Global Wealth Taxation: towards a more equitable Latin American tax system

The tax on wealth (both global, on the possession of certain assets or on their transfer), is included within the direct taxation, and tends to tax the taxpayers with the greatest contributory capacity.

Its importance

While the population of the richest decile in Europe represents 59% of the wealth and in North America it is 70%, in our region it implies 77%. [1] Unfortunately, despite the fact that the greatest social inequalities are found in LAC, and therefore a marked concentration of wealth, the different forms of taxation in this modality barely collect 0.8%, while in the OECD it is 1.9% of GDP. [2]

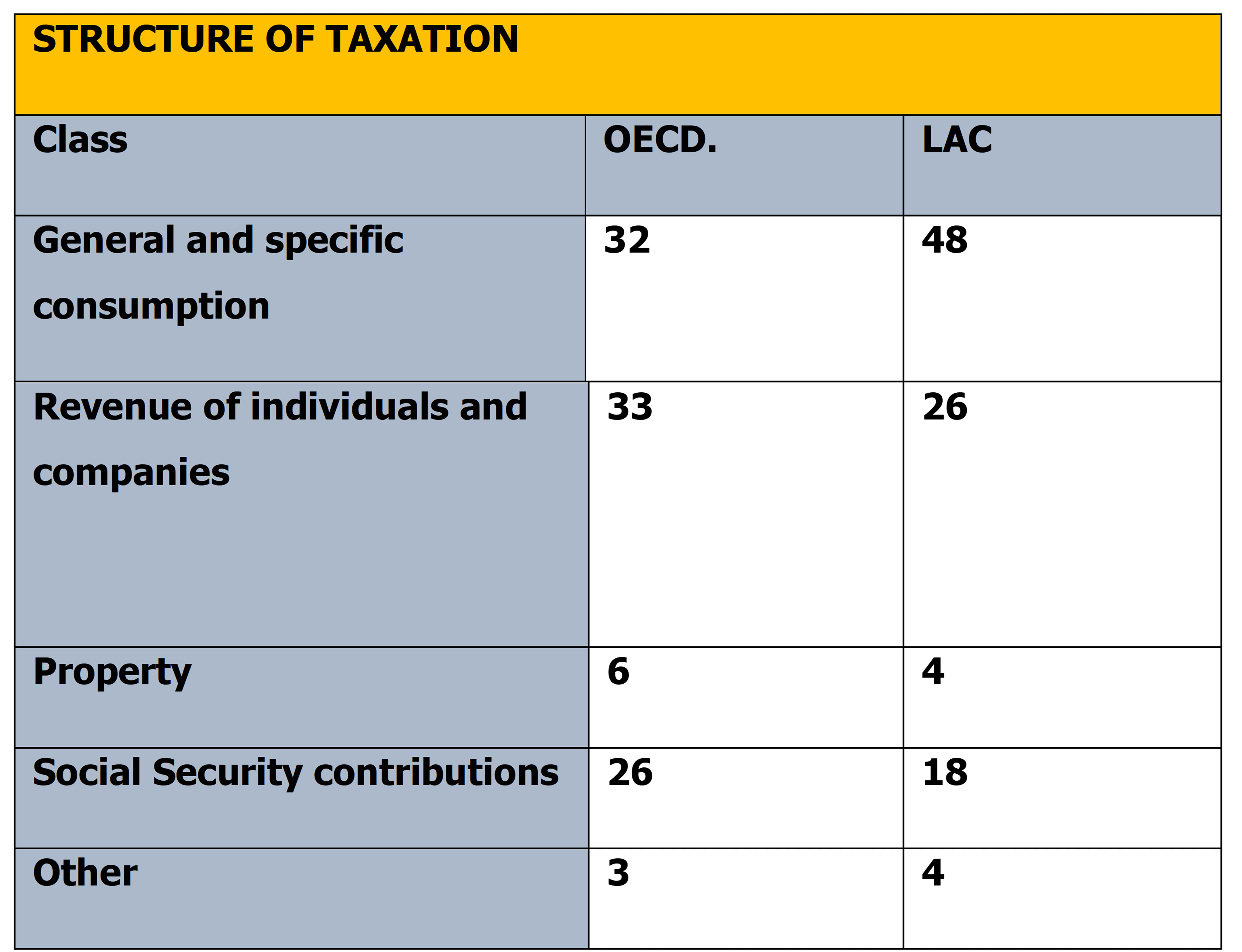

In relation to the tax structure, that is, the percentage of tax revenues on the total collection can be observed as follows:

Source: “Revenue Statistics in Latin America and the Caribbean 2022”, OECD, IDB, ECLAC and CIAT.

