Diálogo sobre digitalización

Productos (Solo inglés)

The CIAT DD

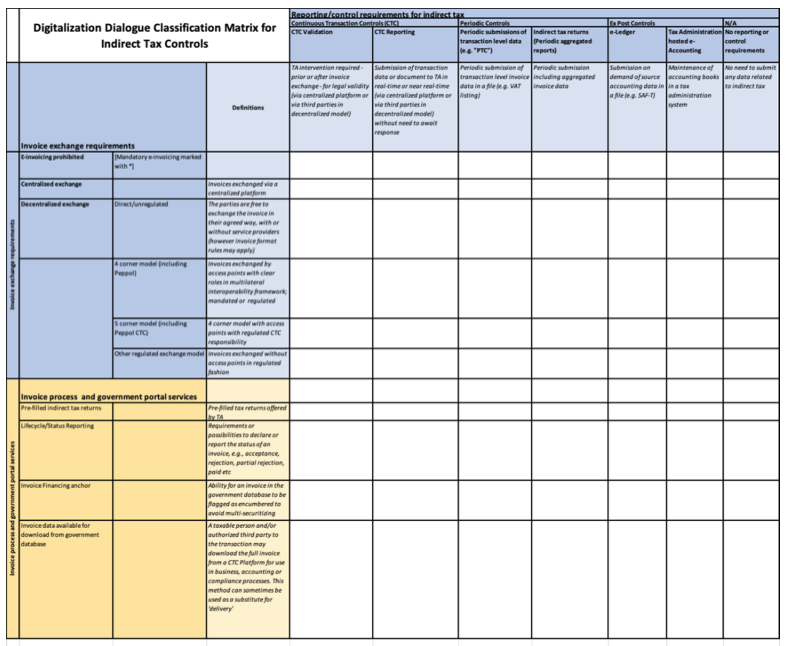

Classification Matrix for Indirect Tax Controls

In 2003, when the Chilean Tax Administration launched the first initiative towards a regulated electronic invoicing system it was difficult to foresee that in a few years a number of countries and jurisdictions would implement some type of controls that continuously monitor transactions, particularly those related with indirect taxes. But, certainly, the approaches taken have been different, very different indeed, with some countries making mandatory the use of electronic invoices with a common format that need to be sent in full to the tax administrations, while others require that only some information of the transactions be transmitted, usually the headers and totals of the corresponding documents. In addition, some leave complete freedom in terms of the means of transmission between the parties, while others establish a specific way in which the information flows. Moreover, there are differences in terms of the consequences derived from errors and non-compliance situations as well as the services that taxpayers, and citizens in general, could expect from the implementation of such systems.

The Digitalization Dialogue (DD) at CIAT has worked on defining a harmonized way to categorize different approaches and regimes, to create common grounds for discussion of these topics among taxpayers, tax administrations and service providers. This has been based on the recognition that the possibility of a single standard would be difficult to reach considering the level of adoption that these systems now have, but also the variation of realities, limitations, legal frameworks, culture and even traditions around the world. Under this umbrella the DD proposes an instrument to help understand the different approaches in place, the different options and alternatives that have been and currently are used in different parts of the world.

The CTC Classification Matrix that we are proposing now, aims to identify a system based on one hand on obligations toward the tax administration such as reporting or clearance of the invoice, where it makes a distinction between the types of systems, These range from reporting systems, which are limited to taxpayers reporting information to the tax administration as opposed to those that produce a consequence on the taxpayer’s formal process based on the response by the tax administration, which we call a clearance model. We recognize that those consequences can vary greatly, from the actual validity of the transaction to the tax administration keeping books on behalf of the taxpayers or pre-filling tax returns.

One the other hand, the rows focus on the way that information, or actual documents, is exchanged between parties. This includes those that do not regulate such exchange at all, to four or five corner

models where specialized service providers interact with their corresponding clients and address the translation of protocols, languages and other communication technicalities.

Classification Matrix

The purpose of this matrix is to harmonize the categorization of legal regimes to create a common ground for further discussion, for government agencies, private practitioners and taxpayers. By introducing the CTC Classification Matrix, we intend to provide a cross-continental set of vocabulary, and, ultimately, a joint understanding of the models and their implications in place, to help ease discussions on different models and legal frameworks. The Matrix intends to serve as a compass for practitioners being affected not only by the obligations currently in place but also for those to come. And as we tighten up terminology and gain further insight into the pros and cons of these varying approaches, it is our desire that over time this proposed standard classification might contribute to further standardization of the underlying tax enforcement frameworks and laws.

3,162 total views, 1 views today