- 29

- Sep

- 2025

- Written by: Agustina O’Donnell, Jameson Alejandro Mencías Vega and Noelia Méndez Santolaria

- /

- Comments Leave a reply

In the framework of taxation in many countries and practically all regions of the world, there are several open discussions, including its relationship with human rights, the use of artificial intelligence and the very persistent tax evasion. This conversation has regularly involved the gender perspective as one more axis in…

- 27

- Sep

- 2025

- Written by: Fernando Serrano Antón

- /

- Comments Leave a reply

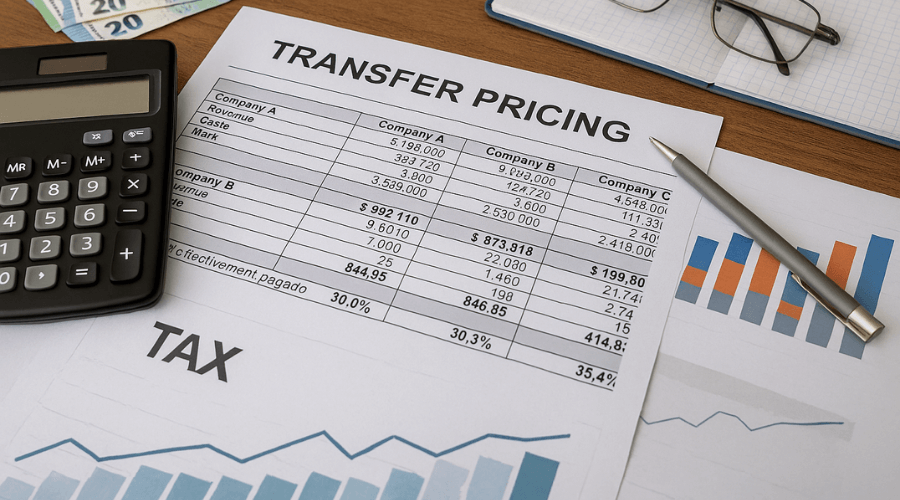

I. Introduction In the tax field, two logics coexist that, although related, speak different languages. On the one hand, transfer pricing, as a set of rules specific to direct taxation, requires performing transactions between companies of the same group as if they were transactions between independent parties, at market values. Its…

7,308 total views, 29 views today

- 22

- Sep

- 2025

- Written by: Andre Dumoulin

- /

- Comments Leave a reply

As countries prepare for COP30 in Brazil, transforming tax systems into engines for climate action and sustainable development is vital. For the Global South, leveraging taxation aligned with the Sustainable Development Goals (SDGs) is critical to mobilizing domestic resources for mitigation, adaptation, and equity. Several diagnostic tools help governments assess…

2,912 total views, 9 views today

- 19

- Sep

- 2025

- Written by: José Luis García Ríos

- /

- Comments Leave a reply

Ninety years weaving questions, seventy-two spinning answers… After nine decades of life and more than seventy years watching how the administration and tax policies shape – and sometimes distort – the pact between the State and society, I wonder which threads sustain coexistence and which ones tear it apart. This…

2,239 total views, 7 views today

- 15

- Sep

- 2025

- Written by: Raul Zambrano

- /

- Comments Leave a reply

There is no doubt that the correct classification of a taxpayer’s economic activity is important, particularly important, for a tax administration. Surely a sales over purchases ratio of 10% and a profit over gross income of 4%, for a fictitious company, called ACME 123 Ltd., for example, does not tell…

1,998 total views, 2 views today

- 13

- Sep

- 2025

- Written by: Decio Carretta

- /

- Comments Leave a reply

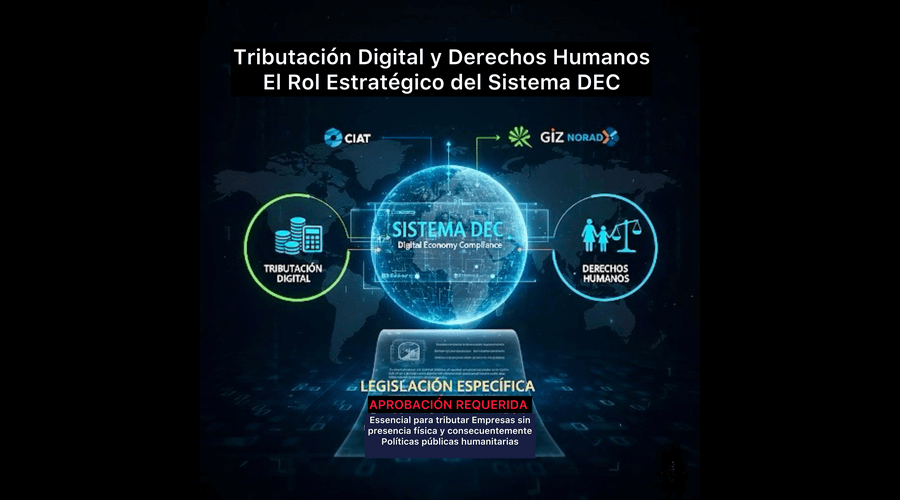

Abstract This article analyzes the role of international cooperation in the development of technological solutions for the challenges of the digital economy, such as the DEC (Digital Economy Compliance) system. Based on the DEC system, developed by CIAT with financial support from GIZ and Norad, we examine how strategic partnerships…

2,812 total views, 4 views today

Ronnie Nielsen en What future does artificial intelligence have in Tax Administrations? "Thanks, Alfredo, for this as always very informative blog! Your tireless comment..."

스카이슬롯 en “Final Beneficiary” or “Effective Beneficiary”? "It is really a nice and helpful piece of information. I am glad that you shared ..."

the walking dead season 9 ซับไทย en “Final Beneficiary” or “Effective Beneficiary”? "Thanks for the tips you have contributed here. Something important I would like ..."

Roxanne Mazzillo en Against corruption, more cooperation "Your blog site is like a breath of fresh air...."

Val en If only it were a game "Great blog...."