Global Climate action in mid-2024

Abstract: As the world suffers more and more from the effects of the climate crisis and global warming, the solutions to these serious threats involve a global transition to zero carbon emissions, which implies a rapid technological transformation and a general willingness to implement environmental regulations, including innovations in taxation.

On March 26, 2024, the NTO (Network of Tax Organizations) which held a virtual seminar on “Implementing Environmental Taxes, Best practices and Lessons Learnt.” The seminar showcased some country cases, such as Norway and South Africa, indicating the different pathways taken by countries according to their development levels.

And this May 4, the CIAT Directorate of Tax Studies and Research has just published a study on environmental taxation in Latin America, emphasizing the importance of evaluating the distributional impacts of environmental taxes and the design of compensatory instruments.[1]

These are examples of the interest that CIAT, as well as other international tax network, provide to the regulatory aspects of the global environmental action to in order to preserve the world’s climate and biodiversity, and to avoid more catastrophic disruption.

The global climate crisis issue is a current topic whose relevance cannot be overstated, and the present blog proposes to report some recent progress in 2023 and 2024.

Acceleration of the climate change

In 2024, the global climate is expected to continue to change significantly, with rising temperatures, extreme weather, and shifting ecosystems as key indicators. The average global temperature may exceed 1.5°C above pre-industrial levels for the first time, which is a crucial threshold for stabilizing the Earth’s climate. According to Carbon Brief, 2024 is likely to be either the warmest or second-warmest year on record. (Carbon Brief) [2]. The disruption in agriculture, multiplication of storms and drought, and the rising sea levels are some of the tragic consequences.

The 2024 G-20 in Rio

The Climate policy Initiative[3] has recently published a “Stocktake of G20 Strategies and Practices” as a contribution to this year’s Brazilian G20 Presidency’s. This report uses the concept of bioeconomy as an economic model that uses only renewable resources to produce goods, services and energy. It aims to drive sustainable development and circularity, including principles like reuse, repair and recycle and conclude that the coming G-20 summit that will take place from 12 to 14 July in Brazil may find common grounds around this concept of sustainable bioeconomy. It will focus on Sustainable goals 8 (Decent work and economic growth, 9 (innovation and infrastructure), 13 (Climate action) and 17 (Partnerships for the goals).

Climate Finance: still insufficient but increasing

Some numbers:

According to the World Economic Forum[4], climate finance doubled to USD 1.3 trillion since 2021, however we need to increase by at least five-folds annually to limit warning to below 1.5°C. In addition, “The report finds that in 2022, investments in nature-based solutions totaled approximately $200 billion, but finance flows to activities directly harming nature were still more than 30 times larger[5]. The gap between the $100 billion annually committed by donor countries and the more than $2.4 trillion needed per year by 2030 to fund the climate transition is growing.

This exposes a concerning disparity between the volumes of finance to nature-based solutions and nature-negative finance flows and underscores the urgency to address the interconnected crises of climate change, biodiversity loss, and land degradation.[6]

The pathway to net-zero emissions

As the world evolve in dangerous waters, countries and large corporations are engaged towards a goal of net-zero emissions in the future.

The pathway to net-zero emissions require global collaboration by businesses, governments and citizens.

Green technological innovation and environmental regulation are the two pillars of the pathway to sustainability and to net-zero emissions. [7]

Globally, the year 2024 shows the rise in “net zero commitments”, meaning that the majority of today’s nations have a global commitment to reach a “net zero carbon emissions target”, but the date for achieving the goals are variable, mostly between 2030 and 2060 according to the country.

