Evasion in American countries through tax havens: corporate profits and financial assets

Given the magnitude of evasion through tax havens and low-tax jurisdictions, the last decades have seen an international proliferation of both regulatory and management measures to limit such maneuvers, both in terms of the profits of multinational companies and the transfer of individuals’ financial assets.

Corporate benefits

The evasive methodology of some multinationals is based on attributing their income to these jurisdictions, beyond their actual activity in them, through the transfer of their intangible assets, the payment of intra-group interest and transfer prices.

In response, countries have dictated or improved their rules on transfer pricing, under-capitalization, application or extension of GAAR and SAAR clauses. In addition, as a specific strategy the developed countries have been significantly decreasing the corporate income tax rates[1].

At the international level, the OECD (2015) issued the Base Erosion and Profit Shifting (BEPS) Program and the United States (2018) through the TCJA (Tax Cuts and Job Acts) took steps to reduce profit shifting by its multinational companies[2].

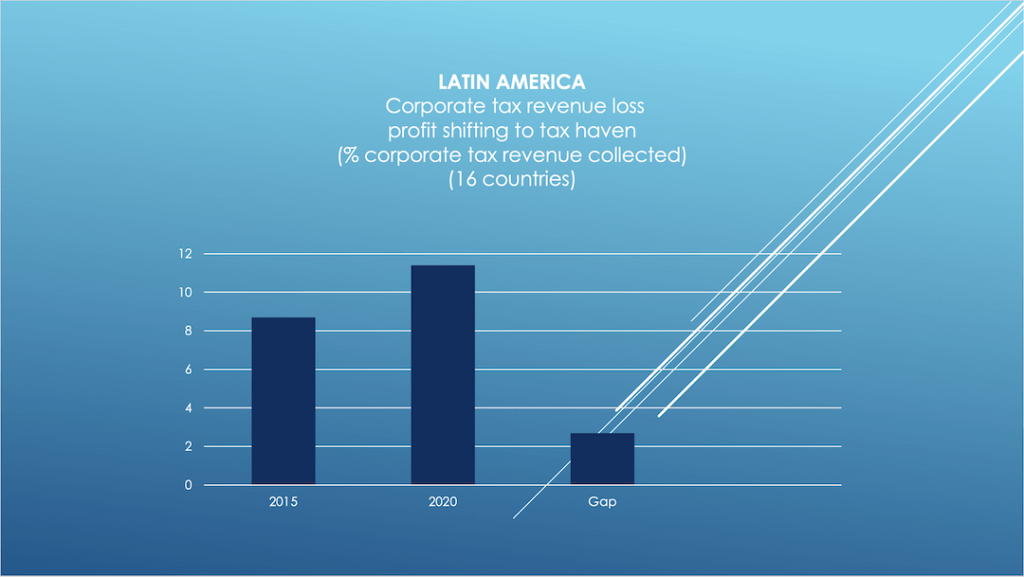

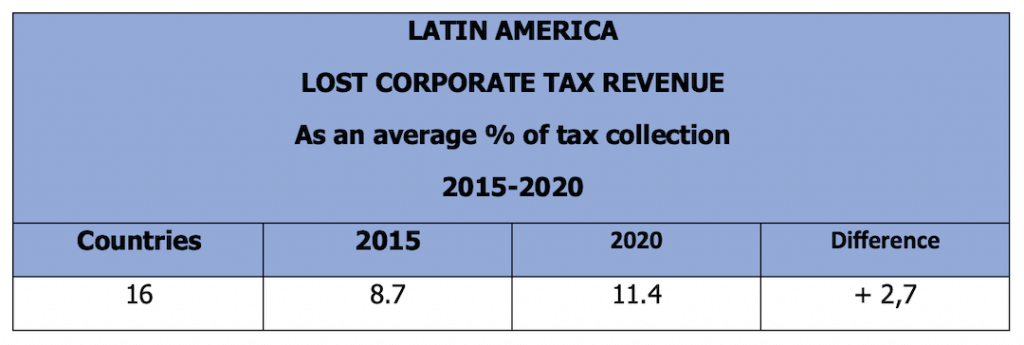

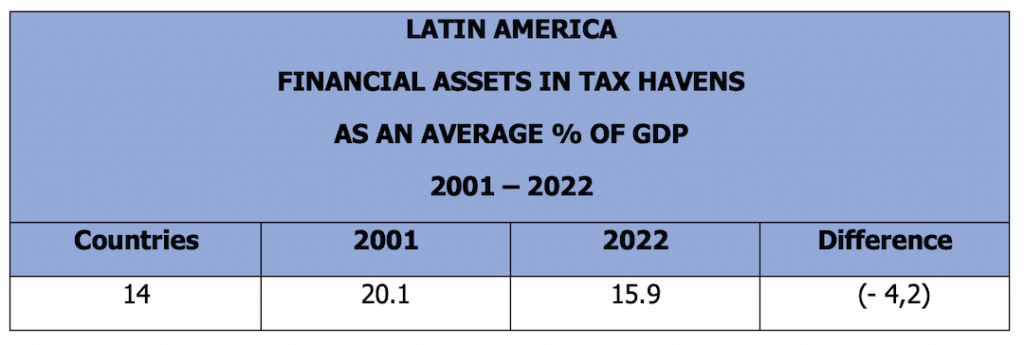

Despite these measures, few results have been obtained. Globally, from 2015 to 2020, the evasion of multinationals by transferring their profits to tax havens is stagnant at 10% of the revenues collected by corporate taxes.

Following this trend, in LAC in 2020, 11.4% of the corporate tax collected was affected, but with the reservation that no strategy of a significant decrease in business aliquots was adopted.

The estimates provided in the research prepared by EUTAX Observatory[3] make it possible to quantify the impact of such evasion over time and to observe whether the measures taken have had an effective result.

In this post, we will focus first of all on the results of the American continent:

Source: Own (2024) based on data from the “ATLAS OF THE OFFSHORE WORLD” EUTAX Observatory.[4] (*) 2016.

The following will detail the situation in LA:

In Latin America, is observed that the corporate tax lost in 2015 has gone from 8.7% to 11.4% of the effective collection.

It emerges “prima facie” that the regulatory and management tax measures adopted in the region have not only not implied the reduction of the existing problems, but that it has increased.

Although it should also be noted that if they had not been applied the level of evasion would have been much higher. Therefore, it can be argued that such measures were necessary, but they have not been sufficient.

