Can a TA provide services through WhatsApp? In Uruguay it already works!

One of the concerns of the modern tax administrations is to help taxpayers to fulfill their obligations. With this objective in mind, in 2018 in the General Tax Directorate (DGI) of Uruguay has implemented a pilot plan to provide a service through the popular WhatsApp application.

One of the concerns of the modern tax administrations is to help taxpayers to fulfill their obligations. With this objective in mind, in 2018 in the General Tax Directorate (DGI) of Uruguay has implemented a pilot plan to provide a service through the popular WhatsApp application.

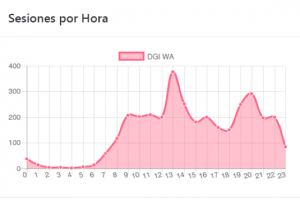

The project includes currently a simple tax, levied on real properties, based on the cadastral value. Thus, it is sufficient that the taxpayer identifies the location and register number of its property and the DGI can supply the amount of its debt and the corresponding invoice. This service was already available on the web, but it was decided to incorporate this new channel, fast, available 24 hours a day, and it works on an widespread application, used by the general public, which sometimes is perceived as even more simple and intuitive than navigating through a website.

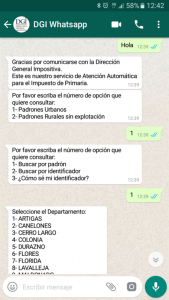

Consequently, once the database with real estate and taxation was generated, we proceeded to make the “tree” of questions and answers, to respond automatically to the taxpayer´s request.

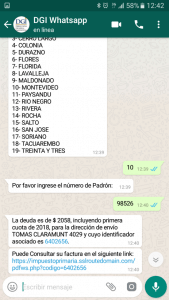

Through three simple questions, we obtain the information necessary to report the tax amount to the taxpayer and add the link from where he or she can get his or her invoice. Consider an example, with the information when a message is send to the DGI’s number (+598 98 966 993):

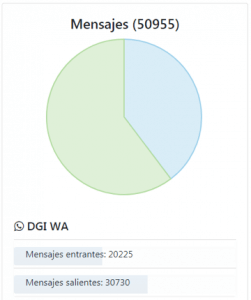

Thus, in a very fast and friendly way you can obtain the invoice for payment of the tax. In the first month of operation, more than 50,000 messages were received, opening a new service channel with taxpayers.

Ultimately, this new technology allows us to approach taxpayers with better services, in an efficient manner, and with reasonable costs.

5,773 total views, 16 views today

1 comment

Parabéns pelo compartilhamento desta inovação no atendimento ao contribuinte da DGI do Uruguai.

Agilidade, redução do tempo de atendimento, comodidade ao contribuinte, possivelmente, aumento de arrecadação.

Entendi que esse imposto equivale no Brasil ao Imposto sobre propriedades territorial urbano – IPTU.

Algumas indagações que a matéria não tratou:

1) o valor cadastral se for inferior ao valor de mercado, como eles fazem?

2) se o contribuinte não concordar com o valor, pode impugnar o valor pelo aplicação WhatsApp?

3) como é a contagem de prazo para fins de ciência do lançamento?

Abraços,