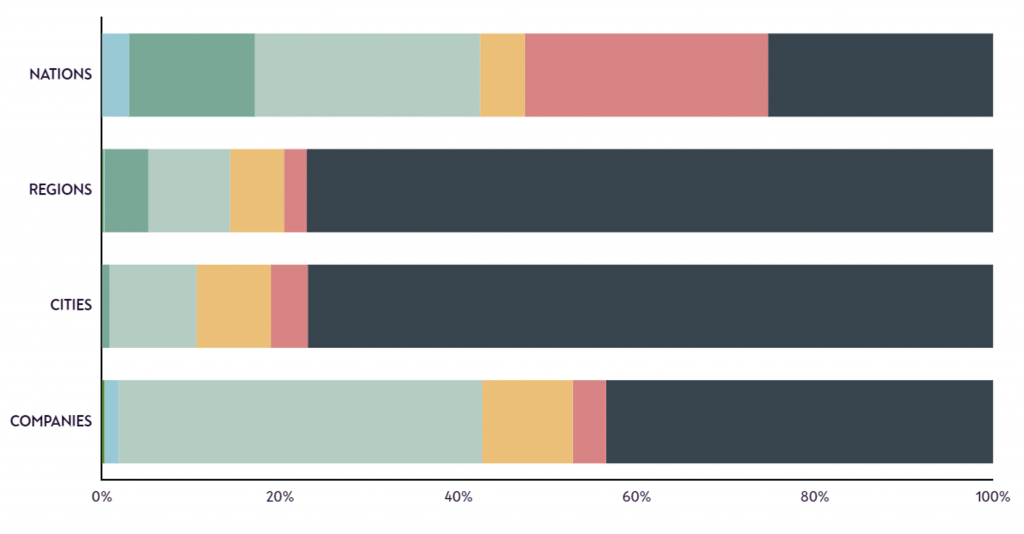

The organization “Net zero tracker” indicates how many nations[8], regions, cities and companies have indicated a goal of “net zero emissions”, and the result is this graph, reflecting different degrees of the credibility of these engagements. [9]

Based on data from 4171 public and private entities, from left to right, blue indicate the progress really achieved. Dark green indicates commitments inserted in laws. Light green indicates pledges in policy documents (for nations) and in corporate strategies (for companies). Orange represent pledges not implemented so far, the red represents proposals emitted, and black represent the absence of any net zero target. Let us talk a little more about the net zero-emission targets.

140 countries have joined the “Net zero coalition with some, such as New Zealand, aiming at reaching this target by 2025. Some forest-covered countries, such as Bhutan and Suriname, are even carbon negative, meaning that they remove more carbon dioxide (CO2) from the atmosphere than they emit.

In the private sector, 65% of the annual revenue of the world’s largest 2000 companies is now covered by a net zero target, demonstrating that net zero is becoming a corporate norm[10].

Technological innovations include renewable energy sources, energy storage and efficiency vital to reducing CO2 emissions. As an example, in 2023, solar energy generation grew by 23%, and wind generation by 10%, and clean energy represent now more than 30% of the energy produced by 215 countries included in the study ( Global Electricity review[11])

On the other hand, environmental regulations include carbon taxes, cap-and-trade programs and emission trading schemes. These are other essential tools to bring about a sustainable global economy.

Let us recall that taxation strategies can play a critical role in supporting the goal of achieving net zero emissions and addressing the climate crisis. Some of the most effective taxation strategies in this regard include:

Implementing these strategies requires a careful approach to balance effectiveness in reducing emissions with economic and social impact, ensuring that policies are both environmentally and economically sustainable.

We have dedicated our previous blog to the evolution of carbon taxes and ETS, and there is no big changes in this field[12]. More than ever, improving global climate governance for a green economic transformation is a key priority.

To conclude these considerations about the net zero goals:

The path to net-zero emissions requires global collaboration between businesses, governments and citizens; more than ever, solving the climate crisis requires our global, collective and personal action.

[1] https://www.ciat.org/dt-04-2024-hacia-administraciones-tributarias-verdes-requisitos-capacidades-y-transformaciones-ante-los-retos-ambientales-y-climaticos/

[2] https://www.carbonbrief.org/factcheck-why-the-recent-acceleration-in-global-warming-is-what-scientists-expect/

[3] https://www.climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2023/

[4] https://www.weforum.org/agenda/2024/02/climate-finance-resolutions-for-2024/#:~:text=2024%20will%20be%20another%20critical,energy%20transition%20in%20emerging%20economies

[5] https://www.unep.org/news-and-stories/press-release/global-annual-finance-flows-7-trillion-fueling-climate-biodiversity

[6] https://www.unep.org/resources/state-finance-nature-2023

[7] https://www.sciencedirect.com/science/article/abs/pii/S0160791X23001690

[8] 140 countries have joined the “Net zero coalition” https://www.un.org/en/climatechange/net-zero-coalition

[10] https://netzeroclimate.org/innovation-for-net-zero/progress-tracking/

[11] https://ember-climate.org/insights/research/global-electricity-review-2024/electricity-transition-in-2023/

[12] See the Carbon pricing Dashboard of the World Bank: https://carbonpricingdashboard.worldbank.org/

12,908 total views, 12 views today