Monotax: Bridge to formality and social inclusion

The National Executive Branch of the Argentine Republic has just submitted to Congress a bill that reforms the current Simplified Regime for Small Taxpayers (RS).

Antecedents

The Monotax originated in 1998[1], and constituted a new concept in the structuring of this kind of regimes. Its main objectives were the formalization of a large segment of taxpayers and their social inclusion.

From the point of view of the tax administration, it did not have as a direct objective the increase of the tax collection, but the formalization of an important segment of the population and the control of the suppliers of these small taxpayers.

Until then, the special regimes had been exclusively for Value Added Tax, but they did not solve the problem of compliance with other taxes or social security and health resources.

In addition, the strategy for the accession of these regimes had been to generate exclusively perception of risk through sanctions (which were not effective) and extensive massive face-to-face controls that only generated “tax rebellions.”

As essential aspect was that in LA most of the most vulnerable sectors did not enjoy social security benefits (retirement and pension), nor did they enjoy preferential health care.

The purpose of the Monotax was to formalize lower income taxpayers through the perception of the benefit, granting the rights of retirement and health care, through an easy compliance regime via the payment of a fixed quota by category[2].

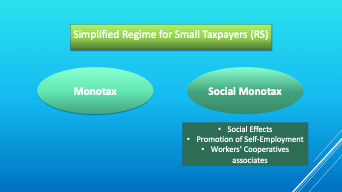

In order to avoid abuses of the regime, the categories were not based exclusively on gross revenue (a widely repeated error in Latin American regimes), but were supplemented by other objective parameters (area, electricity consumption, rent, maximum unit selling price). At the same time, there was a subsidized sub-regime aimed at sectors with the greatest need for state support called “Social Monotax.”

Structure of the Simplified regime

After 23 years of application of the Monotax, the progressive incorporation of low-income workers has not ceased, and from 642,000 adherents at its inception in 1998, it has now exceeded 4,000,000 voluntary adherents.

After 23 years of application of the Monotax, the progressive incorporation of low-income workers has not ceased, and from 642,000 adherents at its inception in 1998, it has now exceeded 4,000,000 voluntary adherents.

But the pandemic has shown us, in view of the social assistance provided by the State, a high number of applications for benefits that were requested by citizens who had not yet been able to join the formality and therefore, enjoy the benefits of social security and health care, as well as the beneficial credit support granted by the national government to the subjects adhered to the Monotax.

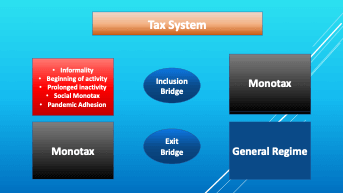

Faced with such a situation, the State was not indifferent, and reacted with the reform proposal that today I describe in this post, to generate the “Bridge of Inclusion to Monotax”, to subjects who are in the informal sector, initiate activities, those who joined the lower categories at the time of the pandemic, had a prolonged inactivity or were beneficiaries of the Social Monotax.

Inclusion bridge

The Inclusion Bridge is transitory and has a duration of 4 years. Those who join enjoy gradual benefits both in terms of taxes and social security resources until their definitive integration into the Monotax regime.

The Inclusion Bridge is transitory and has a duration of 4 years. Those who join enjoy gradual benefits both in terms of taxes and social security resources until their definitive integration into the Monotax regime.

In addition, small taxpayers adhere to the National Health Programs of the Ministry of Health of the Nation when requesting effective care in any Primary Health Care Center (CAPS) and, therefore, should not make contributions to the National Health Insurance System.

Exit bridge

In international experience, as in our own, it has been observed that small taxpayers who have evolved in their economic activity and must move to the general regime, taking into account the “jump” that this change implies both in the fulfillment of formal obligations and in the increase of the tax burden, under-declare their income or divide their economic units in order to continue to enjoy unduly the benefits of the Simplified Regime.

To this reality, a solution was given through the Voluntary Tax Promotion Regime[3], which implies a gradual decrease in VAT[4] in the first three years of this voluntary transition to the general regime.

Monotax

On the other hand, the current Monotax system is still in force, but for reasons of equity, inclusion and solidarity, the first three categories have been exempted from the tax component and excluded from the payment of health insurance, and only the social security component (retirement, pension) has to be paid by those who are members of the system (retirement, pension).

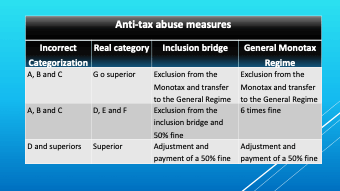

In order to avoid the abuse of the regime, in addition to the gross income and parameters for entering the regime, the following measures have been established:

The purpose of this strategy is to avoid what has historically occurred in similar regimes in LA, that taxpayers are improperly registered in the lower categories[5], therefore the most serious sanction is exclusion from the Monotax[6] or the Inclusion Bridge, and in cases of incorrect categorization in the higher categories, it is the tax adjustment and the penalty of a fine.

The purpose of this strategy is to avoid what has historically occurred in similar regimes in LA, that taxpayers are improperly registered in the lower categories[5], therefore the most serious sanction is exclusion from the Monotax[6] or the Inclusion Bridge, and in cases of incorrect categorization in the higher categories, it is the tax adjustment and the penalty of a fine.

Summary:

As part of Argentina’s tax policy strategy, the Monotax for individuals is ratified, with an essential solidarity character of social inclusion, and its treatment is differentiated from that of micro, small and medium-sized companies, to which the General Regime applies, but with specific benefits for tax and social security contributions.

[1] Act No. 24,977.

[2] The fixed quota has three specific components: 1) tax, 2) social security resources, and 3) health insurance (Social Works Scheme). Trade categories range from A to K, and services from A to H.

[3] Act No. 27.618.

[4] VAT reduction: first year 50 %, second year 30% and third year 10 %.

[5] In the simplified regimes in the region, it is normal for 70 to 90 per cent of taxpayers to join the lower categories in order to obtain greater benefits.

[6] For three calendar years after the exclusion, they cannot be registered therein.

5,047 total views, 2 views today