Tax Administration Program 10ed.

This course seeks to provide tax administration officials and the public in general, specialized knowledge on all relevant aspects of the essential and support functions that must be fulfilled by the tax administration, as well as those most current issues that involve a more direct action with the taxpayers and society in general.

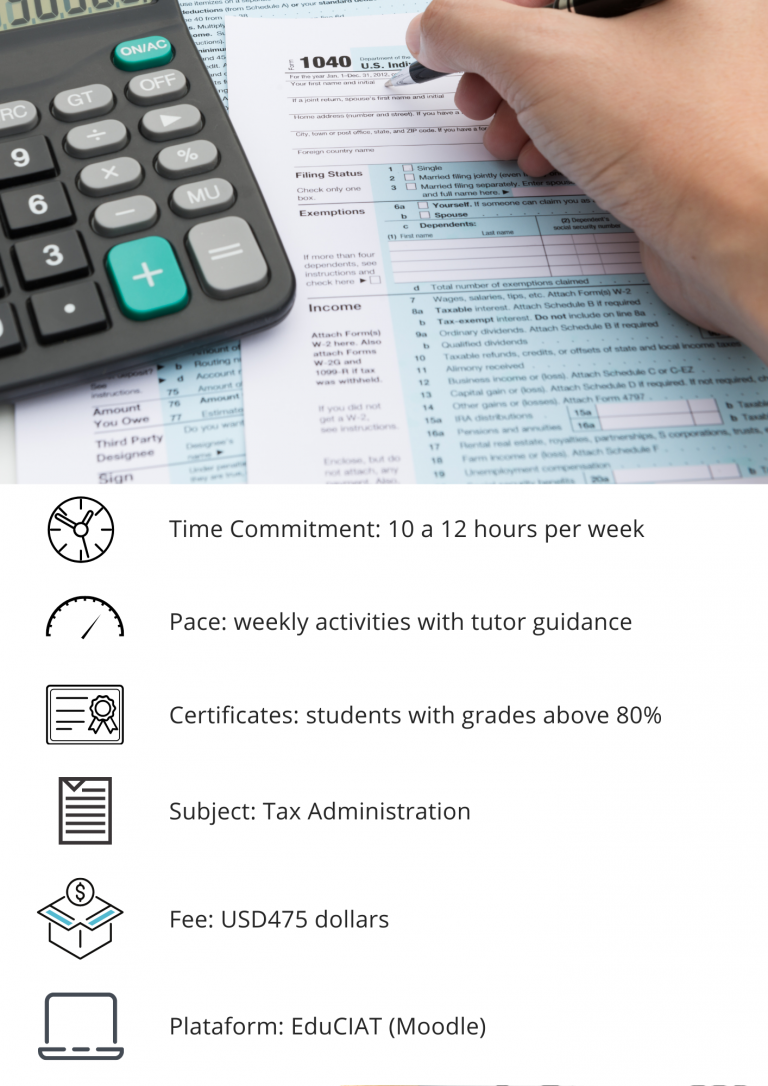

General Information

When: October 04, 2021 to March 27, 2022.

Modality: virtual.

Duration: 24 weeks and 240 academic’s hours.

Target audience: tax administrations officials of the CIAT member countries, as well as the public in general working in the area of taxation or interested therein.

Language: Spanish.

The quotas for this edition have been completed

Requirements

-

Updated browser (Google Chrome, Mozilla Firefox or Safari).

-

Permission to receive external emails.

-

Adobe Reader.

-

Adobe Flash Player.

-

Java.

-

Zoom, is the tool to perform synchronous sessions.

Content

The course will develop the following topics:

– Lesson 1. The Role of the Tax Administrator as Advisor in the Political Sphere.

– Lesson 2. Context of operation.

– Lesson 3. Organizational design.

– Lesson 4. Organizational Structure.

– Lesson 5. Macro-processes of Management: Assistance to the Taxpayer

– Lesson 6. Macro-processes of Management: Collection

– Lesson 7. Macro-processes of Management: Recovery

– Lesson 8. Macro-processes of Management: Control

– Lesson 9. Macro-processes of Management: Determination of Taxes

– Lesson 10. Support processes: Strategic Management.

– Lesson 11. Support Processes: Administration and Development of Human Resources.

– Lesson 12. Support Processes: Information Management

– Lesson 13. Other Management support processes

– Lesson 14. Realities and challenges of American Tax Administrations.