It is noted that most of the income in LAC falls on consumption, while on income it decreases by almost half. Finally, the tax on property or assets is only 4 %. [3] The global trend in recent decades was that the rich were richer but paid less taxes, especially wealth. [4]

Characteristics

COSCIANI (1979) [5] affirmed that the property taxation, by expanding the tax diversification, allows to increase the number of the legal instruments of the State, whose diversity is necessary to be able to fulfill the multiple economic policy objectives that it pursues.

•The arguments in favor of the taxation are:

•Assets represent a manifestation of contributory capacity.

•Allows the diversification of the tax system.

•It is supplementary to the income tax.

•Guarantees the principle of fairness.

•It is a productive and development-promoting element.

•Accentuates the progressiveness of the tax system.

•Allows for an increase in income tax control.

•It makes possible to tax the potential income instead of the actual income.

•It allows to influence the social and redistributive policy.

In favor of this taxation, we can say that its objectives are equity, efficiency in the use of wealth and it serves to control other taxes, especially the income tax. In this sense Saez and Zucman (2019) [6] argue that a progressive wealth tax allows high-net-worth individuals to contribute an amount that reflects their true ability to pay.

Against this taxation, it is argued that it affects investment and savings and presents technical difficulties (valuation, ownership, etc.) and management difficulties because the taxpayers located in the deciles with the highest incomes have hidden most of their wealth abroad in properties and financial assets. [7]

As for the technical and management difficulties, there are similar answers to avoid the indicated obstacles. In turn, it should be noted that since 2010, both by multilateral (OECD) or bilateral agreements, the exchange of banking information, as well as property, identity and accounting information for tax purposes has increased exponentially between the various jurisdictions.

Therefore, it can be inferred that in most LAC countries, the global wealth of individuals is not taxed by a political decision.

On the other hand, the holding as well as the transfer of certain real and movable property are taxed. In many countries, this latter imposition is the responsibility of subnational or local entities. Thus, subnational incomes are present in Belize, Guatemala and Jamaica (100%), Peru (80%), Paraguay and Uruguay (50%), Ecuador, Costa Rica and Chile (40%), etc.

