Publications of CIAT’s TaxStudies and Research Directorate

In recent years, the Directorate of Tax Studies and Research (DEIT) of the Inter-American Center of Tax Administrations (CIAT) has been publishing a significant number of Working Papers and Books, which have dealt with different topics on tax collection, how it is collected and what is not collected. They generally deal with CIAT member countries and in other cases with Latin American countries.

In this blog we introduce some indicators of DEIT’s most recent work from Central American countries (Guatemala, Honduras, El Salvador, Nicaragua and Costa Rica), Panama and the Dominican Republic to try to motivate followers to review our publications.

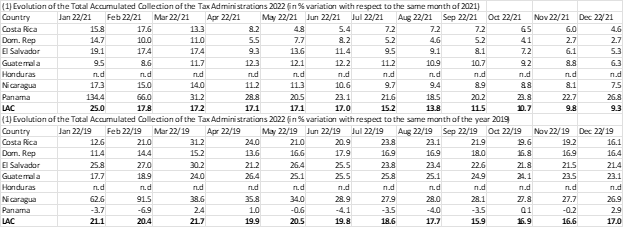

We begin with the Cumulative Total Collection Percentage Variation of the countries under analysis, for the years 2022/2021 and 2022/2019. These monthly statistics will continue to be prepared in the future under the title of Revenue Report CIAT (RRC).

It is important to note that the values are at constant prices, which avoids the shifts that occur due to price changes. These statistics attempt to demonstrate the recovery of monthly collections in the midst of the COVID-19 pandemic.

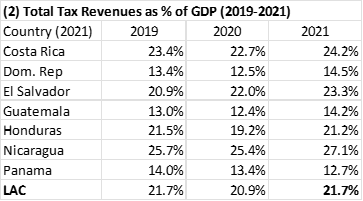

Another of our research topics is the percentage of Tax Revenues from individuals and companies in relation to the Gross Domestic Product (GDP) at current prices; this ratio is also known as Fiscal or Tax Pressure. This publication is a joint work between the Organization for Economic Cooperation and Development (OECD); the United Nations Economic Commission for Latin America and the Caribbean (ECLAC-UN); the Inter-American Center of Tax Administrations (CIAT) and the Inter-American Development Bank (IDB).

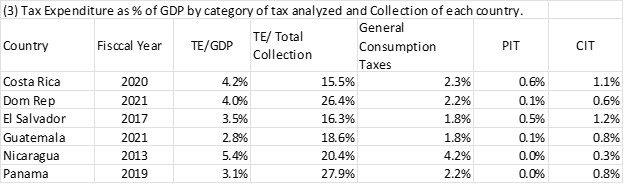

As we mentioned at the beginning, in DEIT we are also interested in investigating what is not collected and this can be done in different ways, among them are the exceptions in the tax system where what is sought is to reduce the tax burden on the beneficiary known as Tax Sacrifice or Tax Expenditure.

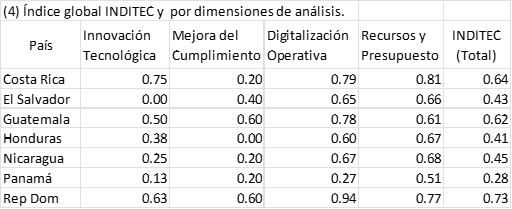

Finally, based on data from ISORA 2020 (International Survey Of Revenue Administration), the Index of Innovation, Digitalization and Technology in Tax Administration (INDITEC) is published. It involves the construction of four dimensions of analysis and their variables (Technological Innovation, Improvement of Compliance, Operational Digitalization and Resources and Budgets).

At some point we will have the opportunity to analyze and discuss the figures presented in greater detail, but for now, we hope to capture the interest in the products of CIAT’s Directorate of Tax Studies and Research.

REFERENCES

(2) Revenue Statistics in Latin America and the Caribbean 2023

(3) Overview of Tax Expenditures in Latin America 2023: Fernando Peláez

12,130 total views, 1 views today