-

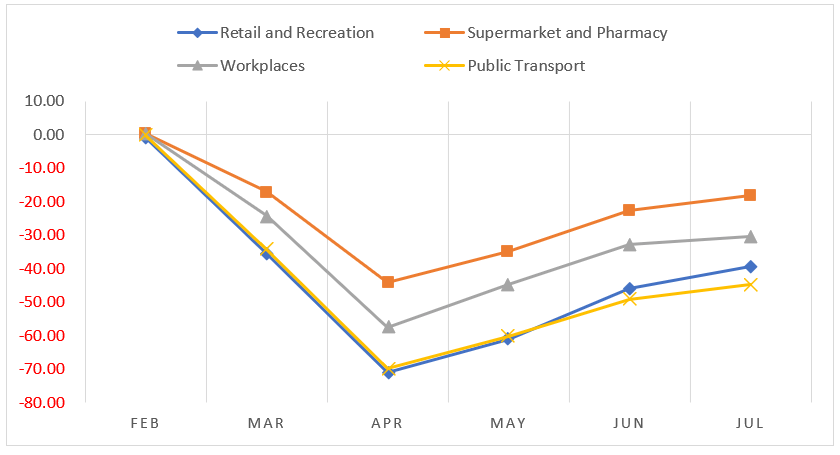

To contrast the effects of the activity control measures implemented in the fight against the pandemic, we use the mobility data provided by Google, which also allows us to anticipate to some extent the revenue prospects for the coming months.

-

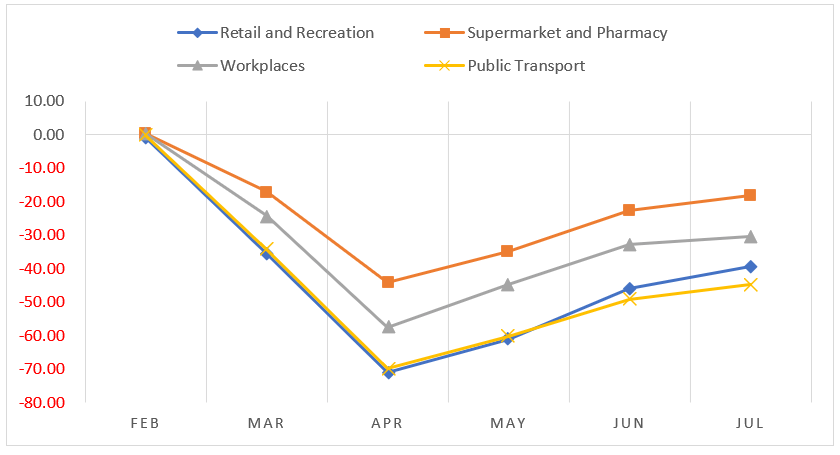

These data show the spectacular decrease in activity measured by movements from mid-March. Movements to shops and entertainment venues plummeted, as did the passage through transport stations, up to 70% in April, with a slight and gradual recovery later up to around -40% in July.

Figure 2. Changes in mobility (monthly average per activity for the countries analysed)

Source: Own development from Google LLC”Google COVID-19 Community Mobility Reports”. https://www.google.com/covid19/mobility / Accessed: July 15, 2020.

-

The comparison with the evolution of the global collection shows a huge correlation between the two phenomena, which would provide on average a slight attenuation of the negative figures in June and July, while in some countries -Panama, Argentina, Guatemala, Costa Rica, USA – there have even been further declines in movements over the past months, clouding the prospects for a recovery in the collection.

-

Finally, the report analyzes in more detail the evolution in some administrations, the three that record the largest decreases in collection (Panama, USA, and Ecuador) and the specific cases of Argentina and Brazil.

The RRC updates will be published in the CIAT Working Papers series. The complete database of information in Excel format (RRC-Database) will also be available shortly, with details by tax figures, constant and current values and the structure of the monthly collection.