Digital Economy – Tax on profits in international transactions. The need to await a global coordination

Introduction

In these lines, we will try briefly to substantiate why we believe it would be appropriate to await an international coordination before progressing unilaterally with taxing the benefits of the digital economy when there is no physical presence of the provider in the place of consumption.

As an example of the services in question, we can mention the storage of information provided by servers located outside the jurisdiction, those of platforms managed from abroad, such as social medias, those used to provide services for big data, advertising or streaming of various content such as movies, videos or music, or search engines and the e-commerce platforms.

Nature of the encumbrances that can levy the International Digital transactions.

The levies that can be applied to these transactions can be:

1. Consumption tax

2. Tax on Presumptive benefits

We refer to a tax on alleged profits, given that when the service provider does not have a physical presence in the jurisdiction of the user it is not possible to rely on the data necessary to determine accurately the taxable income.

Mode of tax collection by surcharge or Withholding at source

When dealing with the collection modality of said services, we must highlight the fact that the service provider is located out of the jurisdiction of the user/consumer, therefore the authorities of said jurisdiction cannot determine unilaterally the taxable base, and neither can they charge directly the service provider.

In addition, for the same reason, the lack of physical presence of the provider in the jurisdiction of the user, the collection of taxes is effected by surcharge (consumption tax) and withholding (profit tax) at the source.

Indeed, the mode of collection of the referred profit tax, and its role on the subject affected economically by the tax, will be our source of analysis that will lead us to conclude the need to avoid unilateral implementation of tax regimes on profits and await an international coordination in the field.

Collection of the Tax on Profits through a withholding agent

In this case, the agent who pays the service or intervenes in its payment withholds the tax and transfers it to the treasury.

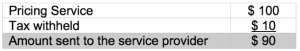

Example:

Then $ 90 are delivered to the external provider and $ 10 enter the Treasure of the country where the user or consumer resides.

Grossing Up

It may be that the foreign supplier does not accept to see their income reduced, therefore agrees to what the tax technique is called “grossing up”.

In the example we have been considering, it would

Price to be billed for the service: Y

Tax rate: 10%

Y = 100 / (1-.10) = $ 111.11

Therefore,

Invoice price: $ 111.11

Tax withheld $ 11.11 (10% s / $ 111.11)

Value received by the service provider: $ 111.11 – $ 11.11 = $ 100

That is, with the application of grossing up the subject affected economically is the service consumer, removing the spirit of the tax, which is to tax the presumed income obtained by the supplier.

Elasticity of Demand as a determinant of the Economically affected subject

As described above, we analyze the different values that, in theory, receives the service provider implemented in the case of implementing a tax on profits, using or not using the grossing up.

Now, whatever the nature of the tax, consumption or profits, and regardless the application of the grossing up, the value actually received by the supplier depends on the elasticity of the demand for the service in question and the degree of competitiveness among the companies providing it.

Let us remember quickly what we mean by elasticity of demand. This is the percentage variation in the amount demanded of a good to a 1% change in the price of said good. In particular, if this is a service with a normal demand, the elasticity of demand tells us how much the quantity demanded decreases in case of a 1% increase in the price of the service. Now, if the demand does not decrease by increasing the price, we have a perfectly inelastic demand. Similarly, if the demand is reduced by less than the percentage price increase, demand is relatively inelastic.

Given the elasticity of demand, in case of the imposition of a tax the offeror transfer its value to consumers in the maximum possible extent that such elasticity permits.

Therefore, the more inelastic the demand, and the lower the competition risk for the service provider, the more the tax will be borne by the local consumer and less by the foreign supplier.

While one might perform econometric studies to determine the elasticity of demand for each service, we wish to point out that certain platforms and digital services have relatively elastic demands due to the oligopolistic nature of the market. Therefore, it is to be expected that part of the weight of taxes, perhaps most of them, will fall on the local consumer. Example of these companies may be Google, Facebook or Amazon.

In this regard, in the case of value added tax, the lawmaker may seek that consumer support the economic weight of the tax, but it is not in the case of taxes that seek to tax the profits of the service.

All the above shows that the intention of establishing a tax on profits made will result in whole or in part, in a consumption tax. If this tax already exists, we would be faced with the fact that from the economic point of view, we would have two taxes on consumption.

The search for a Global Solution

Seeking unilateral solutions that affect the tax base represented by the profits generated[1] by these services is a process in full expansion, as evidenced by the existence of a bill in Spain or the consideration in the UK to create a tax on invoicing of the providers of the services in question[2] .

In[3] this regard, in order that taxes pursuing profits actually fall on them, the appropriate would be a multilateral solution. Such solution would, for instance, determine the tax directly on the taxable income of companies providing services, and distribute it considering some criteria, such as one proposed in Action 1 of BEPS (OECD), consisting of taking into account the sales that companies make in each jurisdiction.

Conclusion

From the above we can conclude:

[1] https://www.iprofesional.com/impuestos/280337-impuesto-ley-empleo-Espana-lidera-la-implementacion-de-la-Tasa-Google-un-nuevo-impuesto-sobre-servicios-digitales.

[2] “The quest for a fairer way to tax the tech giants”, Financial Times, The Editorial Board, 10.30.2018.

[3] 2015 OECD. “Addressing the Tax Challenges of the Digital Economy, Action 1- 2015 Final Report”.

2,920 total views, 1 views today