Taxation of global assets

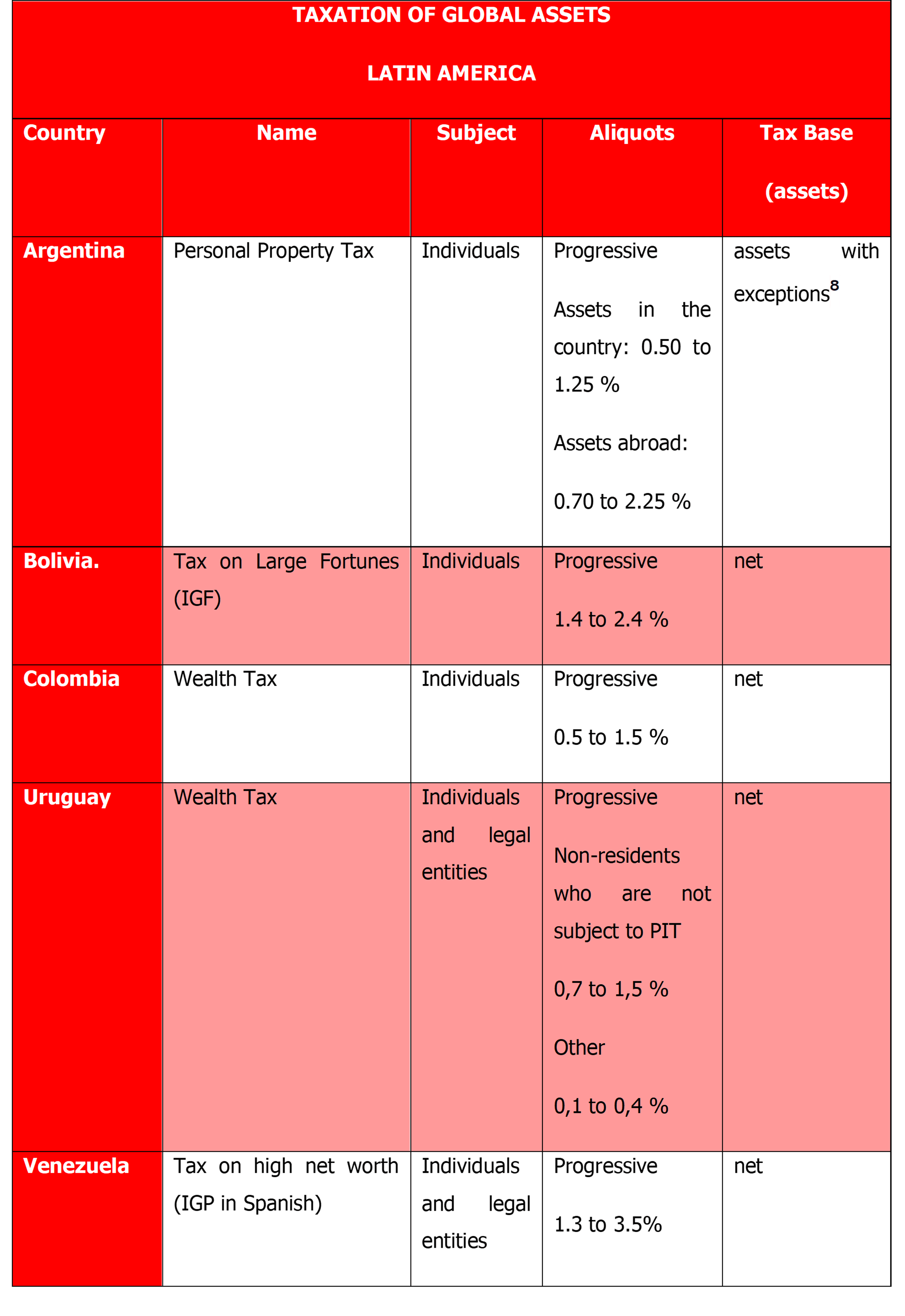

With regard to the taxation of global wealth, the countries of the region that apply it are:

Source: Author

As can be seen at present, only 5 (five) countries in the area tax wealth in general [9]: Argentina (1991), Bolivia (2021), Colombia (1935), Uruguay (1964) and Venezuela (2020).

There is a tendency in some countries to implement a tax on wealth or high net worth. Three countries have applied it: Argentina (Solidarity and Extraordinary Contribution) [10], Bolivia [11] and Venezuela. [12]

The difference between these jurisdictions is that Argentina applied it for the only time in 2020 as an exception, while Bolivia and Venezuela have definitively incorporated it into their tax system.

In Europe, this kind of taxes is regulated in Spain and Switzerland at the sub-national level, and Norway. [13] For its part, Spain has sanctioned the Temporary Solidarity Tax on Large Fortunes. Other countries, such as France, [14] Italy, Belgium and Portugal, also tax wealth, but limited to certain assets. The Netherlands and Liechtenstein, although they do not have an autonomous wealth tax, tax the integrated wealth as a presumed income in the income tax.

