- 14

- May

- 2025

- Written by: Aloisio Flávio Ferreira de Almeida

- /

- Comments Leave a reply

The Value Added Tax (VAT) has been, for decades, the backbone of modern tax systems in terms of consumption taxation. Adopted in more than 160 countries, VAT has proven effective in generating stable income, ensuring economic neutrality and facilitating control in analogue environments. However, rapid technological advances are challenging its…

7,381 total views, 22 views today

- 7

- May

- 2025

- Written by: Fernando Serrano Antón

- /

- Comments Leave a reply

It was an ordinary morning at the tax collection office. The staff arrived, as always, between papers, computers, printers and hurried coffees. But that morning something was different: there were no new officials, but there was an unprecedented, silent presence that would change everything. Artificial intelligence (AI) had arrived. Quickly…

- 28

- Apr

- 2025

- Written by: Alberto Barreix, Mónica Schpallir Calijuri, Axel Radics and Marta Ruiz Arranz

- /

- Comments Leave a reply

Over the past two decades, electronic invoicing (e-invoicing) has transformed tax administrations worldwide. This innovative solution was created in Latin America and first launched in 2003 in Chile, and then in Brazil and Mexico. Since then, this digital transformation has significantly increased transparency and tax collection and reduced economic informality…

- 23

- Apr

- 2025

- Written by: Pablo Porporatto

- /

- Comments Leave a reply

• Introduction In the current world scenario, international tax transparency has emerged as a cardinal tool to reduce information asymmetry and thus “level the playing field”. In this new paradigm, global standards were agreed upon, one of which is the automatic exchange of financial information (AEFI), through the “Common…

3,781 total views, 5 views today

- 14

- Apr

- 2025

- Written by: Darío González

- /

- Comments Leave a reply

Tax compliance requires compliance with both formal obligations (filings, requirements, documentation, etc.) and substantive obligations (payment of the tax). In the field of tax proceedings, the forms are necessary for the timely and proper presentation of appeals against acts of the administration, in which the taxpayer states that an alleged…

4,336 total views, 6 views today

- 7

- Apr

- 2025

- Written by: Andre Dumoulin

- /

- Comments Leave a reply

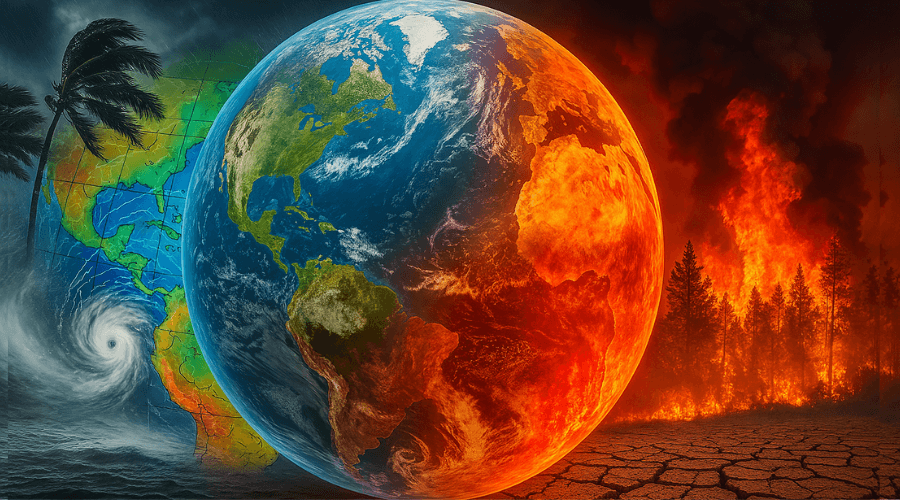

Warren Buffets, the chairperson and CEO of Berkshire Hathaway, a famous American investor and philanthropist nicknamed the “oracle of Omaha”, is considered one of the most successful investors of all time. In his 2025 shareholder letter, Warren Buffett acknowledged the potential for “a truly staggering insurance loss” due to climate…

12,757 total views, 33 views today

Ronnie Nielsen en What future does artificial intelligence have in Tax Administrations? "Thanks, Alfredo, for this as always very informative blog! Your tireless comment..."

스카이슬롯 en “Final Beneficiary” or “Effective Beneficiary”? "It is really a nice and helpful piece of information. I am glad that you shared ..."

the walking dead season 9 ซับไทย en “Final Beneficiary” or “Effective Beneficiary”? "Thanks for the tips you have contributed here. Something important I would like ..."

Roxanne Mazzillo en Against corruption, more cooperation "Your blog site is like a breath of fresh air...."

Val en If only it were a game "Great blog...."