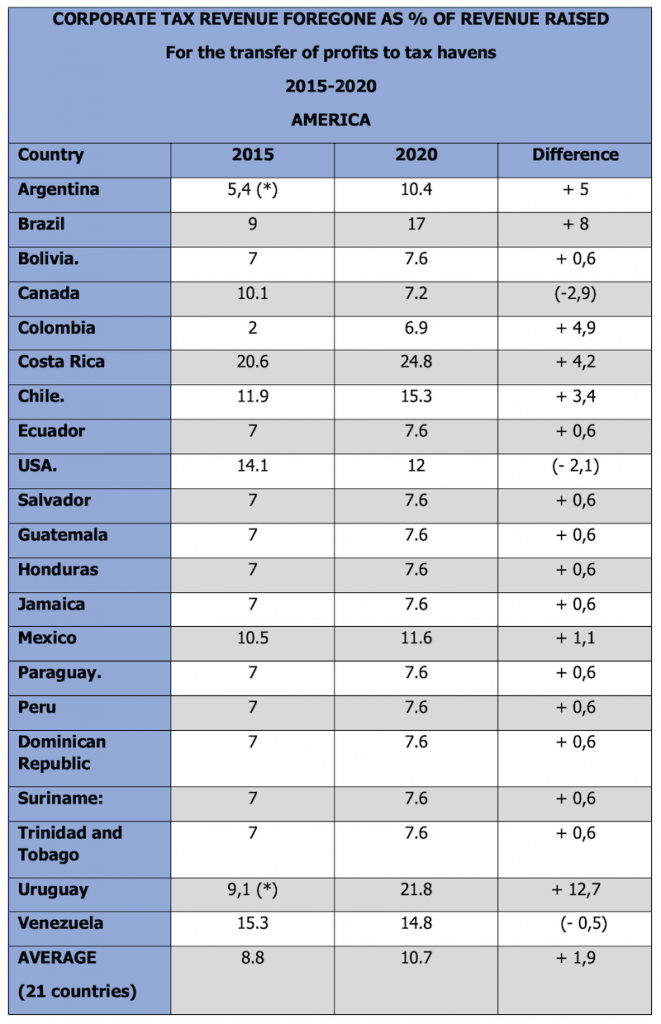

Financial assets

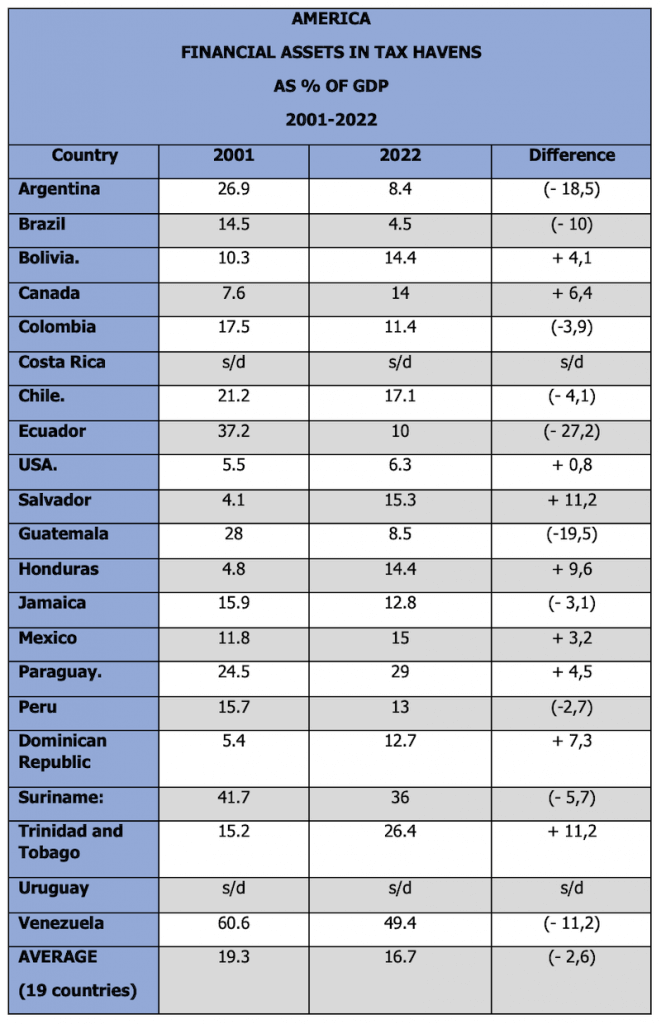

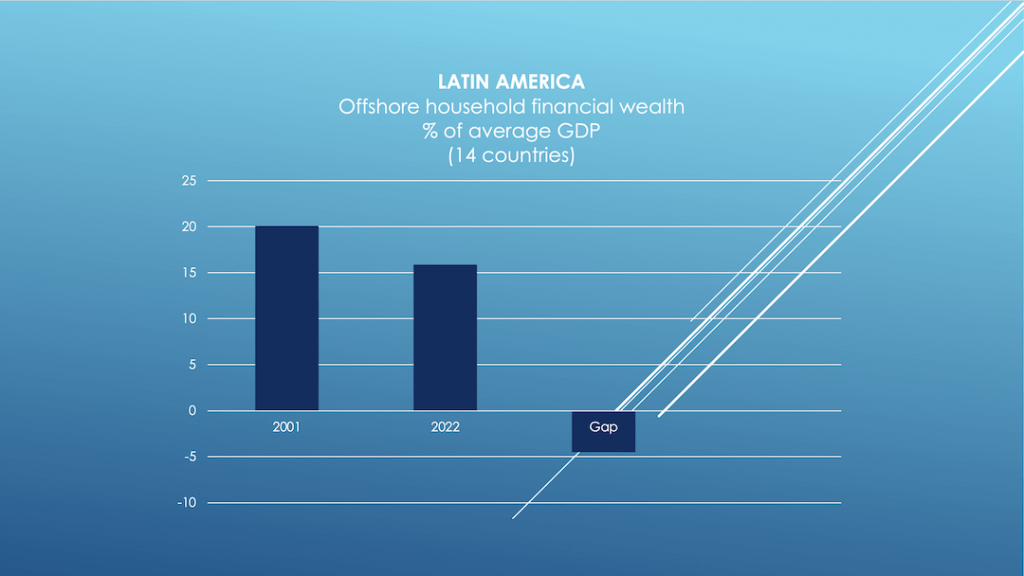

Another research topic was the financial assets (stocks, bonds, mutual fund shares and bank deposits) of residents who were transferred to tax havens or low-tax jurisdictions directly or through a foreign custodian bank. The estimation of its magnitude was based on its determination as a percentage of the GDP of the country of origin.

