“Green, I want you in green”

Requirements, capacities and transformations of tax Administrations in the face of environmental and climate challenges[1]

In the coming years, the tax systems of the countries of Latin America and the Caribbean (LAC) will undergo significant changes to face climate and environmental challenges. The tax transformations will require a considerable effort of adaptation by the Tax Administrations (TAs), which will need to strengthen their technical capacities, supporting governments in the adaptation of tax instruments, efficiently managing the new taxes and generating new information bases that allow evaluating the impact of environmental taxes.

To address the challenges of climate change and promote sustainable development, a new fiscal strategy is essential that incorporates appropriate economic incentives and contributes to mobilizing greater resources to finance the investments necessary to meet climate goals. The region, particularly vulnerable to the effects of climate change, faces the complex challenge of integrating environmental, economic, social and tax collection criteria into the design of fiscal tools, simultaneously incorporating considerations of political economy, distributive objectives, and at the same time considering the competitive capacity of economies in a scenario of increasing globalization.

In this context, we have recently prepared a study (Jiménez, Galindo, Lorenzo & Podestá, 2024) where the specific needs of the TAs in the region have been examined in order to efficiently, effectively and equitably address the transition to a more environmentally friendly model.

From this analysis, it emerges that in the countries of the region there is room to extend the use of green taxes, that is, those tax modalities whose tax bases are defined in terms of physical units (or a substitute for them) that express the magnitude of the specific and proven negative impacts on the environment. Therefore, a feature of environmental taxes that is especially important is that their tax bases are related to the negative environmental externalities that are intended to be addressed and that the aliquot structure reflects environmental damage in the best possible way, thus contributing to achieving certain environmental objectives. Since the environmental tax seeks to internalize a negative externality, it is recommended that the tax be of a specific type. It should be collected based on the quantities produced or consumed of the goods and services that are at the origin of the environmental damage.

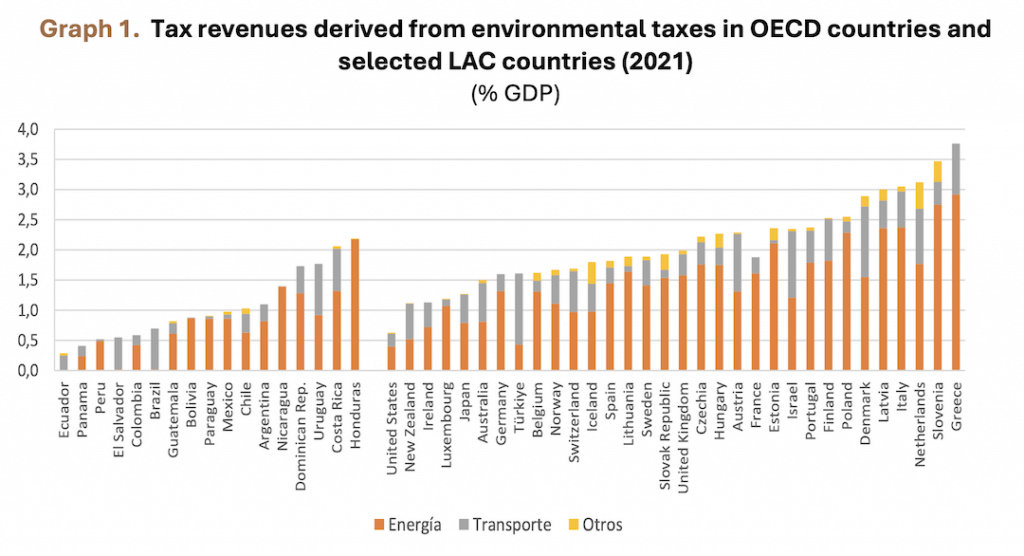

Taxes related to the environment can be classified according to their tax base into three groups: energy (generation, distribution and use in its different forms); motor vehicles and transport; and others (pollution and natural resources).

In Latin America and the Caribbean, taxes related to the environment are significantly lower, in terms of GDP, than those applied in OECD countries (Figure 1). In addition, the relative importance of these taxes in the countries of the region is highly heterogeneous. The contrast is evident when comparing countries such as the Dominican Republic, Honduras, Costa Rica or Uruguay, which in 2021 had a revenue from environment-related taxes of between 1.7% and 2.2%, with other countries, such as Ecuador, Panama, Peru or El Salvador, where these type of taxes are very insignificant. In terms of its structure, in general, energy taxes predominate, which mainly include taxes on fossil fuels, carbon taxes and taxes levied on the production, distribution and marketing of electric energy.

