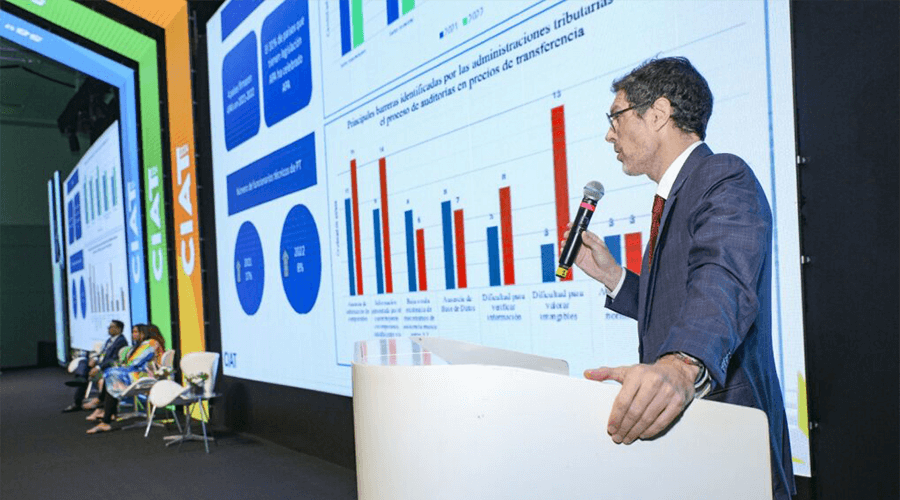

CIAT and the World Bank visit GAFILAT’s Headquarters

Browse through the site without restrictions. Consult and download the contents.

Subscribe to our electronic newsletters: