- 8

- May

- 2024

- Written by: Ceferino Albano Costa González

- /

- Comments Leave a reply

The historical evolution allows to identify three great models or systems of personal income taxation that the most received doctrine has denominated them: a) global, b) schedular and c) mixed. We will analyze in general terms the basic aspects of the technical structure of the mentioned models, in particular the…

7,169 total views, 12 views today

- 7

- May

- 2024

- Written by: Isaac Gonzalo Arias Esteban

- /

- Comments Leave a reply

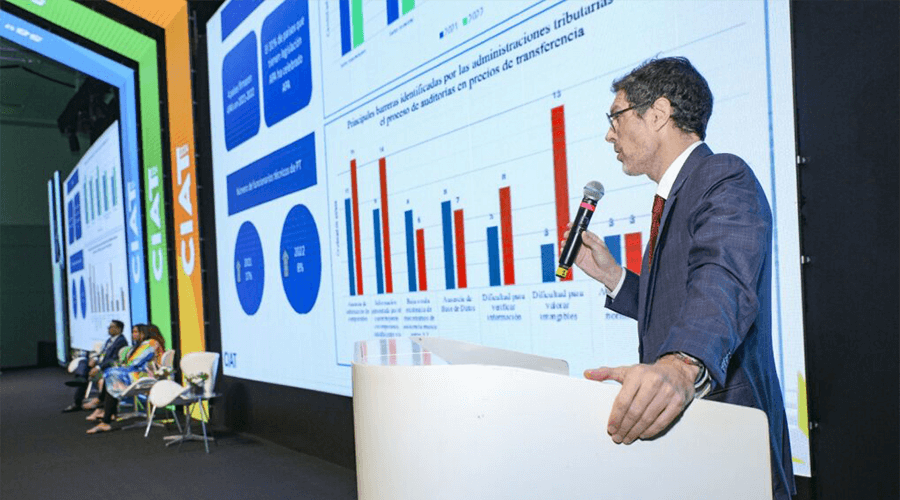

The cooperation represents the essence and purpose of CIAT. Since its foundation in 1967, numerous cooperation actions with countries and organizations have allowed CIAT to consolidate the pillars that have allowed it to be an organization with a regional focus and global impact, despite the small size of its Executive…

5,132 total views, 3 views today

- 26

- Mar

- 2024

- Written by: Darío González

- /

- Comments Leave a reply

Given the magnitude of evasion through tax havens and low-tax jurisdictions, the last decades have seen an international proliferation of both regulatory and management measures to limit such maneuvers, both in terms of the profits of multinational companies and the transfer of individuals’ financial assets. Corporate benefits The evasive methodology…

12,020 total views, 11 views today

- 25

- Jan

- 2024

- Written by: Andre Dumoulin

- /

- Comments Leave a reply

“Alice laughed: “There’s no use trying,” she said; “one can’t believe impossible things.” “I daresay you haven’t had much practice,” said the Queen. “When I was younger, I always did it for half an hour a day. Why, sometimes I’ve believed as many as six impossible things before breakfast.” (Lewis Caroll,…

25,480 total views, 109 views today

- 23

- Jan

- 2024

- Written by: Alejandro Gabriel Rasteletti, Tibor Hanappi, Sebastian Nieto Parra and René Orozco

- /

- Comments Leave a reply

Latin America and the Caribbean (LAC) suffers from chronically low rates of investment, which hurts economic growth. Since high taxes on corporations disincentivize firms´ investments, an important policy question is whether the region should reduce taxation on corporate profits. A first step in answering this question is to analyze how…

63,953 total views, 31 views today

- 26

- Dec

- 2023

- Written by: Yacqueline Lecca Rivera

- /

- Comments Leave a reply

Within the strategic objectives of SUNAT, which seek to improve tax compliance and reduce its derived costs, the digital transformation emerges as a necessity and essential element in favor of taxpayers and customs users, by having closer, simplified, optimized and automated processes. Thus, the Integrated VAT Electronic Management Model (MIGE)…

19,977 total views, 9 views today

Ronnie Nielsen en What future does artificial intelligence have in Tax Administrations? "Thanks, Alfredo, for this as always very informative blog! Your tireless comment..."

스카이슬롯 en “Final Beneficiary” or “Effective Beneficiary”? "It is really a nice and helpful piece of information. I am glad that you shared ..."

the walking dead season 9 ซับไทย en “Final Beneficiary” or “Effective Beneficiary”? "Thanks for the tips you have contributed here. Something important I would like ..."

Roxanne Mazzillo en Against corruption, more cooperation "Your blog site is like a breath of fresh air...."

Val en If only it were a game "Great blog...."