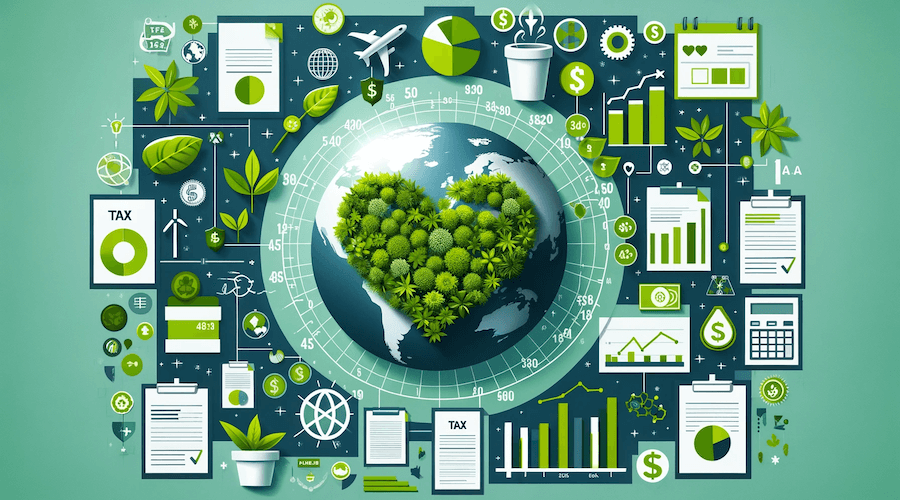

However, in line with international trends, in recent years the countries of the region have witnessed a decrease in tax revenues obtained from the application of energy taxes. The reduction in the relative importance of the collection from these taxes is appreciable if compared with the situation prevailing at the beginning of the XXI century, when a maximum collection had been reached in most countries (Figure 2). In addition, the existence in several LAC countries of a large number of subsidies for energy products – including fuels – represents a great challenge in terms of environmental policy.

Note: The average for Latin America includes the following countries Argentina, Bolivia, Chile, Costa Rica, Colombia, Guatemala, Honduras, Mexico, Paraguay, Peru, Dominican Republic and Uruguay. Source: Jiménez, Galindo, Lorenzo and Podestá (2024).

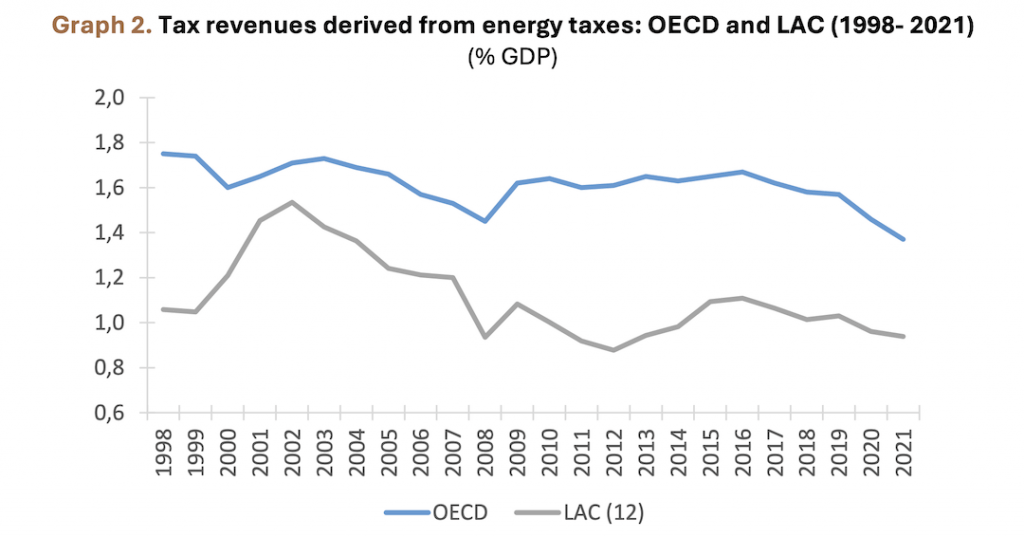

On the other hand, although the nomenclators usually used by international organizations (OECD, European Union) to classify taxes on the environment, include taxes on natural resources, those taxes levied on exploitation and extractive production are not usually considered environmental taxes. Although the dominant objective of taxation in these cases is the appropriation of extractive income and the collection of tax revenues, many of these taxes, such as income from royalties, have a significant – and often unwanted – environmental impact through their effects on production. Although they are not strictly considered green taxes, their high environmental impact and fiscal importance mean that they potentially deserve to be considered as tools for environmental tax reform (Figure 3).

