Course on Information Exchange 9ed.

This course seeks to promote the use of international tax information exchange by tax administrations from a better understanding of the concepts, methodologies and specific practical application of this essential tool for the tax control of taxpayers operating at global level.

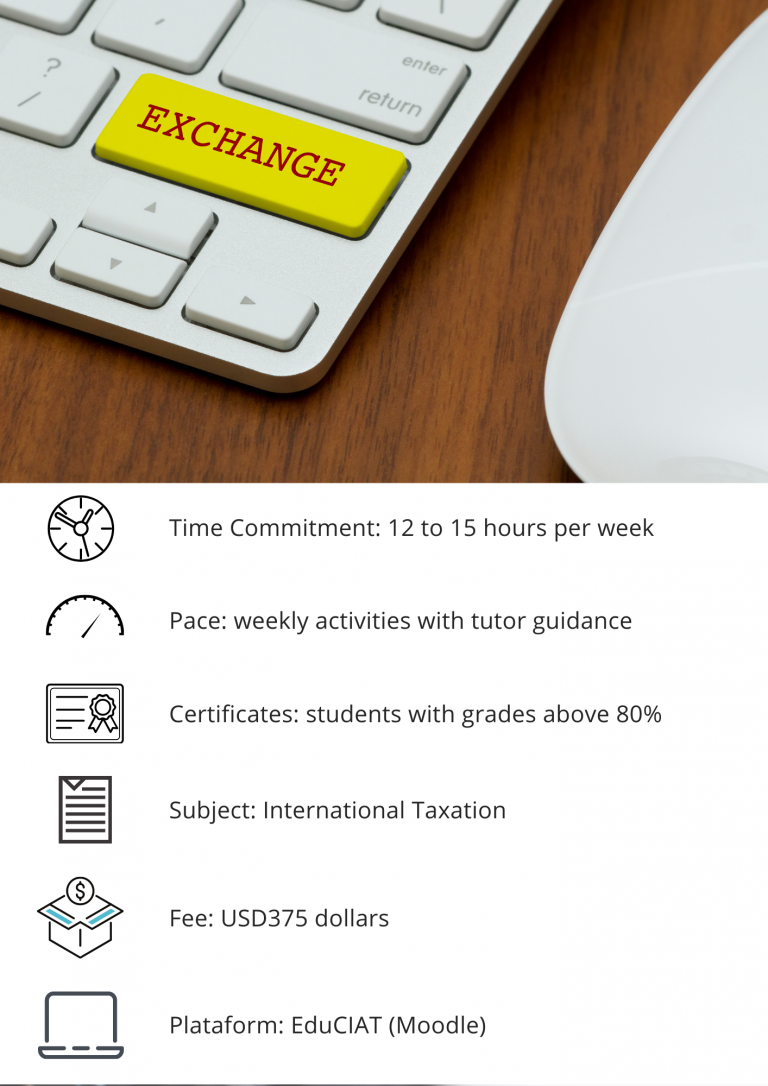

General Information

When: April 12, to June 27, 2021.

Modality: virtual.

Duration: 11 weeks and 150 academic’s hours.

Target audience: Tax Administration officials and auxiliary officials working in the tax control areas; related technical and legal areas, as well as for those fulfilling their duties in specialized areas responsible for international issues and in particular for the exchange of information.

Language: Spanish and English.

Registration Deadline: March 12, 2021. The quota for this edition have been completed.

Requirements

-

Updated browser (Google Chrome, Mozilla Firefox or Safari).

-

Permission to receive external emails.

-

Adobe Reader.

-

Adobe Flash Player.

-

Java.

-

Zoom, is the tool to perform synchronous sessions.

Content

The course will develop the following topics:

– Lesson 1. Information Exchange within the framework of public international law

– Lesson 2. Bilateral administrative assistance in tax issues. OECD/CIAT/UN and FATCA law instrument models

– Lesson 3. Multilateral Assistance in Tax Matters Agreement and Information Exchange within the Framework of the BEPS Plan

– Lección 4. Identification of the Final Beneficiary

Content

– Lesson 5. International evaluation of countries and overseas territories in relation to transparency and international information exchange

– Lesson 6. Organization and management of tax information exchange

– Lesson 7. Use of information exchange in risk analysis and the selection of cases to be audited

– Lesson 8. The examination function within the framework of international information exchange