The Argentine case

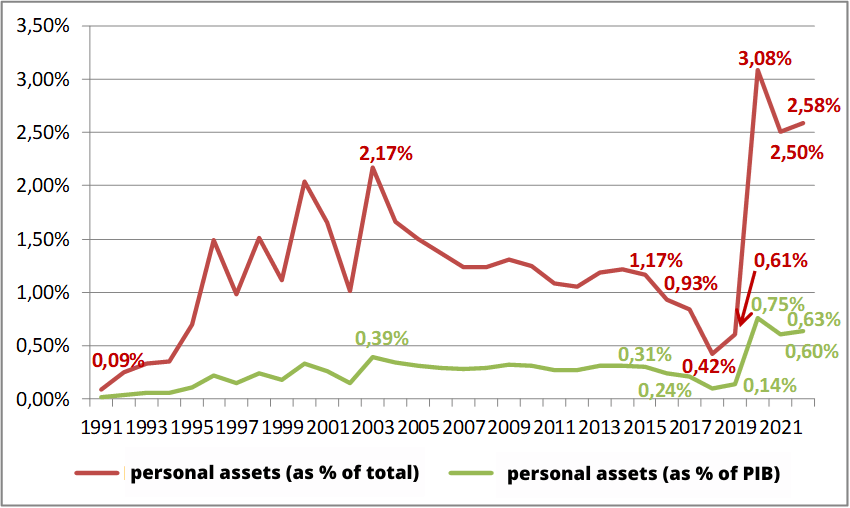

Argentina has been applying the Personal Property Tax since 1991, a tax to global wealth at the central level. If we look at the income obtained as a percentage of the collection as of GDP, it can be concluded that it was not reached by the collection fatigue that its detractors foreshadowed, but, on the contrary, after legislative adjustments placing greater emphasis on foreign assets that fall especially on deciles 9 and 10, its collection has increased reaching about 3 % of the total, granting greater equity to the tax system. [15]

Collection of the Tax on Personal Property (Argentina)

Source: elaboration by DI CITA (SDGPLA of AFIP) based on AFIP data, National Directorate of Research and Fiscal Analysis of MECON, and INDEC.

Complementarity with income tax (calculation)

The non-payment of income tax, among the main issues of the region’s tax systems, is due to the high level of evasion and, with respect to tax legislation, to the significant benefits and existing tax loopholes.

If the global wealth tax was implemented with the technical characteristic of both taxes being paid on account reciprocally, its application would not imply increasing the tax burden of taxpayers who pay the income tax, but on the contrary, it would constitute a tax burden exclusively for those taxpayers who have a significant wealth [16] but do not pay the tax or do not do it in the correct amount. [17]

Conclusion

The application of a global wealth tax is necessary in a region with the greatest social inequality, so people with the greatest contributory capacity from their level of wealth should show solidarity in contributing to the public treasury in order to improve public services and promote social cohesion.

The trend of recent years marks the revitalization of this tax in the tax systems of LAC, since: a) its incorporation in Venezuela (2020), Bolivia (2021) and the projected tax in Chile with current parliamentary procedure (2023), b) its reincorporation in Colombia (2023) and c) its consolidation in Argentina and Uruguay.

In this context, much attention should be paid to the technique used to determine the taxable subjects, tax event and tax base, non-taxable minimum, valuation, aliquots, calculation with income tax, etc. All this to optimize both the subject and the object of the tax and facilitate the management of the tax administration, in accordance with the objectives of the tax policy of each country.

[1] In LAC, the concentration of income in the wealthiest 1% of the population is 24.6%.

[2] Michel Jorratt (2021) “Net Worth Tax in Latin America”, ECLAC and Spanish Cooperation, Macroeconomics of Development Series 218, Santiago.

[3] The difference with the OECD countries lies in the taxation on the ownership of real estate where OECD reaches 1.8% of GDP and 0.3%.

[4] By its derogation or delegation to the sub-national or local entities.

[5] Cesare Cosciani (1979):” Reasons behind a wealth tax”, Bulletin of the General Tax Directorate N° 312, Buenos Aires.

[6] Sáez, E. and G. Zucman. (2019) “The Triumph of Injustice. How the Rich Dodge Taxes and How to Make Them Pay.” London: W.W. Norton & Company.

[7] Barreix A, Bés M., González de Frutos U, Roca J. y Velayos F. (2023) “El Estado Actual del Impuesto al Patrimonio en América Latina”, Nota Técnica N° IDB-TN-2676, BID, Washington.

[8] In parentheses, date of application.

[9] 10,600 taxpayers submitted this tax declaration.

[10] 182 taxpayers were registered.

[11] Intended only for special taxpayers determined by the SENIAT.

[12] From 0.95 to 1.1 %.

[13] The Real Estate Fortune Tax (IFI) replaced the Solidarity Tax that was on global wealth.

[14] In this country, car and real estate ownership transfers are also taxed at the central level, and real estate and car ownership are taxed at the subnational and local levels.

[15] To the extent that they exceed the non-taxable minimum established by the respective legislation.

[16] They use this calculation technique: Uruguay where the IRAE is payment on account of the Wealth Tax up to a percentage, and Bolivia where the IUE paid by liberal professionals and trades is also creditable on account of the wealth tax.

[17] The following countries use this computation technique: Uruguay, where the IRAE is a payment on account of the Wealth Tax up to a percentage, and Bolivia, where the IUE paid by liberal professionals and trades is also creditable on account of the wealth tax.

8,493 total views, 7 views today