In addition to the low quantitative relevance of green taxation in LAC, a real concern is the low quality in the design of many taxes. Often, these taxes leave out important polluting sectors and activities; at the same time, the tax rates applied may not adequately reflect the environmental impacts, frustrating the objective that justifies this type of tax modalities. It is also common that in order to improve the environmental reputation (“greenwashing”), certain taxes are labeled as environmental, although in fact environmental considerations have not been explicitly incorporated into their design. At the same time, there is an excessive administrative complexity and an uneven and uncoordinated proliferation of taxes at different levels of government, where some tax bases usually have little connection with the environmental problems that are intended to be solved.

In this context, one of the main challenges faced by TAs is related to the generation of relevant information for the proper design and successful implementation of environmental taxes. In particular, it is required to have information regarding the environmental externality that is to be addressed (ecological damage), as well as on the measurement of the expected impacts of the introduction of green taxes on collection, consumption, production, employment and income distribution, among others. The availability of accurate and detailed information is not only essential for the correct assessment of these impacts, but also to strengthen the tasks of supervision, control and advice to the Ministries of Finance, establishing the links between green taxation and environmental goals.

In order to support the design of an environmental tax system that meets its objectives, the TAs require information on the price and income elasticities of the demand for the good or service in question, as well as on the main cross-price elasticities of goods (substitutes or complementary) that serve to estimate the reaction of demand to tax changes and the effects on tax collection.

The development of an agenda that allows progress in the redesign of tax systems with environmental considerations requires a solid staff capacity development program, with training experiences led, both by technical professionals from the TAs themselves, and by external experts. It is important that officials have a clear guide for the preparation of analytical studies and that they are trained in the design and use of tools to understand the effects of green taxation in different climate scenarios.

The training programs should cover the different aspects that relate the process of deep decarbonization of the economy with the use of fiscal and tax tools that contribute to defining a new system of economic incentives aimed at producing a structural change in the current consumption patterns and in the forms of production that are at the base of climate change. Thus, through the training programs and the accumulated experience in the development of this type of tax tools, officials could acquire skills to monitor a wide range of aspects related to climate change.

On the other hand, to mitigate the impact of environmental taxes on income distribution, it is crucial to consider the role of compensation mechanisms. These can be materialized through various instruments, such as tax expenditure (differentiated rates, tax credits, exemptions, etc. for the most vulnerable sectors), subsidies for the acquisition of equipment and facilities, and targeted monetary transfers. It is essential that compensation strategies are carefully and transparently designed and implemented, ensuring an equitable distribution of the benefits and costs associated with green taxes. At the same time, it is essential that the compensations do not counteract the environmental improvement achieved by green taxes or reduce the effectiveness in correcting negative environmental externalities.

A recommended practice is to allocate part of the revenues collected by green taxes to finance activities related to environmental preservation, as well as use a portion of these fiscal resources to implement targeted distributive compensations, such as subsidies aimed at low-income groups or investments in affected communities. The TAs can allocate part of the funds raised to education and training programs, especially aimed at small businesses, to facilitate adaptation to new environmental policies and improve the efficiency of their productive practices.

Continuous monitoring systems must be established to evaluate the distributive impacts of green taxes, in order to adjust tax policies and improve the design of compensation mechanisms. In addition, it is crucial to promote dialogue and citizen participation in decision-making on environmental taxes and compensatory measures, which can contribute to designing more equitable solutions that are accepted by taxpayers. Similarly, to effectively address distributive impacts, it is essential to promote cooperation between various government bodies, civil society and the private sector.

Another area in which the role of TAs is relevant is in the preparation of studies on tax expenditures since they constitute a relevant input for conducting cost-benefit analyses regarding these preferential tax treatments. To this end, it is appropriate to focus not only on tax expenditures with a positive impact in terms of climate action, but also to address the effects of tax expenditures with negative environmental repercussions, including their effects on production and income distribution.

To meet the new challenges, TAs must make progress in adopting new practices, strengthening the technical capacities of their staff and collecting detailed and updated information to assess the impacts of green taxation in the economic, social and environmental fields.

It is important to note that, although specific taxes can be useful to address negative environmental externalities, the presence of inelastic demands limits the effectiveness of applying taxes to increase prices and control them completely. Therefore, green taxation must be complemented with new regulations, accompanied by a greater effort of public investment in sustainable infrastructures, and to promote a revision (decrease or elimination) of fossil fuel consumption subsidies.

In short, TAs must sustain the efforts to adapt the tax systems, providing an integral and transversal perspective, and assuming the challenges involved in the implementation of environmental taxes that require careful technical development and a detailed evaluation on a case-by-case basis.

[1] Article based on the Working Document “Towards Green Tax Administrations: requirements, capacities and transformations in the face of environmental and climate challenges” published by the Inter-American Center of Tax Administrations (CIAT).

https://www.ciat.org/Biblioteca/DocumentosdeTrabajo/2024/DT-04-24.pdf

6,308 total views, 3 views today