Course on Tax Code 7ed.

This course seeks to provide participants with an up-to-date knowledge of the General Part of the Tax Law (material, procedural and sanctioning), allowing them to know modern trends in the matter, through the guidance of a recent model such as the CIAT Tax Code Model.

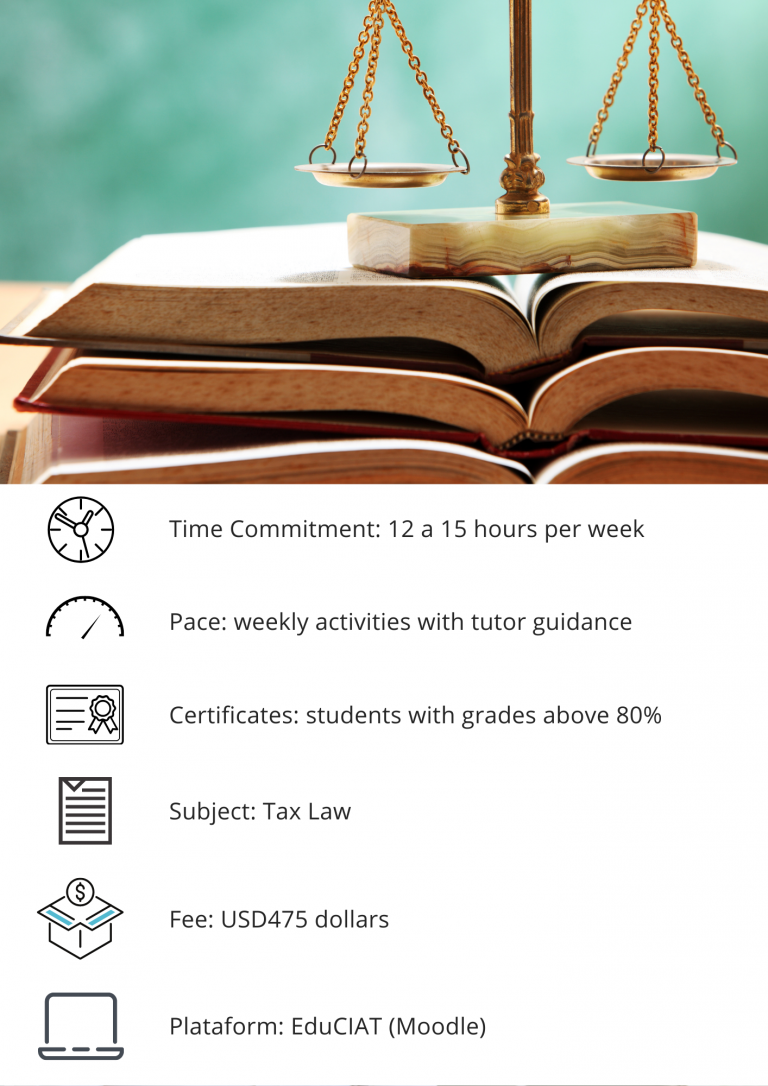

General Information

Modality: virtual.

Duration: 21 weeks and 240 academic’s hours.

Target audience: medium-high-level and / or high-level officials of the tax administrations with capacity for decision-making, responsible for the design of tax policies and their strategic implementation. Private sector lawyers, administrative litigation judges and tax courts officials in Latin America may also participate.

Language: Spanish.

Soon will be opening an online registrations.

Requirements

-

Updated browser (Google Chrome, Mozilla Firefox or Safari).

-

Permission to receive external emails.

-

Adobe Reader.

-

Adobe Flash Player.

-

Java.

-

Zoom, is the tool to perform synchronous sessions.

Content

The course will develop the following topics:

– Lesson 1. Basic Concepts

– Lesson 2. Constitutional Principles

– Lesson 3. Principles of Interpretation and Application of Taxes

– Lesson 4. The Substantial Tax Relations – Part 1

– Lesson 5. The Substantial Tax Relations – Part 2

– Lesson 6. The Substantial Tax Relations – Part 3

– Lesson 7. Actuations and Procedures of Tax Application – Part 1

– Lesson 8. Actuations and Procedures of Tax Application – Part 2

– Lesson 9. Function of Information and Assistance

– Lesson 10. Management Procedures

– Lesson 11. Audit Procedures

– Lesson 12. Collection Procedures

– Lesson 13. Tax Infractions and Sanctions – Part 1

– Lesson 14. Tax Infractions and Sanctions – Part 2

– Lesson 15. Tax Infractions and Sanctions – Part 3

– Lesson 16. Procedures for Revision of Tax Acts