Documents and electronic transactions (vi)

Watch out! Electronic stickers

In a recent conversation in Guate (mala), as we like to nickname the city, Omar Franco, SAT Collection Director, told me the results of their latest experiment.

In a recent conversation in Guate (mala), as we like to nickname the city, Omar Franco, SAT Collection Director, told me the results of their latest experiment.

The SAT is in charge of the motor vehicles registry. As in many other countries, the tax administration used to give a sticker that vehicle owners had to place somewhere on the vehicle, usually on the windshield corner, as proof of payment of the corresponding tax. In theory, the presence of the sticker allows officers to visually check if the payment corresponding to the period of validity has been received.

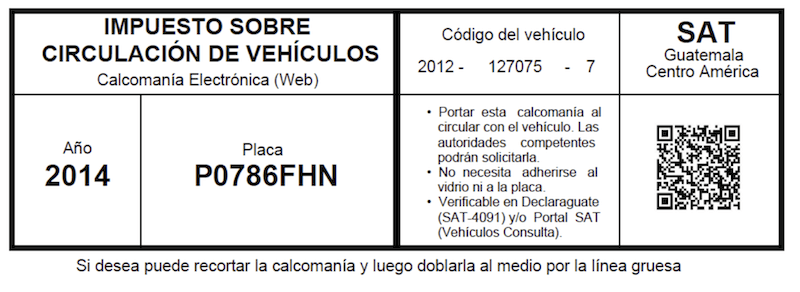

From 2014, the SAT has replaced this windshield sticker with another proof of payment. This new method uses the Internet. Through the SAT website and banking agreements for tax payments, taxpayers can enquire and pay the due taxes. Then the taxpayer receives a printable voucher with a QR code, which can be printed many times if necessary, or pasted as an image on the mobile equipment. This QR code can be read by any smart mobile device and can be used by the appropriate authority to confirm that the payment has been made. Of course, information provided by this the inquiry brings to the official much more than the payment information only, including the license plate number, type, brand, model vehicle, cubic centimeters, and the vehicle code as well as information that may exist about complaints related to the vehicle.

Those who cannot pay via Internet continue using the old method of paying at the bank, but for them, instead of the old sticker, the Bank issues a receipt that includes a printed number plate and the NIT of the owner. The taxpayer is required to carry this proof inside the vehicle to be presented to authorities whenever required. Even if this is not as easy and efficient as the QR code, the SAT systems can also be consulted by entering the data manually to verify that the payments have been made.

Omar told me that not all the SAT officers were optimistic about the new process. Some believed that difficulties would arise from the applications or the Internet use. Some wondered if the adoption of the electronic payment would be widely accepted; someone worried if this electronic document would satisfy the legal requirement of issuing a payment voucher, but most objections came from a same type of concerns: “To eliminate the sticker and stop having a visual element would worsen the level of voluntary compliance for the payment”.

Fortunately the compliance levels remained stable and were not harmed. From the first year, the use of the electronic system has been already greater than face-to-face payment at the bank. The SAT did not have to invest in those hundreds of thousands of stickers printing and or in the logistic to distribute them throughout the country. The authorities have a better and more complete control tool and it is very difficult “to use” the proof of payment of a vehicle to “help” another one.

Windshields are cleaner. And when someone consider buying a second-hand vehicle, a simple query at the payment voucher with the smart phone allow the potential buyer to verify that not only that all the taxes have been paid, but also if there is any pending problem or complaint regarding the vehicle.

But those who surely are happier are the vehicle drivers. The annual vehicle tax payment process does not require going to a bank window anymore. Windshields are cleaner. And when someone consider buying a second-hand vehicle, a simple query at the payment voucher with the smart phone allow the potential buyer to verify that not only that all the taxes have been paid, but also if there is any pending problem or complaint regarding the vehicle. . This will be complemented by greater automation of the vehicles transfer process, which can be started at the internet site of the SAT but still requires physical presence at a window to complete the procedure.

Many national tax administrations do not manage vehicles issues and some of those which do it do not manage the registry itself, but in my opinion, the experience is useful, certainly replicable, and it will satisfy many drivers who, like me, prefer not to have to visit the bank and wish to keep their windshield cleaner.

Good luck

1,594 total views, 4 views today