CIAT participated in “Consolidation of the Fraud and Corruption Observatory: Visualizing results” – ITRC Agency – Colombia

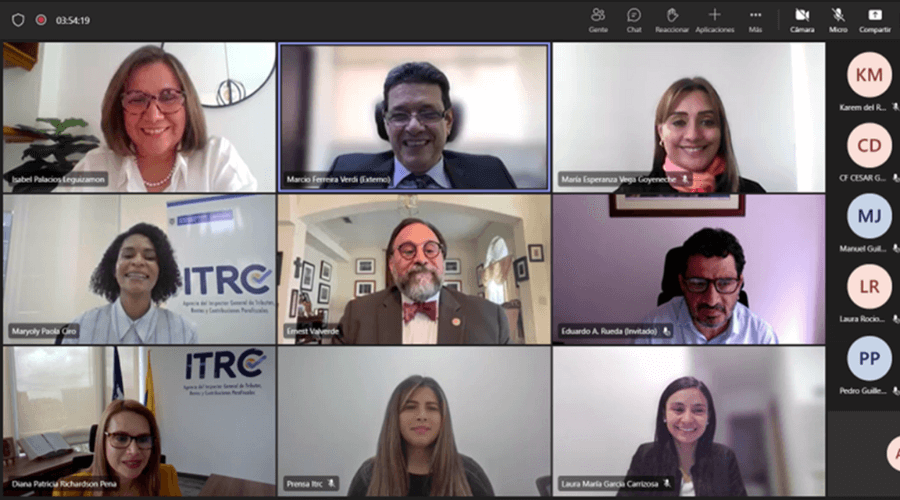

The Executive Secretary of the Inter-American Center of Tax Administrations, Márcio F. Verdi, participated on July 26, 2022, in the event “Consolidation of the Fraud and Corruption Observatory: Visualizing Results”, organized by the ITRC Agency – Colombia.

At the event, the Director of the Agency, Diana Richardson Peña, presented the achievements obtained from 2019 to date, in the process of strengthening this important tool, which, from its structural axes of measurement, education and participation, have allowed visualizing the results of this agency’s preventive and sanctioning work, and have laid solid foundations for the promotion of Transparency, Integrity and Ethics in the tax administration of Colombia.

Likewise, during the day, a panel discussion of experts was held on the topic: “Challenges and Opportunities in the fight against corruption, and the role that the Fraud and Corruption Observatory of the ITRC Agency can play in the future”, whose technical moderation was in charge of Dr. Richardson, and in which intervened Dr. Beatriz Londoño, Secretary of Transparency of the Presidency of the Republic of Colombia, Mr. Ernest Valverde, Advisor of the Office of Technical Assistance (OTA) of the United States Department of the Treasury, and of course Mr. Márcio F. Verdi.

Mr. Verdi highlighted, among other aspects, the strategic importance of Colombia in the promotion of transparency, with the creation of observatories such as the ITRC Agency, to socialize the results of the entities. He also emphasized the need to create control entities with the technical level and focus on risks of fraud and fiscal corruption such as the ITRC Agency.

In addition, he highlighted the value of international inter-institutional relations to mitigate any corruption action in the tax administrations and praised the work of approaching citizens through the development of educational actions, focused on achieving an understanding of the fundamental aspects of Tax Morality and indicated the need to train all officials of the tax administrations on the principles and values of ethics.

1,952 total views, 3 views today