An essential data for the analysis is the validity from 2017 of the automatic exchange of financial information for tax purposes (AEOI) and the countries that were integrating it[5].

For its part, the United States applies FATCA unilaterally or with reciprocal exchange (IGA Model 1) with the signatory countries of our region.

The situation in America:

From the analysis of the data corresponding to 20 years, it emerges that in the countries of America there was a reduction in the use of tax havens to transfer financial assets.

The situation in LA:

In 20 years, the transfer of financial assets from LA implied a decrease. The lower use of financial assets in offshore centers was due to advances in bilateral or multilateral (automatic or on-demand) banking information exchange and the improvement of the economic situation in some countries. However, these placements still represent an average of 15.9% of the regional GDP.

The “Global Tax Evasion” report highlights that the persistence of placements in tax havens despite the AEOI[6] in force, is mainly due to two reasons: a) there are financial assets that escape being reported, due to the non-compliance of certain offshore financial institutions or the limitations in the design of the automatic exchange of information, and b) not all assets are covered by the automatic exchange of banking information. It should also be added that 45 countries have not yet joined the AEOI[7]. Regarding the reciprocal FATCA, its extension to more countries in the area is missing.

The destination of assets to offshore financial centers (OFC)[8], have also had a modification in the countries of the region. Switzerland[9] which was the main destination in 2001 gave way to the American OFCs in 2022. In the EU, this change took place in Switzerland as the preferred OFC place in Europe. It is also observed that their incidence is increasing the Asian financial centers[10].

Summary

From the analysis of LA’s estimates, it can be seen that there was a increase in the trend of multinational corporations’ profit shifting to tax havens, despite the regulatory and management measures implemented. This implies a wake-up call and requires readjusting the strategies applied.

On the other hand, with regard to the transfer of individuals’ financial assets, a decrease has been observed due to the exchange of financial information and the economic stability of some countries[11]. Therefore, it is necessary to continue expanding the automatic exchange of information (AEOI) or reciprocal exchange of information (FATCA) to more Latin American countries, as well as to improve the existing ones.

[1] In the EU, the average corporate tax rate fell from 50% in 1985, to 32% in 2000 and finally to 21% today.

[2] Reduced the corporate aliquot from 35% to 21%.

[3] ALSTADSAETER A., GODAR Sarah, NICOLAIDES P. and ZUCMAN G.: “Global Tax Evasion, Report 2024” EUTAX Observatory. https://www.taxobservatory.eu/publication/global-tax-evasion-report-2024/

[4] https://atlas-offshore .world/

[5] In 2017 there were 49 jurisdictions, in 2018 another 51 jurisdictions were added. In 2023 they totaled 113 jurisdictions. AEOI: Status of Comments. OECD (2024) https://www.oecd.org/tax/transparency/AEOI-commitments.pdf

[6] Exchange of Financial Information for Tax Purposes (OECD/G20).

[7] The following developing countries of the continent are not yet members of this agreement: El Salvador, Guatemala, Guyana, Haiti, Honduras, Paraguay and the Dominican Republic.

[8] The following Offshore Financial Centers are considered tax havens: 1) Asian (Singapore, Hong Kong, Macau, Malaysia, Bahrain) (also includes the Bahamas, Bermuda and the Netherlands Antilles due to the impossibility of making separate statistics), 2) Switzerland, 3) other European countries (Cyprus, Guemsey, Jersey, Isle of Man, Luxembourg, Belgium and United Kingdom), 4) americans (Cayman Islands, Panama and the USA).

[9] They joined AEOI in 2018.

[10] It should be noted that some institutions in these Asian countries operate under the management of Swiss banks.

[11] Note that the use of tax havens in some cases may be motivated by financial reasons and not evasion if these are declared to the Tax authorities of the resident’s country.

12,480 total views, 8 views today