Global financial risks and taxation at COP 16 Summit on Biodiversity in Cali, and at COP 29 in Baku this Month

Two years after reaching a historic agreement to “stop and reverse” the loss of nature with the Kunming-Montreal Agreement, signed on December 19, 2022, the 195 countries that make up COP 16 met in Cali (Colombia) in the last round of UN talks on biodiversity, from October 21 to November 1, 2024. The 16th Conference of the Parties to the Convention on Biological Diversity (COP 16) I conclude with a success in terms of popular participation, with more than 30,000 visitors per day, but with little progress for the financing of biodiversity. The main objective is to reverse the loss of biodiversity by 2030. COP 16 includes 23 goals for 2030 and four global goals for 2050. More information about these goals and objectives is available at this report [1].

Unfortunately, COP 16 negotiations did not reach a conclusive agreement on financing towards protecting biodiversity. Big companies present at the summit regret the absence of clear guidelines regarding international financing. Wall Street’s biggest bank, JP Morgan, says it intends to step up work on designing products exploring the risks and opportunities around the theme of biodiversity. “Investors already face considerable losses if they ignore nature risk, which can take form of anything from fines imposed for pollution to reputational damage if their products are associated with ecological damage” [2]

Biodiversity and climate are the two main dimensions of environmental protection. Less than two weeks after COP 16 begins UN climate change conference in Baku, Azerbaijan – from November 11, 2024, for two weeks of crucial negotiations, dynamic debates and global collaboration, all focused on addressing the climate crisis with urgency and ambition. (The difference in numbering between COP 16 and COP 29 is explained by the fact that the world climate conference is an annual event, while the biodiversity conference is every two years).

ㅤ

The links between environmental crimes and the fight against illicit financial flows

A study by the FATF group [3] (Financial Action Task Force) on money laundering from environmental crimes was published earlier. This report considers that, as part of biodiversity conservation efforts, countries’ financial authorities should better define the links between financial crime, which includes tax evasion and avoidance, and environmental crimes. Crimes against the environment – such as forest crimes, illegal mining and waste trafficking – are an extremely profitable criminal activity, generating billions in profits every year. It fuels corruption and converges with many other serious and organized crimes, such as tax fraud, drug trafficking and forced labor. This FATF report identifies the methods that criminals use to launder profits from environmental crimes, but also the tools that governments and the private sector can apply to disrupt this activity.

Countries should consider including environmental crimes in their assessments on money laundering and FFI. Financial investigators and environmental experts should collaborate more regularly to strengthen investigations and, on the other hand, environmental policies should take into account the financial aspect of these crimes.

According to the organization Financial Crime Academy [4] “Environmental crimes are considered one of the most lucrative and rapidly expanding subsets of global crime.” It is estimated that up to 25% of the market of animals and plants is carried out illegally. Crimes against the environment are expected to increase by 5% to 7% per year, that is, by 2 to 3 times the rate of development of the world economy.” (September 2024). Environmental crimes can often be related to financial crimes, as perpetrators of environmental crimes may be motivated by economic gain or may seek to avoid the costs associated with environmental compliance.

The analysis of financial data can play an important role in environmental protection. Tax systems can play a more active role through various tax mechanisms designed to incentivize sustainable practices and discourage harmful activities.

Global risks

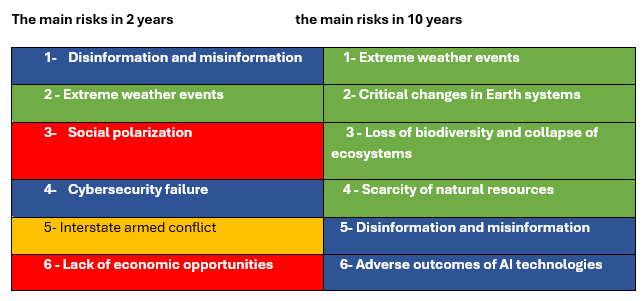

The World Economic Forum has described broadly the major global risks of the next ten years as follows: World Risk Report 2024

The 6 main risks (Source: World Economic Forum Global Risk Perception Survey 2023-2024) [5]: The forecasts clearly indicate that environmental risks continue to increase dramatically.

According to these forecasts, the pressure of the environmental crises will continue to dictate the international agendas of the coming years. There are several ways in which taxation systems can contribute to the sustainability objectives in each country, according to the guidelines of their respective governments:

- Carbon taxes: Imposing taxes on carbon emissions encourages companies and individuals to reduce their carbon footprint. This stimulates investment in renewable energy sources and energy-efficient technologies

- Taxes on pollution: Taxing pollutants can deter companies from dumping excessive waste, encouraging them to invest in cleaner technologies and processes.

- Tax credits and deductions: Offering tax incentives for environmentally friendly practices – such as improvements in household energy efficiency, renewable energy installations or sustainable agriculture – can encourage individuals and companies to adopt green practices

- Ecological tax reform: It is about shifting the tax burden from work and income to the use of resources and environmental impact, promoting the sustainable management of resources.

- Financing of environmental programmes: Tax revenues can be used for environmental protection initiatives, including conservation efforts, wildlife protection and pollution clean-up.

In conclusion, although the reduction of GHG emissions and the preservation/restoration of biodiversity can sometimes be treated separately in the NDCs, the importance of integrating these two dimensions is increasingly recognized. Combining efforts in climate action and biodiversity conservation can improve sustainability and effectiveness in addressing the interconnected challenges posed by climate change and biodiversity loss.

Tax systems are considered part of the public financial sector, although they fulfill specific functions that differentiate them from private financial entities such as banks, investment firms and insurance companies.

Significant progress has been made in the integration of climate and biodiversity risks into public financial planning, however it is necessary to redouble efforts to close the existing gaps. Continuous collaboration between governments, companies, financial institutions and civil society is crucial to refine methodologies, increase transparency and facilitate the transition to more sustainable economies. The issue is gaining momentum and is likely to become an increasingly central element of financial decision-making in the coming year 2025.

The ability to incorporate environmental conditions, such as climate change and biodiversity, into national budgets and public investments is increasingly recognized as a key determinant of a country’s financial progress and development. This integration promotes sustainability and enhances economic resilience, fosters social equity and positions nations to adapt in a rapidly changing global environment. As the effects of climate change and biodiversity loss become more pronounced, the importance of ensuring that national financial systems reflect and address these challenges will continue to grow.

[1] https://es.mongabay.com/2024/09/temas-clave-cop-16-biodiversidad-cali-colombia/

[2] https://www.investmentnews.com/industry-news/jpmorgan-says-finance-firms-cannot-ignore-biodiversity/258062

[3] PDF (www.fatf-gafi.org) Money-Laundering-from-Environmental-Crime.pdf.coredownload.pdf –

[4] https://financialcrimeacademy.org/financial-crimes-in-environmental-crimes/ and https://financialcrimeacademy.org/money-laundering-in-environmental-crimes/

[5] https://www.weforum.org/publications/global-risks-report-2024/

5,790 total views, 7 views today